“Don’t try to catch the falling knife” is an age-old colloquial stock market phrase that basically means you should wait for a stock to bottom out before adding it to your portfolio.

“I like things better when they are on sale, so December was a better time to buy. I don’t believe that prices having been rising is a reason to buy, and I also don’t think the fact that prices have been falling is a reason to sell.”

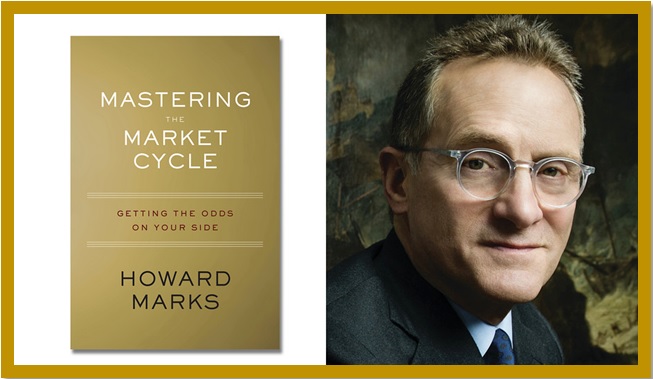

But billionaire Oaktree Capital Group Co-Chair Howard Marks begs to differ.

“When stores put goods on sale, I buy more,” he said during an event Monday in Singapore. “Why would you possibly want to buy more at rising prices?”

It’s incredibly difficult if not impossible to time things for exactly when stocks hit bottom so the trick, Marks said, is to watch assets as they decline and before they start to appreciate.

Marks went on to say we are in the “eighth inning” of the current market cycle, leaving plenty of opportunities for investors to make money — but they should be more cautious than aggressive, he said.

Marks said the sharp declines during the fourth quarter of 2018 are a prime example of how quickly market sentiment can shift from excessive optimism to excessive pessimism, even when fundamentals haven’t changed. The S&P 500 fell 20 percent from late September through a Christmas Eve low, only to rebound by more than 10 percent since market close last week.

“We had one of the most violent downdrafts I had ever seen,” Marks said. “Nothing much changed except people were first ignoring the bad news and then they were obsessing about the bad news.”

The sell-off is a buying opportunity for those with the ability to ignore their emotional responses, Marks said.

Per Bloomberg:

“I like things better when they are on sale, so December was a better time to buy,” he said. “I don’t believe that prices having been rising is a reason to buy, and I also don’t think the fact that prices have been falling is a reason to sell. And if anything, some of the overpricing was reduced a little bit.”

Here are some other comments Marks made:

- Oaktree, which secured capital commitments of about $8.5 billion in 2015 to prepare for market duress, has started deploying some of that money over the past year. Marks didn’t elaborate on where he was investing the capital.

- With the recent rebound in risk assets, Marks said he’s unsure how quickly Oaktree will invest its funds. At a discussion earlier in the day in Singapore, he said trends are favoring distressed-debt and value investors, though “we are not there yet.”

- Emerging markets generally and Asian markets are relatively cheap. Oaktree is giving “a lot of attention” to emerging-market stocks and bonds, Marks said.