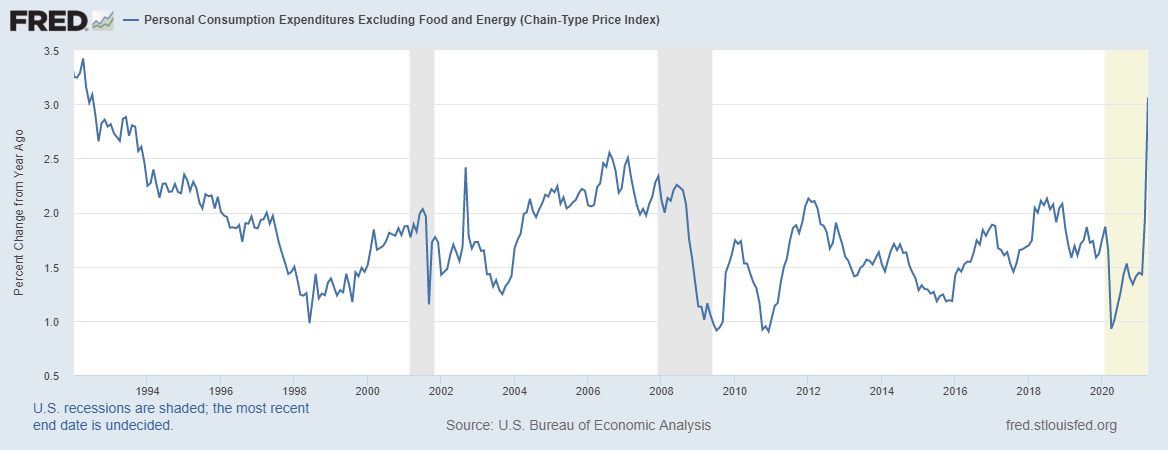

Federal Reserve Chairman Jerome Powell must be ecstatic. He was right. Inflation is back, but it may be stagflation instead.

On Friday, the Commerce Department reported core personal consumption expenditures (PCE) index rose 3.1% in April. CNBC noted this was because “price pressures built up in the rapidly expanding U.S. economy.”

Fed officials have been warning of higher inflation for months, but the report exceeded expectations. Economists had been expecting an increase of 2.9%.

This was the fastest rate of change in PCE since July 1992.

PCE Index Spike the Largest in Decades

Source: Federal Reserve.

PCE Index Points Towards Stagflation

While this is bad news for consumers, digging deeper into the report showed even worse news.

Core PCE excludes food and energy. While economists prefer talking about this price index, consumers spend money on food and energy in the real world.

When the index included those prices, it was up 3.6% compared to a year ago. The trend towards higher prices appears to be accelerating, with the headline PCE up 0.6% in the last month.

At the same time, income is dropping. Personal income dropped 13.1% from March as government stimulus payments ended.

Wages grew just 0.9%, and much of that increase was due to employees going back to work. This week’s employment report will offer insights into hourly wages, but this report indicates wages are not keeping up with inflation.

This is similar to the scenario of the 1970s when prices raced higher while wage growth lagged. Economists needed a new word to describe that idea, and they came up with stagflation.

The Fed has assured us this time is different. Instead of stagflation, we are experiencing transitory inflation. This is just temporary, they say, and prices will fall within months.

As consumers, we know prices don’t usually fall. The costs of goods and services tend to move endlessly higher. We are most likely on our way to a second round of stagflation, and that will batter stock markets as badly as it did 50 years ago.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.