Gold and silver have captured the attention of investors lately. Both metals offer protection against inflation. But that’s just one source of potential gains in metals.

COVID-19 has changed the way millions of people work. Working from home requires more connectivity, more processing power and more storage devices. This will increase demand for electronic devices.

Small amounts of precious metals are used in many devices. And that increased demand contributes to the bullish case for gold and silver.

Electronic devices also use copper. There is a bullish argument there as well. Copper may also be an important part of the battle against the coronavirus.

According to a recent report in Smithsonian Magazine:

A microbiology researcher at the University of Southampton (U.K.), has studied the antimicrobial effects of copper for more than two decades. He has watched in his laboratory as the simple metal slew one bad bug after another.

He began with the bacteria that causes Legionnaire’s Disease and then turned to drug-resistant killer infections like Methicillin-resistant Staphylococcus aureus (MRSA). He tested viruses that caused worldwide health scares such as Middle East Respiratory Syndrome (MERS) and the Swine Flu (H1N1) pandemic of 2009. In each case, copper contact killed the pathogen within minutes.

Demand for copper could increase if the metal is used on high-touch surfaces in public schools (on door handles, for example) and other public places.

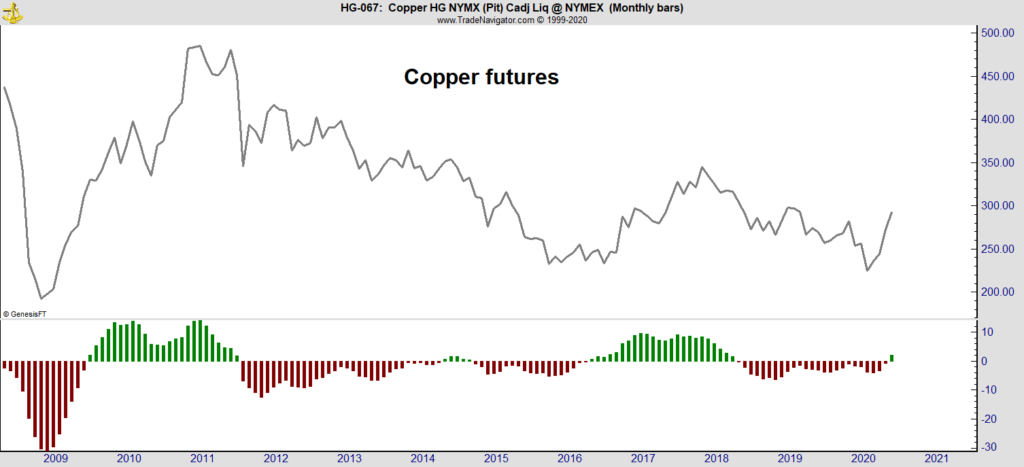

Those are fundamental reasons to expect gains in copper. The chart below shows a technical reason.

Copper Is Gaining Momentum

MACD is at the bottom the chart. This is a popular momentum indicator. It measures how rapidly prices rise or fall.

It’s commonly shown as a bar chart centered on zero. Positive values are shown as green bars (buy signals) while negative values (sell signals) are shown in red.

The recent MACD buy signal shows that now could be an ideal time to add copper to your portfolio. An exchange-traded product, United States Copper Index Fund, LP (NYSE: CPER), is an option.

Copper miners, including Southern Copper Corporation (NYSE: SCCO), are another way to play the upward trend.

Many investors overlook natural resources as an inflation hedge. That includes copper, gold and silver.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.