Last year, airline stock United Airlines Holdings Inc. (Nasdaq: UAL) earned $3 billion. Fees for baggage, seats with leg room and changing flights (which are all close to 100% profit) equaled 80% of that amount.

But United recently cancelled all flight change fees. And that should set off alarms for anyone investing in airline stocks.

The standard change fee, charged to passengers when switching reservations, was $200. Last year, passengers paid United $625 million to change flights.

United is the first major carrier to give up fee income. That might offer a competitive advantage.

Investors must now ask: How does sacrificing profits improve a business? Of course, it doesn’t.

United is responding to the new reality for airlines.

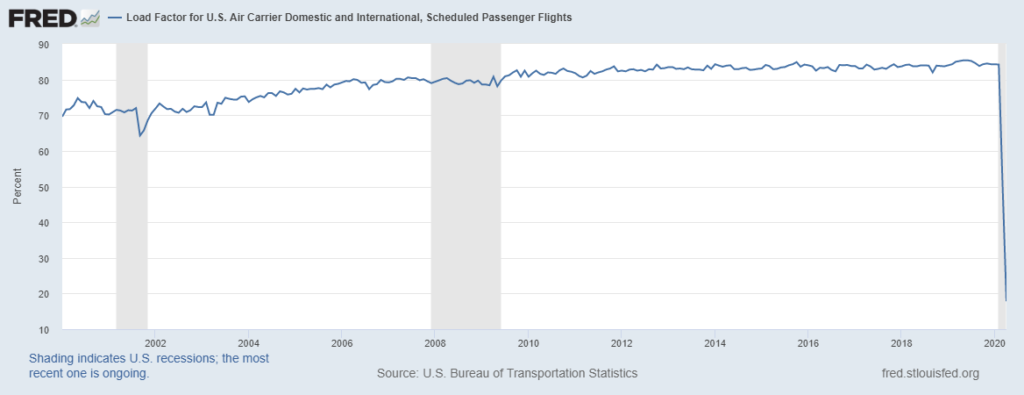

The chart below shows the load factor (aka how full the planes are) fell from 84.3% in December to 17.8% in April.

Planes Aren’t Full Right Now

Source: Federal Reserve

Load factor is the percentage of passengers to the number of seats.

For comparison, the low in the last recession was 72.2%. Airlines responded to load factors below 80% by cutting the number of planes they flew. Fleet reduction, and more fees, led to profits.

United knows it needs to fill seats. Offering flexibility to passengers might help.

One Way to Profit off Struggling Airline Stocks

If United thought it would enjoy a V-shaped recovery in travel, it wouldn’t cut fees.

This announcement confirms it: The airline industry faces a challenge that requires reorganization.

This announcement confirms it: The airline industry faces a challenge that requires reorganization.

This wouldn’t be the first time that airlines reorganized. United and US Air went bankrupt in 2002. Seven regional airlines followed suit in 2008. Only Frontier emerged from the process.

For investors, it’s time to start planning for inevitable changes in the industry. Put options on individual airline stocks is one way to trade a downward move. United must be in bad shape to take the lead on change.

Put options on U.S. Global Jets ETF (NYSE: JETS) are another way to trade the problems in the industry.

It’s important to remember that United didn’t give up $600 million in revenue to help passengers.

United didn’t give up $600 million in revenue to help passengers.

United did it because the company faces a crisis. Investors should make decisions based on this looming crisis.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.