Home builders are selling more new homes than they have at any time in over a decade. That’s an indicator that stock prices could move higher.

New single-family-home sales rose 13.9% in July from June, according to the most recent data from the Census Bureau.

That’s an annualized rate of 901,000, the highest level since December 2006.

Single-family housing starts, a measure of U.S. home building, rose 8.2%. Strength in new starts means completed-home sales should remain strong for months.

Strong home sales come at a time when the price of lumber is at record highs.

Some experts blame the pandemic for lumber’s price gains. There are a few reasons for that:

- Pent-up demand for new homes as the country was locked down.

- Surging demand for lumber: Homeowners used time at home to work on projects such as decks and gazebos.

- Decreased supply of lumber: Lumber mills needed to change processes to adapt to concerns including social distancing. Some facilities shut down as workers reported illnesses and others slowed production.

While the industry is recovering, the gap between supply and demand is large, and the price of lumber is soaring.

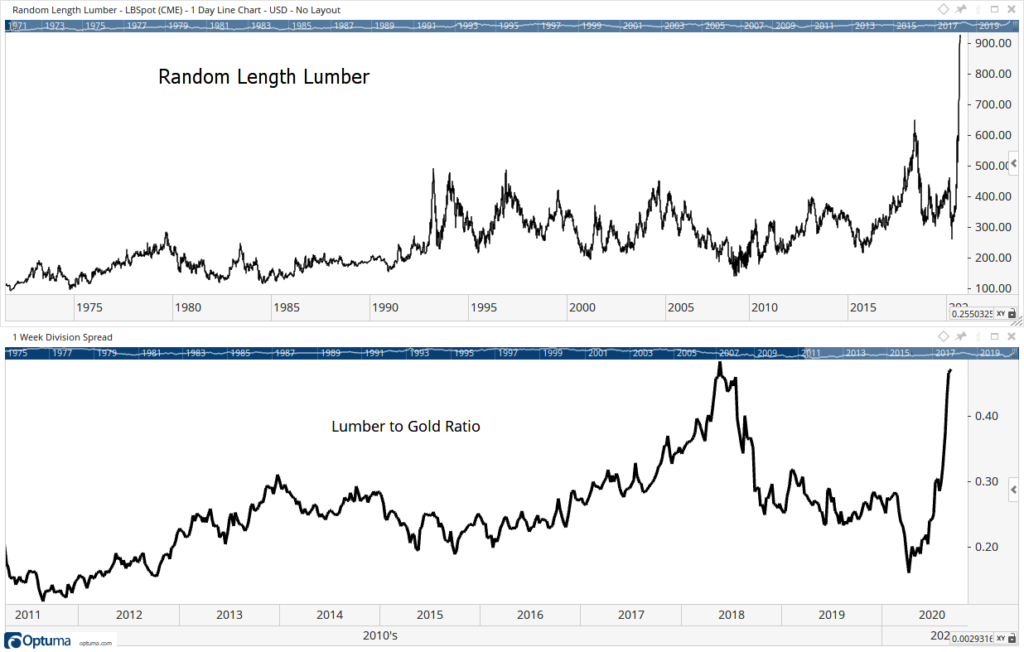

Price of Lumber Hits Record Highs

Source: Optuma

What the Lumber Price Tells Us About Stocks

You can see the lumber-to-gold ratio at the bottom of the chart. It compares the price changes of the two commodities over the past three months. This is a useful stock market indicator.

Researchers found that stocks perform best when lumber outperforms gold over the previous 13 weeks. Lumber supports economic expansions, and gold is a defensive hedge in economic contractions.

Strong lumber prices are bullish for stocks. But high prices could slow the market for new homes.

Recent price gains could add up to around $14,000 extra per house, according to the National Association of Home Builders. With the average new home prices at more than $330,000, additional increases could reduce the pool of available buyers.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.