In this edition of the Marijuana Market Update, I deep dive into Khiron Life Sciences Corp. (OTC: KHRNF).

Eliminating stock losers is just as important as finding winners.

This carries even more weight in a newer, competitive industry like cannabis.

Today, I highlight a message that landed in our inbox recently.

Martha writes:

Hi Matt,

Could you do a video about KHRNF, please?

Khiron Life Sciences Corp., formerly Adent Capital Corp., is a Canada-based company engaged in the alternative medicine sector. The company is an integrated medical cannabis company with its core operations in Latin America.

Khiron is active in the research area of the medical cannabis industry. It develops and commercializes medical cannabis products, mainly in Columbia.

Love and appreciate your videos. Keep up this great service!

Thanks for writing in, Martha. Let’s take a look at Khiron Life Sciences Corp. (OTC: KHRNF) in this week’s edition of the Marijuana Market Update.

Khiron Life’s Shaky Business Model

Khiron is an integrated cannabis company with operations in Latin America, but it also operates in North America and Europe.

At first glance, Khiron has a lot going on.

It cultivates, produces and distributes medical THC and CBD.

Khiron also operates various health centers under the ILANS and Zerenia brands and CBD-based skin care products under the Kuida brand.

Its medical cannabis sales are limited to Columbia, Peru and the United Kingdom, but it wants to expand its medical cannabis sales into Brazil and Germany as well as its CBD sales into Hong Kong and Spain. It also wants to provide physician training and health services in Mexico and Germany.

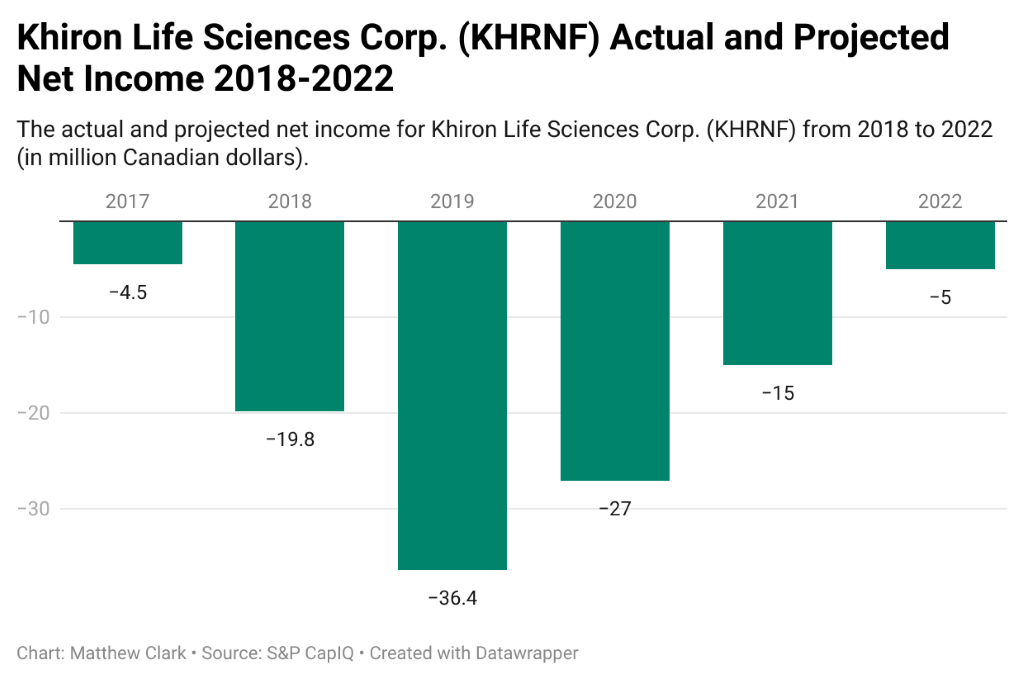

But there is a lot of red ink in Khiron’s financial ledger.

Its net income worsened from 2017 to 2019, dropping from negative CA$4.5 million to negative CA$36.4 million in 2019.

Those are pretty staggering losses, thanks in large part to Latin American lockdowns due to COVID-19.

Latin American markets weren’t open in the same capacity as Canadian markets.

Because it relies heavily on the Latin American market, the lockdowns hit Khiron hard.

In short, the company expects a stronger financial picture after the pandemic subsides, but it lost a lot last year.

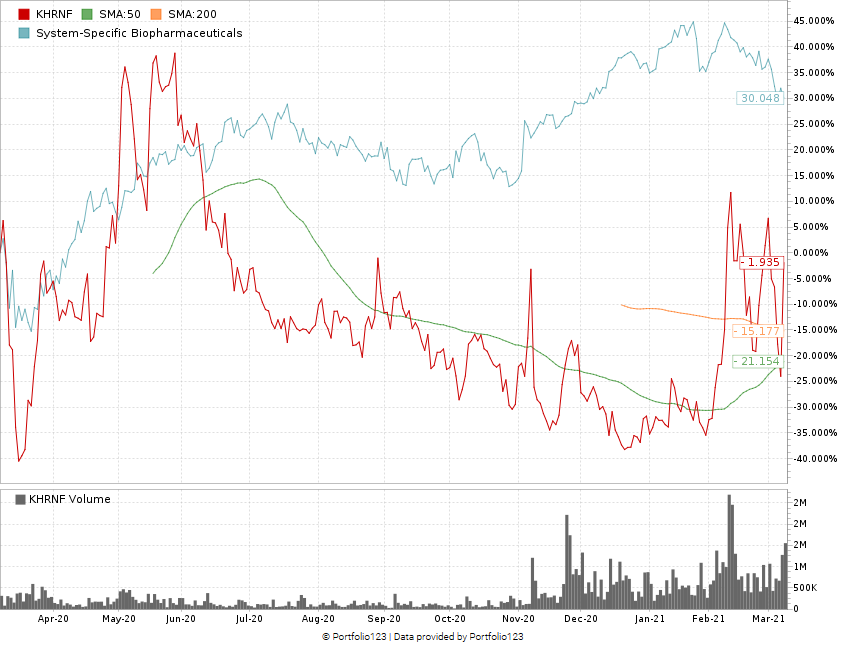

Khiron’s stock price hit a bottom of around $0.26 per share during the March 2020 crash.

KHRNF (Red) Proves Volatile in Past 12 Months

By June 2020, the company hit a 52-week high of $0.60 per share — a 131% increase in its share price.

However, unlike many cannabis stocks, the price took a nosedive in the summer of 2020.

It went even lower after the 2020 election — as low as $0.27 per share in late December.

KHRNF bounced back in February to trade between $0.45 and $0.50 per share, but it continues to bounce all over the place.

And I’m concerned about the company’s limited expansion initiatives.

Khiron’s Future

Khiron performs well in the medical cannabis space, but it doesn’t plan to expand much in this sector. Instead, the company is focused on its physician training and medical services.

I think it’s smart to avoid KHRNF until its price finds more solid footing and the company moves away from the aggressive medical cannabis space.

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.