We’ve all followed the rise of companies including Tesla Inc. (Nasdaq: TSLA) and Apple Inc. (Nasdaq: APPL).

There’s one thing these tech giants have in common: an element that powers their popular products.

Both use batteries to extend the lives of their automobiles and smartphones.

And it’s what’s inside those batteries that makes all the difference.

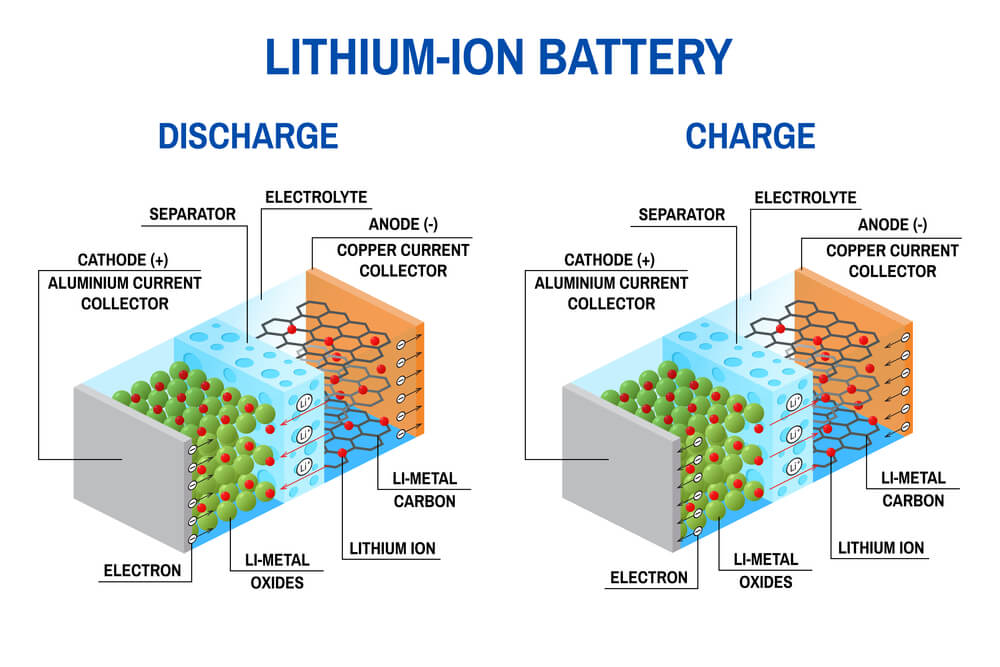

Tesla’s cars and Apple’s iPhones both use lithium-ion batteries.

Those batteries provide cheap, high-performance energy storage that extends the life and the use of the products they power — at a low cost.

How a Lithium-Ion Battery Works

And — key for investors like us — since those companies started using those batteries, their share prices have skyrocketed.

In 2007, Apple started using lithium-ion batteries in iPhones. Since then, its stock price has jumped more than 2,900%.

Tesla first used the battery in its Roadster in 2008. Its share price has returned more than 4,700% in that time.

The fact is that those products wouldn’t be the same without lithium-ion batteries.

And neither would either company’s massive growth in share price.

Using Money & Markets Chief Investment Strategist Adam O’Dell’s proprietary stock rating system, you’re going to find out about a company set for a massive breakout as the lithium-ion battery market continues to grow.

The Lithium Battery Market Is Growing

The Pew Research Center found in a study that 76% of people living in advanced economies — the U.S., Germany, Spain, etc. — own a smartphone.

That number drops to just 45% in emerging economies. (Think Brazil, South Africa, Mexico and India.)

But the number of people looking to buy smartphones in both types of economies is growing.

And when you factor in the coming 5G revolution, that growth will happen even faster.

As for electric cars, 2019 was another banner year, with sales topping 2.1 million globally.

The International Energy Agency projects electric vehicle demand will grow by 11,000% to between 150 million and 250 million by 2030.

That demand will lead to a boom in companies in the lithium-ion battery market.

Lithium-Ion Battery Market to Grow 101% by 2025

Companies who produce these batteries will see increased profits. But, more importantly, those companies that provide the necessary elements for those batteries will see gains in their share prices.

Lithium Leader’s Strong Momentum

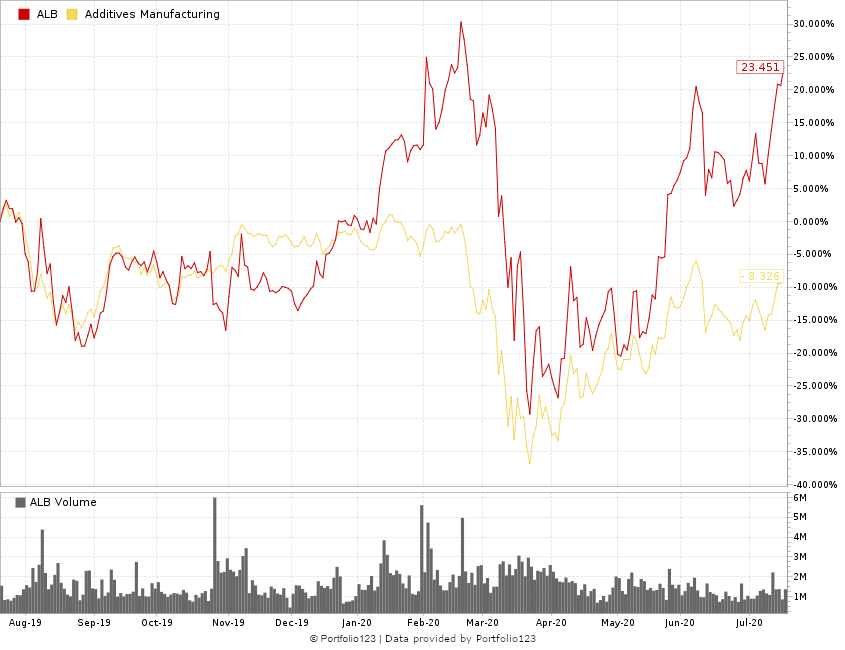

Using Adam’s stock rating system, we found Albermarle Corp. (NYSE: ALB).

The company is a buy based on its momentum and quality.

It specializes in chemical manufacturing, but one of its biggest segments is lithium. The company makes chemicals used in lithium batteries for electronics and electric vehicles.

Albermarle Corp. Beats the Industry

If your phone or car uses a lithium-ion battery, Albermarle Corp. likely provided the lithium chemical used.

In its last quarter, Albermarle sales beat Wall Street expectations by $16 million.

Here’s what else we found:

- Momentum — ALB’s momentum rated better than 86% of all other stocks rated. Its trailing returns are better than 75% of the rest of the market.

- Quality — Albermarle rated an 83 overall on quality — only 17% of all stocks were better. Its returns on investment, equity and assets rated better than 89% of all other stocks. To add to its quality rating, ALB’s margins were better than 80% of every other stock.

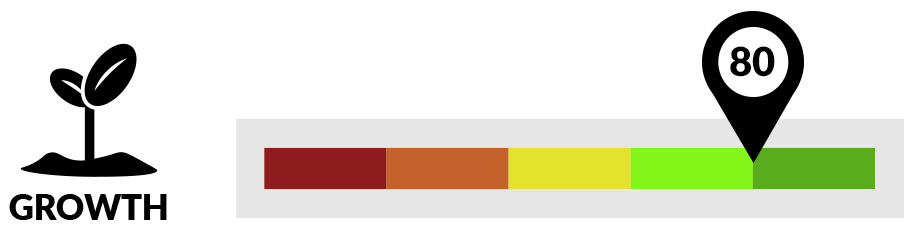

- Growth — The company rated an 80 in growth, meaning just 20% of every other stock rated was better. Albermarle’s growth is highlighted by its net income — it is better than 81% of all other stocks — and its earnings per share — better than 79% of all other stocks.

What You Should Do Now

Fossil fuels are going by the wayside. Even with oil prices low, we continue to look for ways to reduce our dependence. That means more consumers will be looking for electric vehicles.

And more people will buy smartphones — not just in the U.S., but across the globe.

The one thing both products have in common is the need for lithium to power their batteries.

As the market for lithium batteries continues on its rapid pace, investors can get in now and find substantial future gains.

Adam’s system found Albermarle Corp. We think this is the perfect company to realize those profits.