Experts usually define a bear market as a 20% decline in a major market average.

Traditionally, the Dow Jones Industrial Average is used because it offers the longest history, though many analysts rely on the S&P 500 since it is more representative of the broader market.

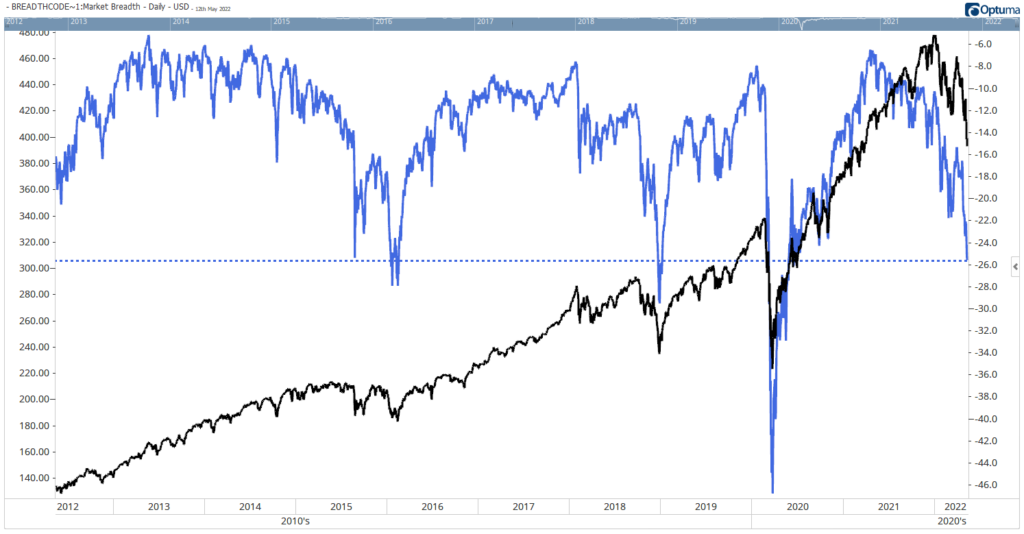

We aren’t there yet using either definition. But the average stock is in a bear market. The chart below shows that the average stock (blue line) in the S&P 500 (black line) is 25.6% below its 52-week high.

S&P 500 Stocks Fall Into Bear Market Territory

The blue line shows the average drawdown from the 52-week highs for the stocks in the index. The dashed line shows the current level of that indicator. The black line is the S&P 500.

S&P 500 Indicator Precedes Bear Markets

This is just the fourth time the indicator has reached this level in the past 10 years.

In 2016, the S&P 500 fell about 11%. Prices took about eight months to form a double bottom. This indicator bottomed at 27.2%.

In 2018, the indicator fell as the S&P 500 declined 19% in just three months. China and the U.S. were imposing tariffs on each other’s goods in a trade war. At the same time, the Federal Reserve was raising interest rates. The indicator bottomed at 29.3%.

The third dip coincided with the bear market that began in 2020, and the indicator bottomed at 46.8% as the S&P 500 dropped more than 30%.

This chart shows the average stock is already in a bear market. That means the average investor is already experiencing a significant loss of wealth. That sets up the potential for additional selling as investors review their accounts. Seeing losses mount, many will sell. That could lead to a steeper decline.

This is yet another signal showing we are at a critical level. If the indicator reaches 30%, we can be certain a bear market is at hand.

Rather than waiting, it makes sense to take action now. Get defensive now instead of waiting for the experts to confirm the arrival of the bear market.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.