We know inflation will rise this summer. The Federal Reserve is telling us that will happen. This is important because actual inflation affects future inflation expectations. And that will determine how consumers respond.

The newest member of the Fed, Governor Christopher Waller, recently told CNBC that he sees the U.S. economy as set to take off.

“I think the economy is ready to rip,” Waller told CNBC’s Steve Liesman during a Squawk on the Street interview. “There’s still more to do on that, but I think everyone’s getting a lot more comfortable with having the virus under control, and we’re starting to see it in the form of economic activity.”

He also discussed his outlook on inflation. Waller added that he thinks inflationary pressures that have begun to show up are likely temporary, a view widely held at the Fed. The consumer price index rose 2.6% in March from a year ago.

Waller said he expects the Fed’s preferred inflation gauge based on personal consumption expenditures could run around 2.5% for 2021.

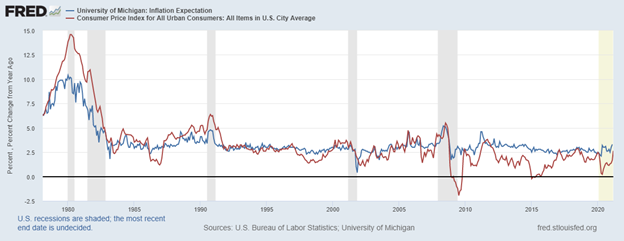

The chart below shows that future inflation expectations, the blue line, closely tracks the actual rate of inflation, the red line.

Inflation Expectations Mirror Inflation Rates

Source: Federal Reserve.

Inflation Expectations Can Cement Inflation

The Brookings Institution explains:

Inflation expectations are simply the rate at which people — consumers, businesses, investors — expect prices to rise in the future. They matter because actual inflation depends, in part, on what we expect it to be.

If everyone expects prices to rise, say, 3% over the next year, businesses will want to raise prices by (at least) three percent, and workers and their unions will want similar-sized raises. All else equal, if inflation expectations rise by one percentage point, actual inflation will tend to rise by one percentage point as well.

If consumers panic when inflation jumps, inflation could be locked-in for the next year. This would affect many economic decisions and could force the Fed to act. That could lead to a second recession and higher unemployment.

That makes the next few months critical for the economy and the stock market.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.