I’ve never lived in what you would call a big city … until now. The Miami metro area is home to over 6 million Americans.

Before moving to South Florida, the largest city I had lived in was my hometown of Kansas, which has about 390,000 people.

Getting around was never much of a problem … no traffic or crazy drivers to contend with.

So ride-sharing — riding in a private vehicle driven by its owner for a fee — was not something I considered.

Here in South Florida, like other dense urban areas, it’s a different story.

Ride-sharing is everywhere down here, and I use it often — sometimes just to avoid the stress of racing other commuters on the I-95 speedway.

But with our Stock Power Ratings system, you can see that while these ride-sharing programs are popular, their stocks are not.

Such is the case with Lyft Inc. (Nasdaq: LYFT).

A quick look at our system helps you see the truth for a company.

Lyft was started in 2012 by computer programmers focused on helping Californian college students get around Santa Barbara.

It went public in 2019 with a valuation of $24.3 billion.

But despite its initial popularity, the company’s stock has been in a downward spiral.

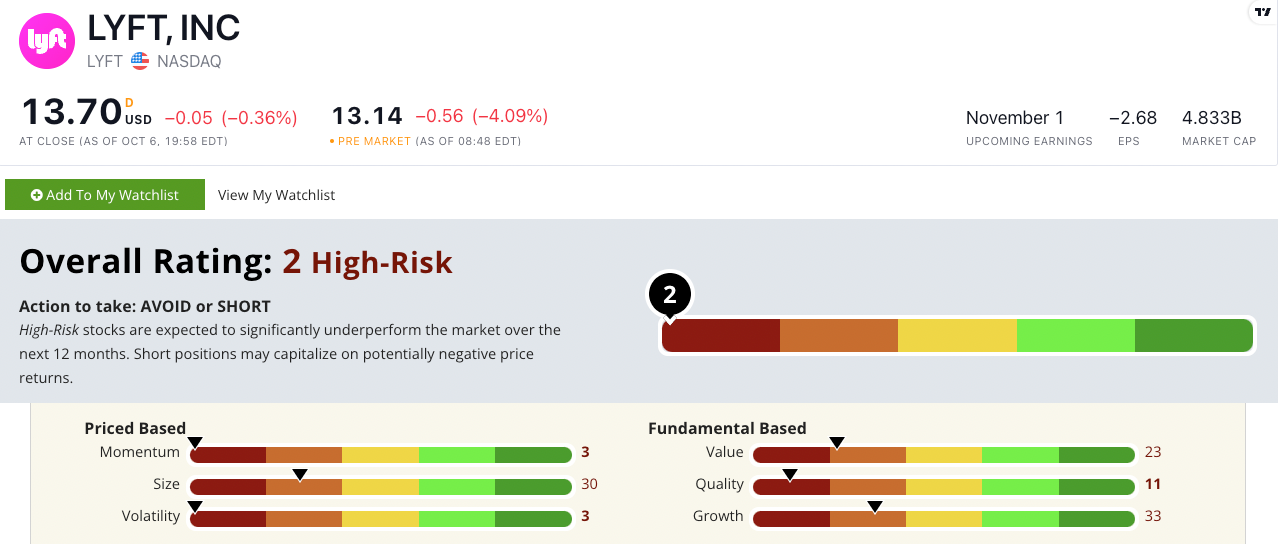

LYFT’s October 2022 Stock Power Ratings.

LYFT stock scores a “High-Risk” 2 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

LYFT Stock: Sluggish Momentum + Poor Value

Here is where I usually tell you about positive company financials.

This is not the case for LYFT:

- It reported a quarterly net loss of $377.2 million — 7% more than its $251.9 million loss a year ago!

- Its net loss margin jumped from 22.5% in the first quarter to 38.1% in the second quarter.

That shows why LYFT scores a 33 on growth.

It also scores in the red on our other five factors.

LYFT has a negative price-to-earnings ratio, meaning it’s not making any profits. It scores a 23 on value.

The company has a dismal return on equity of negative 80% and a return on investment of negative 40.2%, earning it an 11 on quality.

These numbers tell me that the stock is overvalued, and the company continues to sag in its finances.

Created October 2022.

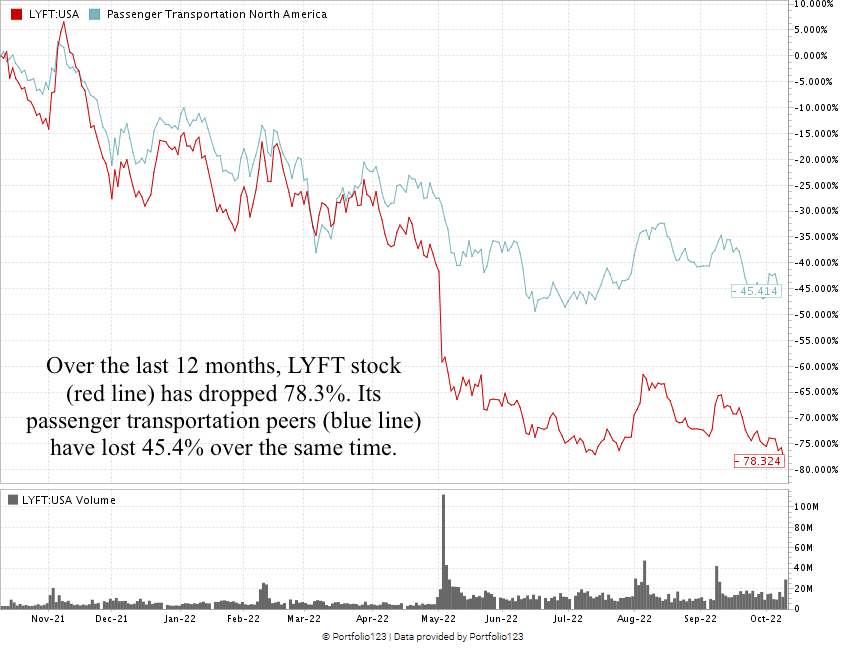

LYFT stock has fallen 78.3% over the last 12 months.

Its passenger transportation peers dropped an average of 43.6% over the same time.

Lyft stock scores a horrendous 2 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Ride-sharing may be all the rage in big cities, like where I am in South Florida.

But until it finds a way to turn a profit, steer clear of LYFT.

Stay Tuned: Construction Outperforms S&P 500 — Take Advantage With One Stock

Tomorrow, we’re returning to our original Stock Power Daily format.

Stay tuned — I’ll share all the details on one construction company that rates a 95 on our proprietary ratings system.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing “High-Risk” stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?