DoubleLine Capital CEO and noted, outspoken billionaire “Bond King” Jeffrey Gundlach laid out a doomsday scenario for the stock market that “will get crushed” when the next recession inevitably hits, adding that it won’t recover for several years.

As the stock market ticked to record high after record high the past few weeks, Gundlach said “the pattern of the United States outperforming the rest of the world has already come to an end” during an exclusive interview with Yahoo Finance.

Gundlach told Yahoo that 2019 was one of the “easiest” years in history for investors in “just about anything. Just throw a dart and you’re up 15 to 20%, not just in the United States, but global stocks as well.”

“2019 looks really strong when you look at things like global stocks and bonds and gold and Bitcoin, just about everything. But you have to remember that it came off an extremely arbitrary point: year-end was a very low point because the fourth quarter of 2018 was incredibly weak,” he explained. “And so if you look at things in a broader context, markets are kind of turning around. Treasury yields have been at around 2% on the 10-year (Treasury) for a while, the S&P 500 and the Dow Jones have reached new highs, but stocks outside of the United States are still below where they were Jan. 26 of 2018. So we’re kind of grinding along and what has helped in 2019 was the massive U-turn by the Federal Reserve.”

The Fed ended 2018 hinting at more rate hikes in the new year, but after the worst December on Wall Street since 1931, there was an about-face and we actually got three rate cuts in 2019, the first three cuts in more than a decade, sending stocks to the recent record highs along with the Fed’s stealth quantitative easing in the repo market.

But all good things must come to an end.

Gundlach mentioned the recent ISM numbers that looked “terrible across the board” and “trouble signs” in the bond market that could portend the next recession for an economy he said is actually not in great shape aside from low unemployment.

“The growth of the national debt is substantially higher than the growth in nominal GDP,” he said. “It’s pretty amazing when you think about it. We talk about how the economy is so good — in terms of employment it’s true. But in terms of other things the economy isn’t that good. If you weren’t expanding the national debt at all and just keeping it constant, we would actually have negative nominal GDP right. So it’s kind of a sobering thought that the recent expansion we’ve had in the recent several quarters is all debt based.

“The national debt and the deficit as a percentage of GDP are at levels historically that have been associated with the depths of recession in terms of a stimulative policy.

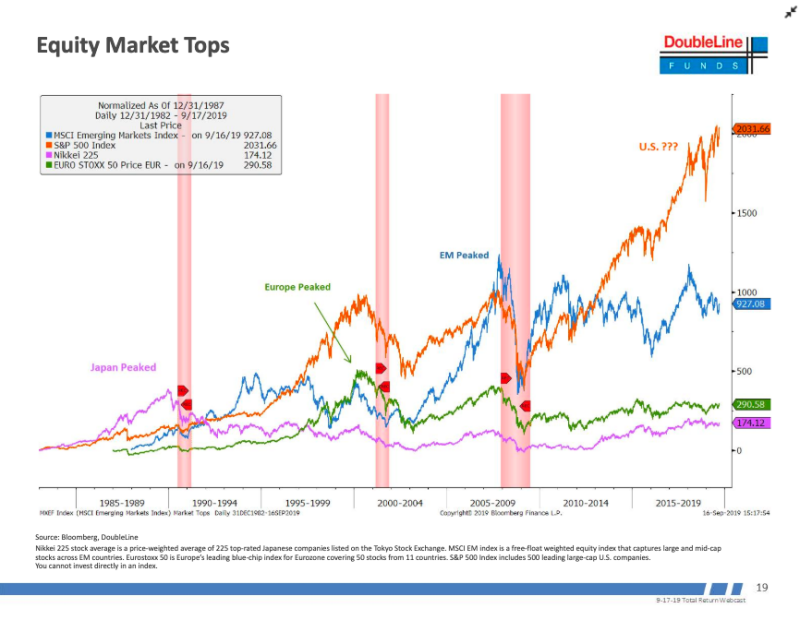

Gundlach points investors to a pattern in his “Chart of the Year.” The chart divides the world into four stock markets: the U.S., Japan, Europe and emerging markets, and it shows how three of those markets never recovered from the Great Recession while the U.S. market did.

And that same fate is coming to an S&P 500 near you at some point, according to the Bond King’s latest predictions.

“So, where are we today? Today we have the S&P 500 killing everybody else over the last 10 years, almost 100% outperformance versus most other stock markets,” he said. “My belief is that pattern will repeat itself.

“In other words, when the next recession comes, the United States will get crushed, and it will not make it back to the highs that we’ve seen, that we’re floating around right now, probably for the rest of my career, is what I think is going to happen,” adding that the U.S. market will take years to recover.

Gundlach also said that the “remarkably stable” U.S. dollar will finally start to weaken under the massive debt that is only growing — even during a good time for the economy, when the debt should be shrinking.

“I think in the next recession the dollar will fall because of the deficit problem in the United States, and that investors will be better served to own foreign stock markets instead of the U.S. stock market in dealing with the next recession,” he said.

So now for the $64,000 question: When is that recession coming?

“It’s around 40% right now (in the next year). In the summer … things were looking pretty dire,” he said. “It’s gotten a little bit better since then. So when you look at things, the ISM looks bad … that certainly looks recessionary. Consumer sentiment though remains at a decent level. What you have to watch for is consumer confidence declining because that’s almost the definitional cause of recession, and retails stocks (got) substantially weaker recently.

“Put it all together, it’s about a 40% (chance of recession in the next 12 months).”

2020 election

Gundlach famously predicted Donald Trump would win the 2016 election before he even won the primary, and he’s sticking with his horse for 2020 — as long as a recession doesn’t hit.

“It’s all about the economy. If the economy holds together and it just might into the election, and then I think Trump’s going to win,” he explained.

“I look at the Democratic candidates and I don’t see any of them as being winners. The only way that Trump doesn’t win reelection is a recession. And if there is a recession, I don’t know if he can even run because he runs on braggadocious language and it’s difficult to get braggadocious if you have a negative sign in front of the GDP.”