My wife’s vehicle has had problems in recent months that required us to take it into the shop.

We were fortunate that the vehicle’s warranty covered the required repairs.

When I saw what we would have paid, I almost fell out of my chair!

The chart above shows the auto repair industry’s revenue through 2024.

After a dip from 2019 to 2020, the industry is climbing back and will reach $135.1 billion by 2024 — a 21.3% jump from 2020!

One reason Americans are fixing their cars instead of buying new ones is financial: New car prices jumped $6,220 in 2021. This led many folks to decide they were better off paying to repair the vehicle they’re driving now.

LKQ Corp. (Nasdaq: LKQ), a large distributor of automotive replacement parts, is today’s Power Stock.

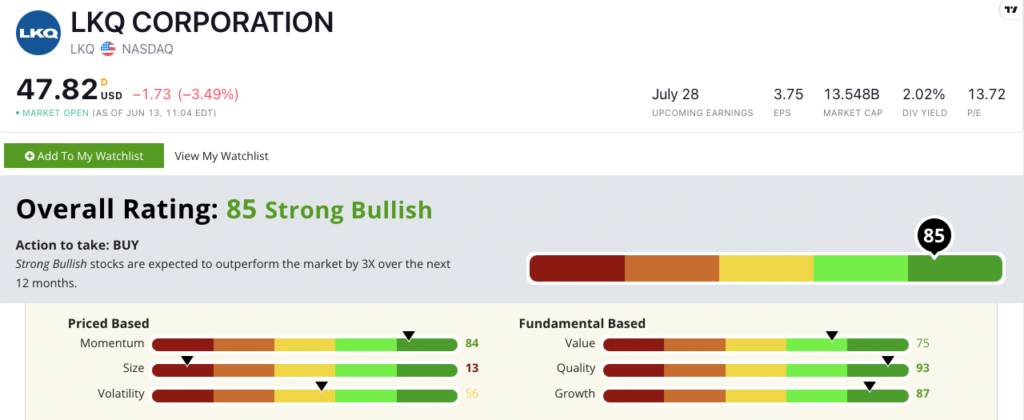

LKQ Stock Power Ratings in June 2022.

LKQ distributes both large items — windshields and trunk lids, for instance — and small items such as brake pads and filters.

It sells parts to dealerships and repair centers in the U.S., Canada, Europe and Taiwan.

LKQ Corp. stock scores a “Strong Bullish” 85 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

LKQ Stock: Excellent Quality

The stock had a strong first quarter this year.

Here are two highlights:

- The company increased its revenue by 6% year over year to $3.3 billion!

- LKQ increased its revenue growth for 2022 from 5% to 6.5%, citing strong demand for its products.

LKQ’s gross margin of 40.8% means management knows how to turn a profit.

Its return on assets is 8.6%, which is triple the auto retail industry average — earning it a 93 on our quality metric.

Its one-year earnings-per-share growth rate of 75% and sales growth rate of 12.5% make it a solid growth stock to boot.

LKQ stock dropped 28.7% from its 52-week high in January 2022 to its 52-week low in March.

The stock recovered and rose 14% from that low. It’s testing support at $48 per share.

Over the last 12 months, LKQ is up 1% while its auto retail peers are down 9.9%.

LKQ Corp. stock scores an 85 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The cost of buying a new or used car continues to increase, pricing millions out of the market.

That means Americans will spend money to repair their current vehicle instead.

An international supplier of auto repair parts, LKQ Corp. is a strong quality stock for your portfolio.

Stay Tuned: South American Natural Gas Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent natural gas stock to buy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com.