Interest rates are low and falling. In a normal market, prospects of inflation would fall.

But this isn’t a normal market.

The Federal Reserve is providing money to bond markets. It’s buying billions of dollars of corporate bonds. And that’s hiding inflation.

Let’s review the Fed’s programs.

Under one program, the Fed can buy up to $750 billion in corporate bonds. That represents about 11% of the market. The Fed creates these programs whenever it decides a problem exists. So that amount could increase at any time.

The Fed is also active in the Treasury market. Purchases there have topped $1.6 trillion since the recession began earlier this year.

And it’s supporting the municipal bond market, purchasing up to $500 billion in debt. Purchases are limited to bonds that one of three groups issue:

- Cities with populations of 250,000 or more.

- Counties with populations of at least 500,000.

- Or other debt issuers that states designate.

Basically, almost anyone.

All that buying holds interest rates down. But traders are concerned about inflation.

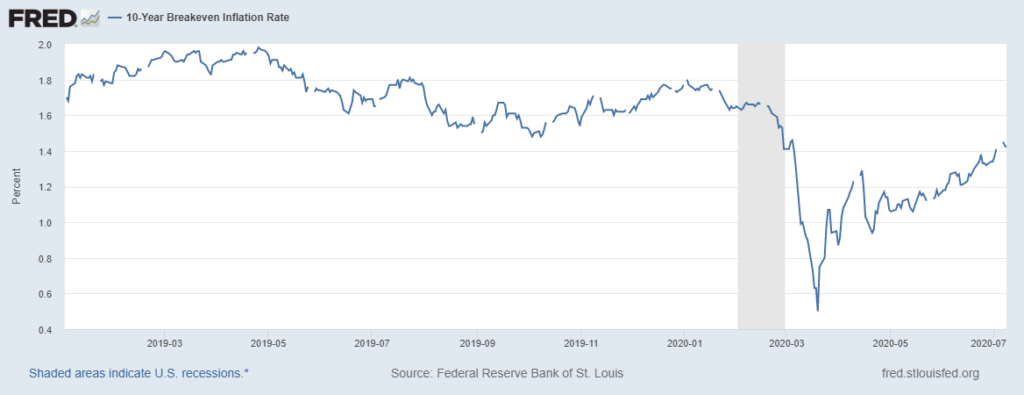

You can see this in the chart of the 10-year Treasury Breakeven Inflation Rate below:

10-year Treasury Breakeven Inflation

Source: Federal Reserve

Breakeven inflation rates are what bond traders expect inflation to average in the next 10 years. It is calculated from the market prices of 10-year Treasury notes and 10-year Treasury Inflation-Indexed Constant Maturity Securities.

This rate rose from 0.5% in March to 1.42% in July. While inflation of 1.42% is low, traders are still worried about a big spike.

What an Inflation Spike Means

This hurts companies that need to raise debt to finance operations. Growth companies that have surged in the recent stock market rally fall into this category.

It also hurts consumers with credit card or student loan debt set to current rates. Inflation hurts almost every sector of the economy.

And it’s lurking in the minds of traders. More important, fixed income investors are betting on inflation with real money in the market.

For now, the Fed is hiding inflation. But markets tell us it won’t do so for long.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.