Junk bonds are an overlooked source of stock market information.

Companies judged to be at some level of bankruptcy risk issue junk bonds, aka high-yield bonds. Yields on junk bonds are much higher (and riskier) than yields on Treasury securities.

High-yield bonds are also volatile.

Because investors holding the bonds can lose everything if the issuing company goes bankrupt, worried traders tend to sell quickly. Likewise, because the bonds offer high yields, traders buy at a quicker pace when they are confident that risks are low.

This rapid-fire buying and selling make junk bonds a useful stock market indicator. We can even develop complete trading strategies based on their yields.

How Junk Bonds Affect Stocks

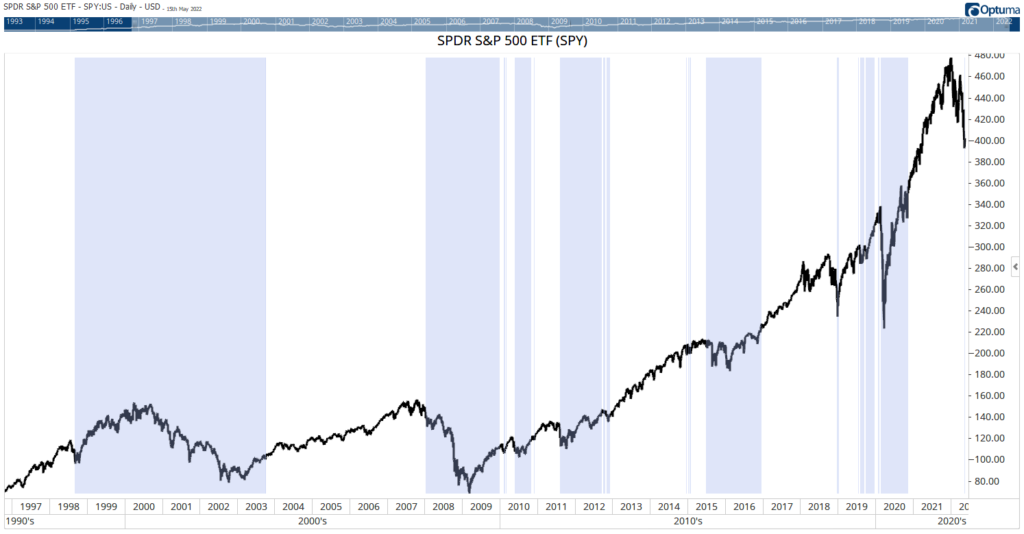

The simplest junk bond strategy is to sell stocks and hold cash when yields are too high. The chart below shows how the SPDR S&P 500 ETF (NYSE: SPY) fared when junk bond yields were more than 10% as they are now.

High Junk Yields Trigger Stock Sell-Offs

Source: Optuma.

This chart uses the ICE BofA CCC & Lower U.S. High Yield Index Option-Adjusted Spread (OAS). You don’t need to calculate the OAS or even know what an OAS is. The Federal Reserve provides the data here.

Most of the time when the yields top 10%, stocks sell off. This happened during all three of the bear markets in the 21st century. The picture gets even worse as the yields on junk bonds rise.

The yields on junk bonds are almost certain to rise as the Federal Reserve raises rates. The Fed’s action will make it harder for financially shaky companies to secure funding for their operations. That will push the first companies with high-risk bonds into bankruptcy.

Now is an ideal time to prepare for this.

Bottom line: Avoiding the stock market at times like this beats a buy-and-hold strategy.

You could also buy put options on the iShares iBoxx $ High Yield Corporate Bond ETF (NYSE: HYG). Put options increase in value as prices fall, and bond prices fall when yields rise.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.