Policymakers and economists have cheered recent news on unemployment. Headline unemployment, the percent of the workforce without a job, has dropped from a peak of 14.7% in April to 6.7% in November.

Digging into the data beneath the headlines, there are signs of trouble.

More than 4.1 million individuals have dropped out of the workforce since businesses started shutting down in response to the pandemic. If those individuals were still looking for jobs, the unemployment rate would be more than 9%.

Unfortunately, the number of individuals out of the workforce is more likely to grow than shrink. Economists found that the longer someone is unemployed, the more difficult the job search for that individual becomes.

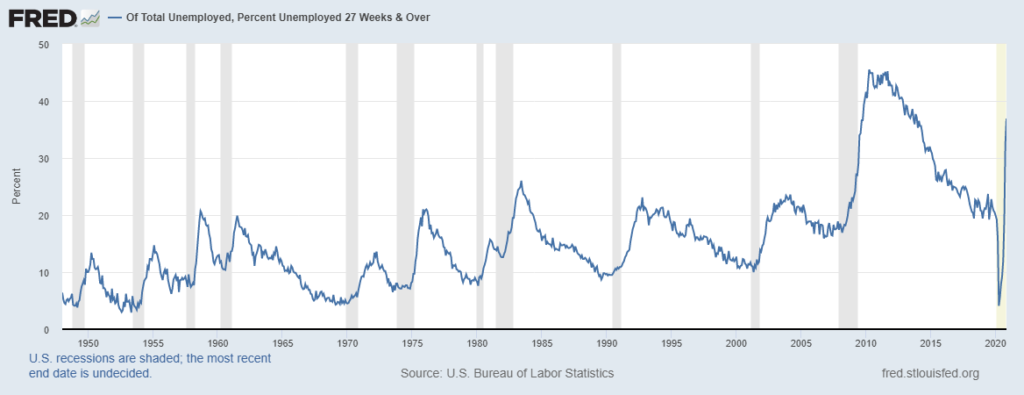

Since long-term unemployment is, by definition, being without a job for at least 27 weeks, that makes the current long-term unemployment level worrisome.

Percent of Unemployed Classified as ‘Long-Term’

Source: Federal Reserve.

Long-Term Unemployment Could Worsen

Today’s level of 36.9% was exceeded only during the Great Recession. These are 3.9 million individuals who were unable to find work since at least June.

One study showed that many of those who find work after a long period of joblessness return to the ranks of the unemployed within a year.

In addition to economic costs, the personal costs of long-term unemployment can be devastating. Gallup found that 18% of long-term unemployed people are depressed.

While depression is common, with a 10.1% incidence rate among all Americans, the high rate in this group could explain some of their difficulty in finding jobs.

It will take time to bring the nearly 4 million long-term unemployed back into the labor force. Until this number falls, economic expansion will struggle.

Yet this number is likely to grow in 2021. In the past six months, the second wave of shutdowns likely created a second wave of long-term unemployment as more businesses closed for good.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.