A fatal decision made in Washington is now creating a clear and present danger for the world economy and every stock market on the planet.

You might think I’m talking about something related to the U.S. government shutdown … or the trade war with China … or maybe some other dramatic announcement among the many of recent times.

But I’m not.

The fatal decision was made just about one year ago.

It was long overdue and unavoidable.

And it has already begun to make dominoes fall in the Nasdaq, the NYSE and all over the world.

Three of the smartest people I know first warned us about this early last year.

Interest-rate specialist Mike Larson virtually shouted the news from the rooftops.

Sean Brodrick, editor of Wealth Supercycle, predicted the dire consequences in a series of three interviews for hundreds of thousands of investors.

Cycles specialist Juan Villaverde then pinpointed the timing when it would all begin to come unglued.

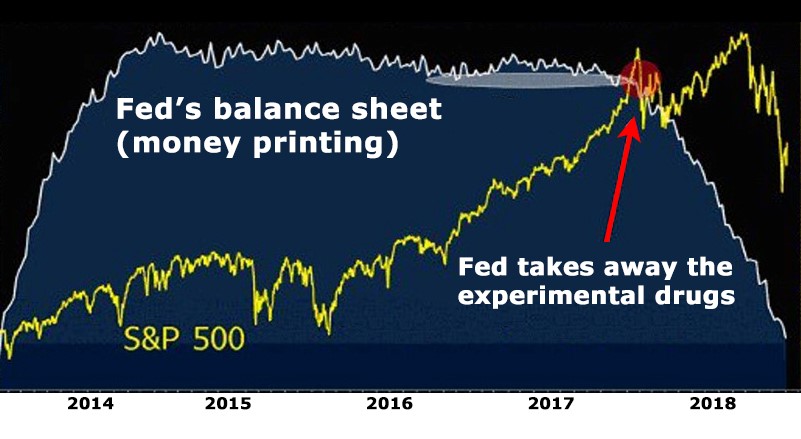

And just a few days ago, Sean sent me an email with an urgent update — a single picture that tells the entire story in a nutshell. Here it is:

Source: Lawrence McDonald

It’s a seismic shift in the Fed’s balance sheet, and the consequences are potentially enormous.

To help you understand why, Sean and Mike provide this play-by-play log of the critical events so far …

Sept. 15, 2008: Exactly one decade and four months ago, on the fateful day that Lehman Brothers failed, the Fed embarked on the greatest money printing run of all time.

The ensuing eight years: The Fed injected an unprecedented $4 trillion of new liquidity into the banking system. It was an extremely risky, grand experiment never before attempted by any major government since the German Weimar Republic in the aftermath of World War I.

Those liquid funds, like powerful new drugs, flowed into some of the highest risk investments ever created. And in their wake, there emerged a new superbubble — like the dot-com bubble and the housing bubble combined.

Late 2017: The Fed began to sop up some of the liquid funds, taking away some of the experimental drugs.

Jan. 26, 2018: Wall Street reacted to the news almost immediately; the S&P suffered a 10 percent correction.

Early February, 2018. Analysts spread the word that it was “no big deal,” that the Trump tax cuts would save the day. The S&P rallied. It even made new highs, but only by a hair.

All of 2018 and into 2019: The analysts were wrong. Quietly and with as little fanfare as possible, the Fed persisted. It continued to pull the experimental drugs out of the economy.

Oct. 3, 2018: The stock market broke down again, but this time with far greater fear and fury than in the January correction. This time, the S&P plunged by more than 20 percent, tipping into bear territory. Despite a Christmas rally, it marked the market’s worst year since 2008 and one of its worst Decembers since 1931.

Early January 2019: To help soothe investor wounds, the Fed put out the word that it’s going to think twice before raising rates again.

But will the Fed crank back up its giant money printing presses again?

If so, how soon and by how much?

Will it be enough to hold up the market?

Or will it be too little, too late?

This is THE single most important question of our era. It will determine the dividing line between a great speculative bubble and an equally large speculative bust. And for investors, it could mean the difference massive losses or huge profits.

We will give you the answer in our online video conference at 2 p.m. EST tomorrow, Tuesday, Jan. 15.

We will tell you …

Precisely WHEN this crisis will reach critical mass.

What will be the next big move in stocks, bonds, gold, gold shares and oil.

Which specific investments you should sell and which should you buy for the ultimate in protection and profits.

All of us will be there, including me, Sean Brodrick, Mike Larson and Juan Villaverde.

If you want to join us, today’s your last day to register. It’s free and will only take you a single click here.

Best wishes,

Martin

[totalpoll id=”8000″]

Editor’s note: In addition to answering the poll, if you are concerned about a significant S&P 500 crash, what are you doing to prepare?