When it comes to the holiday season, Coca-Cola Company (NYSE: KO) knows how to make an impression.

Source: Coca-Cola Company.

Growing up in my family, nothing brought in the seasonal spirit quicker than seeing a six-pack of glass bottles with the iconic red label in the fridge.

For a friend of mine, that polar bear family enjoying a sixer of Coke is a permanent holiday memory.

Whichever memories you may have, Coke’s marketing genius is undeniable.

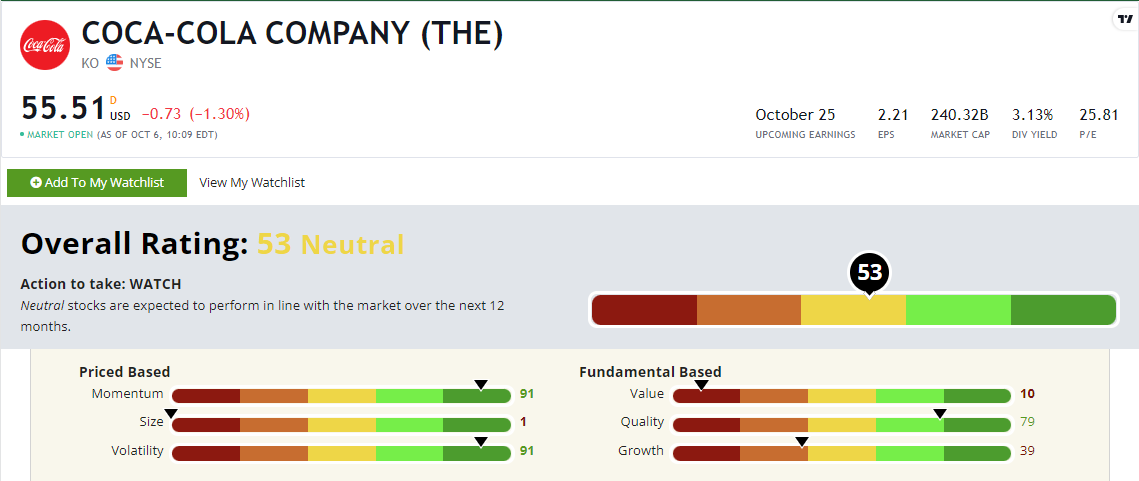

Today, Coke earns a “Neutral” 53 out of 100 on our proprietary Stock Power Ratings system.

I can’t discuss Coke without getting into a major key to its prolonged success.

Coke’s Advertisement History

Coca-Cola’s marketing staff could teach a master class on advertising.

It changed the face of Christmas as all of us know it.

I won’t go into detail because I don’t want to reveal any secrets for the child at heart — but I do like to discuss the company’s untouchable advertising.

Initially distributed in 1886 in Atlanta, it only sold nine drinks daily.

Asa Candler purchased Coca-Cola in 1892 with an advertisement budget of $11,000 and splattered the logo and slogan on whatever he could get his hands on.

Calendars, soda fountain urns, painted walls, napkins, pencils and even clocks were all fair game.

By 1895, every U.S. state and territory sold the soda.

Throughout the 1900s, celebrity endorsements, billboards and radio program marketing led to the famous and probably most influential marketing campaign for the drink: its 1931 holiday advertisement of Saint Nicholas drinking a nice, cold Coke.

Its marketing success didn’t stop as Coca-Cola evolved for modern consumers.

One of the most popular and successful ads for the soda featured the song “I’d Like to Buy the World a Coke,” which aired in 1971.

The 1990s brought the “Northern Lights” ad. This was the one that featured the polar bear family for the first time.

By 2011, Coke’s marketing budget was $4 billion.

And it’s led to more success even in the modern age.

KO’s Steady 2022 and Stock Power Ratings

KO started 2022 off with a nice climb higher.

Coca-Cola’s Stock Power Ratings in October 2022.

KO rates a “Neutral” 53 out of 100 overall rating, but let’s zoom in on volatility to understand how KO has been a steady stock amid the broader sell-off.

KO’s volatility rates a “Strong Bullish” 91.

Over the last 52 weeks, KO rose 6.3%, while the S&P 500 fell almost 13%.

With the recent announcement of another collaboration with Molson Coors, KO is looking forward to an exciting 2023.

Coke is set to continue on an upward path despite dealing with a shaky market from inflationary pressures.

Speaking of dividends, Co-Editor Charles Sizemore’s latest issue of Green Zone Fortunes discusses one of his favorite income stocks of all time.

Click here to learn more and find out how you can gain access to an entire dividend portfolio!

The Bottom Line

Coke scores a “Neutral” 53 out of 100 on our Stock Power Ratings system.

However, “Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in every weekday, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!