Policymakers have assured us for almost two years that inflation isn’t going to last.

They argued, at first, that high inflation was due to some unique factors. Most prominently, they blamed used car prices.

Used cars and trucks account for 4.6% of the Consumer Price Index (CPI). This seems high, but remember that most of us buy cars infrequently.

Maybe we buy a car every five years. When we make the purchase, the price will be equal to more than 20% of our annual income. Spreading that out over the five years means the CPI weighting is probably a good estimate.

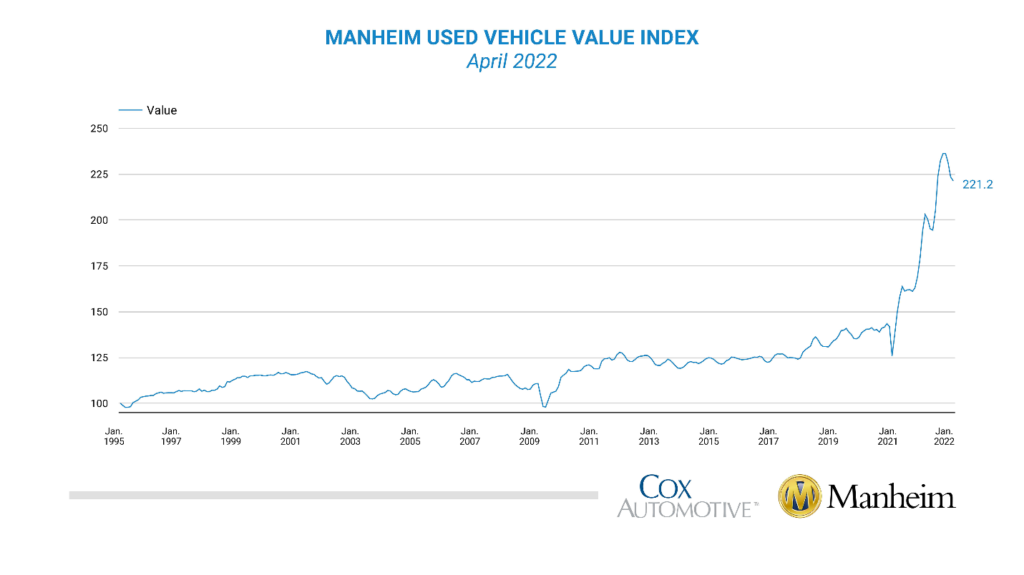

As used car prices skyrocketed, so did the CPI. Prices jumped 89% in two years. That accounted for a gain of about 4% on the CPI. That’s more than a third of the CPI’s increase over that time.

Used car prices have started to fall. The Manheim Used Vehicle Index is down 6.4% in the past three months.

Source: Manheim.

This index is based on more than 5 million used vehicle sales that are completed every year. And it accounts for differences in ages and features of vehicles. The Manheim Index is considered an accurate measurement of the market.

Why Watch Used Car Prices?

Used car prices falling is welcome news. But it doesn’t mean the CPI will drop. Many prices are sticky, meaning they go up quickly but rarely, if ever, come down.

This does indicate the pace of increases in the CPI should slow. Families are trapped in a higher-cost world, but if inflation falls, they may have a chance to catch up.

There’s no guarantee that inflation will slow. If it doesn’t, expect Federal Reserve officials to blame some other unique factor.

Bottom line: After two years of rapidly climbing prices, consumers have some hope that inflation will slow. And good news is needed now that the stock market looks vulnerable to a sell-off.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.