Recently, I wrote about how inflation can impact stock market returns. I found that the stock market tends to deliver below-average returns when inflation tops 4%.

Some readers noted that the result was interesting but questioned the arbitrary level of 4%. I was already digging deeper into that question and want to share new results with you today.

The potential problem with using a fixed level of inflation is that 4% might be good or bad. If inflation rose to 4% from 1%, that’s bad. If it fell to 4% from 6%, that’s good.

This is the same problem investors who use price-to-earnings (P/E) ratios discovered in the last decade. Since the 1960s, some value investors insisted a P/E ratio under 15 identified value. When interest rates fell to zero, investors were willing to pay more for stocks. P/E ratios of 20 or more are now normal.

Using a dynamic level overcomes this problem. For value investors, they might compare the P/E ratio to earnings growth rates or current interest rates.

For economic data like inflation, I researched how that data compares to its moving average (MA). An MA shows the recent trend. This is a technique that traders often use when selecting stocks.

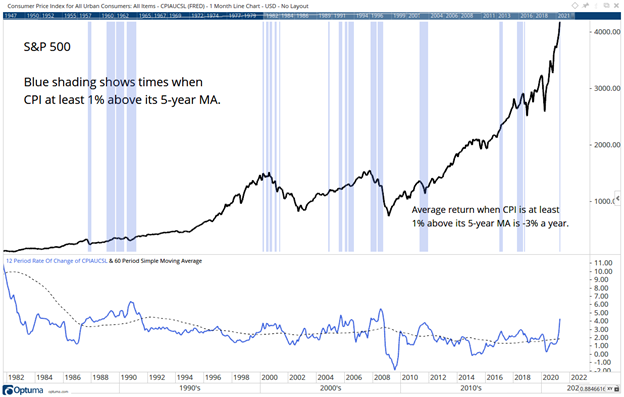

When the Consumer Price Index (CPI), a common gauge for inflation, is above its MA, it’s inflationary. As I studied this question, I found a research firm, Ned Davis Research, had identified the 5-year MA as a standard for defining the trend of inflation. This period considers the average time between recessions, which should be related to the trend in inflation.

Testing shows that selling stocks when inflation is more than 1% above its MA would avoid some bear markets — shown in the chart below.

Selling When CPI Is Above MA Can Avoid Bear Markets

Source: Optuma.

Inflation Suggests Investors Be Bearish

There were times when stocks went up, even when inflation was high. But overall, owning stocks then was a losing strategy.

There were also times when stocks went down, even when inflation was bullish.

While this could be used as a complete strategy, it could be best to consider it as just one input into a strategy. And that input is bearish right now.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.