My wife often asks me where I’d like to go on vacation if money and time were no object.

The list is long, but one country has solidified its spot: Portugal.

With its scenic beaches, low cost of living and warm climate, Portugal offers plenty of affordable activities.

That led me to today’s Power Stock, a massive Portuguese retailer:

The retail sales index in Portugal rose from 2014 through 2020, and then it plummeted due to COVID.

The index is now up 30% in value, as you can see in the chart above!

People in Portugal are buying more despite record inflation across the European Union. (Portugal’s inflation rate is lower than the EU average.)

Today’s Power Stock is a Portuguese retail giant: Jerónimo Martins SPGS SA (OTC: JRONY).

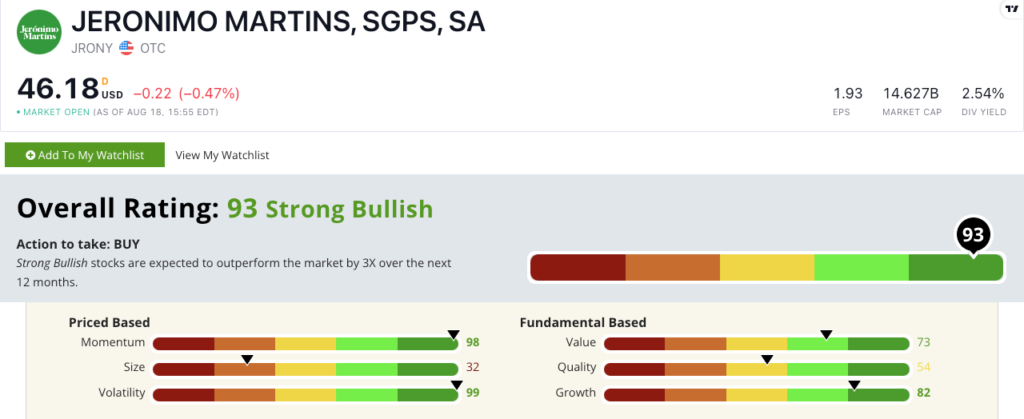

JRONY Stock Power Ratings in August 2022.

Jerónimo Martins operates thousands of supermarkets and retail stores in Portugal, Poland and Colombia.

JRONY scores a “Strong Bullish” 93 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

JRONY Stock: Strong Growth + Momentum

Here’s what I found interesting when looking closer at JRONY:

- In the first six months of 2022, it increased sales by 20% to $12 billion compared to the first half of 2021.

- JRONY‘s $6.7 billion in sales for the second quarter marked its best three months since 2018.

Those numbers show why JRONY earns an 82 on our growth metric.

It scores “Bullish” on value at 73, thanks to a price-to-sales ratio of 0.57 — lower than the food and beverage retail industry average of 0.71.

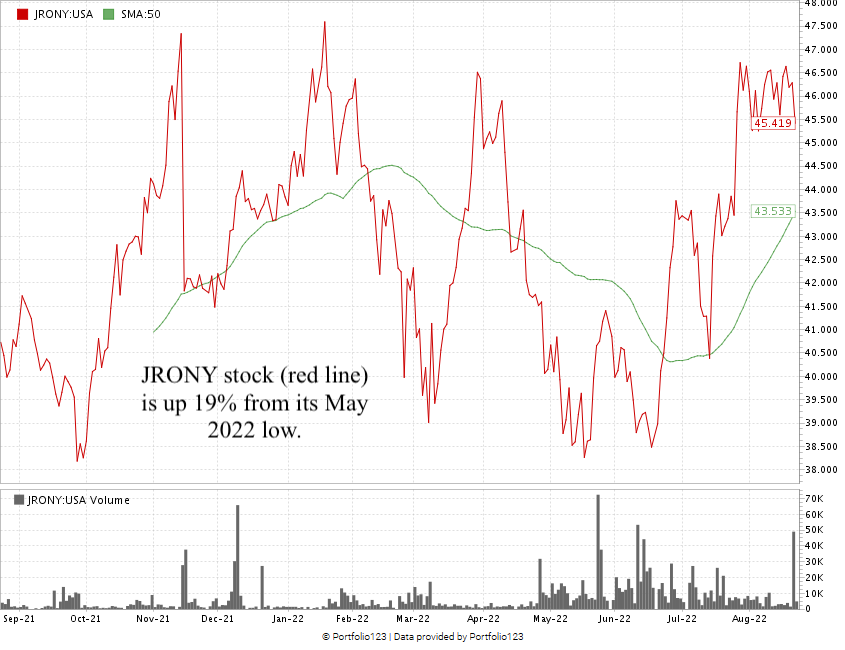

JRONY excels most on momentum, where it rates a 98:

JRONY weathered the recent sell-off and climbed higher after hitting a low in May.

It’s now up 21% from that May low.

It’s testing resistance as it tries to hit a new 52-week high.

Jerónimo Martins stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Despite high inflation across the EU, people are still shopping.

Jerónimo Martins has the grocery and retail markets cornered in Portugal, where inflation is lower than the EU average.

Strong consumer demand is one reason to add JRONY to your portfolio.

Bonus: JRONY’s 3.5% forward dividend yield pays shareholders $1.65 per share per year just to own the stock.

Stay Tuned: Unique Grocery Real Estate Trust

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a grocery real estate investment trust (REIT) that’s soaring amid higher inflation.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.