Interest rates are still low by historical standards. The interest rate on ten-year Treasury notes, at about 1.6%, is almost 75% below its 40-year average of 5.7%.

The reason for the low rates seems to be the Federal Reserve. The Fed is buying massive amounts of Treasury securities which forces rates down.

Last week, Federal Reserve Chairman Jerome Powell assured traders that the Fed was planning to maintain this policy for some time. In an interview with The Wall Street Journal, Powell expressed concern about the economy.

He said: “Today, we’re still a long way from our goals of maximum employment and inflation averaging 2% over time.”

Powell noted that the U.S. has about 10 million fewer jobs than before the pandemic and said, “It will take some time to get back to maximum employment.”

He did say he is watching the recent rise in long-term rates noting that it “was something that was notable and caught my attention.”

But he is more concerned with the overall state of the market, adding: “I would be concerned by disorderly conditions in markets or a persistent tightening in financial conditions that threatens the achievement of our goals.”

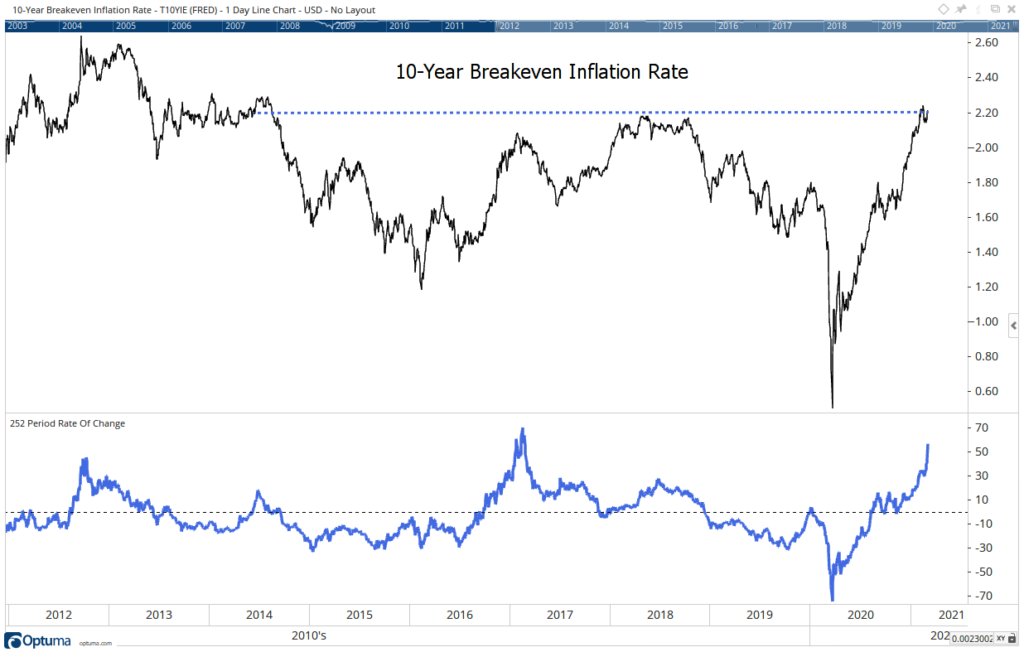

Traders may not be as patient as the Fed. The chart of the 10-year Treasury Breakeven Inflation Rate is at levels last seen in 2014.

10-Year Breakeven Inflation Rate Reaches 6-Year High

Inflation Fears Are at Six-Year Highs

Breakeven inflation rates show what bond traders expect inflation to average in the next 10 years. It is calculated from the market prices of 10-year Treasury notes and 10-year Treasury Inflation-Indexed Constant Maturity Securities.

This rate rose from 0.5% in March 2020 to 2.2%. While inflation of 2.2% is still considered low by historical standards, it’s above the Fed’s target and a cause of concern for consumers.

The one-year rate of change in expectations, shown at the bottom of the chart, is at levels last seen in February 2017. Back then, interest rates were falling, and the economy was slowing. Today, the opposite conditions are in place.

Inflation is lurking in the minds of traders, and, more importantly, fixed-income investors are betting on inflation with real money in the market.

For now, the Fed is ignoring inflation. But markets tell us they won’t do so for long.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.