One of the important, decades-long debates in the U.S. has been about inequality. Some economists and politicians argue that wages aren’t high enough, believing that’s an indication that businesses have too much leverage in the economy. Fortunately, there’s a tool to measure how insecure workers feel: quit rate.

Former Federal Reserve Chairman Alan Greenspan noted in 1997 that “worker insecurity is a powerful force in keeping compensation inflation in check. Workers who are frightened of losing their jobs don’t insist on large boosts in pay and benefits, the Greenspan argument goes.”

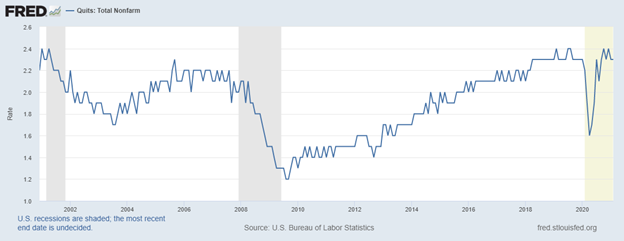

Quit rate is the percentage of workers who quit their jobs, which is generally an indicator that they believe they can find a better job, often with better pay or benefits.

In the latest data, the quit rate has returned to pre-pandemic levels.

Quit Rate Has Reached Pre-Pandemic Level

Source: Federal Reserve.

Rising Quit Rate Indicates Increased Job Security

This indicates that employees see signs of growth in the economy. In this new era, the fact that the quit rate is near and not above its historic highs indicates workers are also satisfied with safety precautions. If they believed employers were putting them at risk, the quit rate would be higher than average.

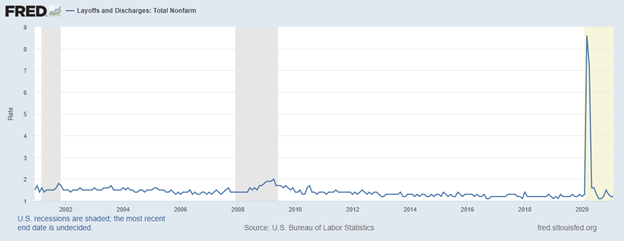

Another indication of the return to normal is the fact that the layoff rate is also back to its pre-pandemic level.

Layoff Rate Has Returned to Normal

Source: Federal Reserve.

Quit Rate and Layoff Rate Show Strong Job Market

This indicates that employers are seeking employees since a high number of layoffs is consistent with a weak job market.

Taken together, these two charts show a strong job market. While employees may not be bargaining in the sense that their union is seeking better pay, in this environment, employers need to compete for the best available talent. That means they will increase wages, and employees will move from low-wage positions to better pay whenever possible.

This may not be the equality politicians seek, but it is a market where success is rewarded, and that’s consistent with strong economic growth.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

P.S. I’ve been telling my readers that someone could double their money in a year with this. By the end of 2020, I proved that to be true. My “One Trade” strategy has never had a losing year across 12 years of back testing. And last year’s live results were even better. Click here to see how it all works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.