When I was young, both of my grandfathers told me stories about life on the farm. The two lived on farms that were only miles apart in southern Kansas.

From planting to harvest, there was never any slowdown.

They both told me about maximizing their crop yields — the amount harvested per acre.

To get better yields, they had to use the right fertilizer to grow crops bigger, faster and in greater quantity.

Fertilizer in agriculture is more important than ever, with a higher demand for crops including wheat and soybeans. (If you missed my recent article about a Brazilian soybean producer, click here.)

In 2020, U.S. farmers spent $42.9 billion on fertilizer and chemicals to help increase crop yield. You can see that in the bar chart above.

The University of Missouri’s Food & Agricultural Policy Research Institute projects that will grow to $44.6 billion by 2025.

That increase is due to the growing demand placed on American farmers for wheat, soybeans and other crops used to make the food we eat.

Today’s Power Stock is Intrepid Potash Inc. (NYSE: IPI).

Intrepid Potash extracts and produces potash that we use in the U.S., as well as abroad.

Most of its potash goes into fertilizer for the agricultural market. Intrepid also produces salt used in animal feed, road treatment (think salting roads before ice or snow) and pool treatments.

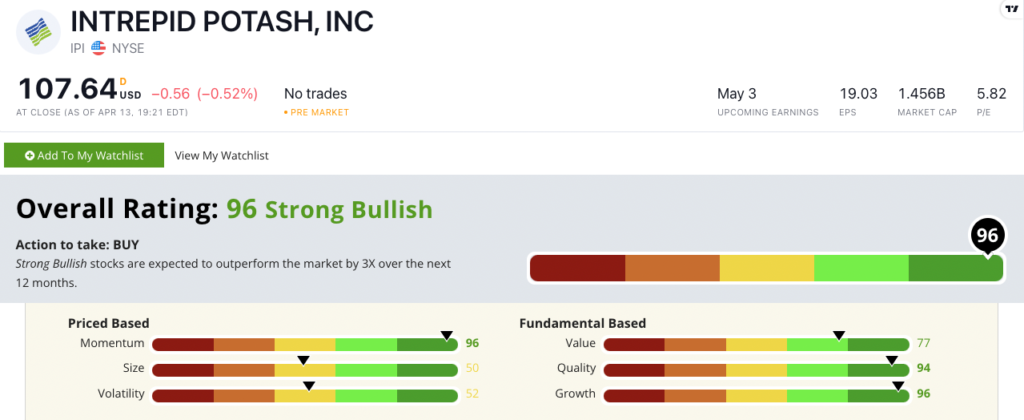

IPI scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

IPI Stock: Excellent Growth & Quality + Strong Momentum

Two items stood out to me about IPI in my research:

- In 2021, IPI increased its year-over-year sales by 4% to $151.7 million thanks to higher fertilizer prices in the U.S.

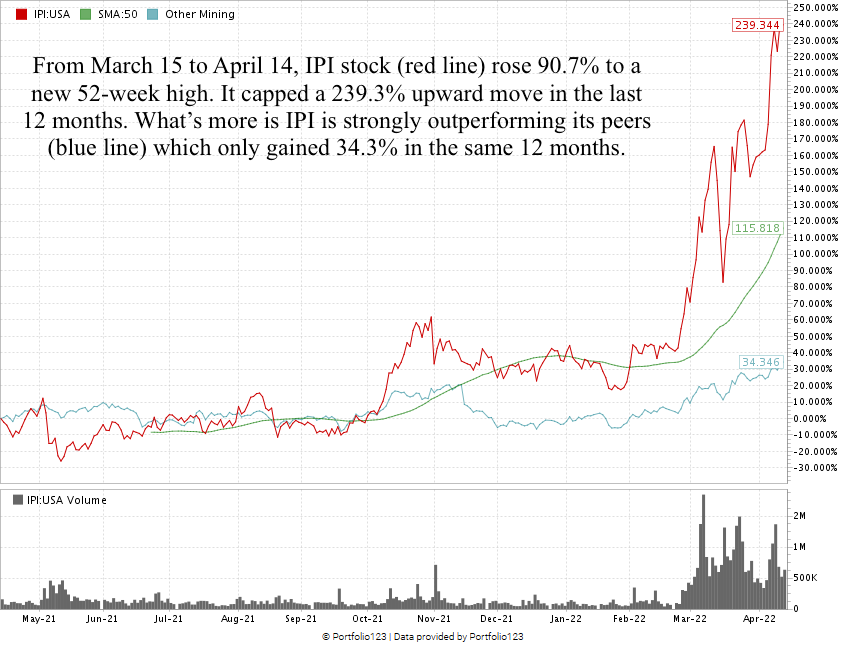

- In less than a month (March 15 to April 14), IPI stock price rose a massive 90.7% to reach a new 52-week high.

We don’t rate many growth stocks that are better than IPI. With a growth score of 96, IPI is in the top 4% of all stocks we rate on the metric.

Its one-year annual earnings-per-share growth rate is 992.6%, and its annual sales growth rate is 37.3%.

And it’s poised to capitalize on the increasing demand for fertilizer as farmers need to produce more grains.

A broader market pullback didn’t stop the stock from reaching a 52-week high earlier this month.

On top of that, IPI’s 239.3% gain over the last year is seven times greater than the 34.3% gain its peers made over the same time.

Intrepid Potash stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

The stock is in the top 6% of all stocks we rate in quality, thanks to returns on assets (38%), equity (47%) and investments (44%) that are far higher than its peers’ negative return-ons.

Its net margin of 92.4% quashes its peer average of negative 183.7%. IPI is generating a ton of profit as a percentage of its total revenue, folks! And I have high conviction that it will continue to do just that.

Stay Tuned: Excellent Gold & Copper Miner

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a gold and copper miner that I think is a top contender for your portfolio!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets