Editor’s Note: The results are in! We’ve been digging into our initial survey responses, and more than 85% of your submissions asked for more stock analysis. That makes a ton of sense considering our field of work … and we’re all about giving you what you want!

Below, Adam walks through why small-cap stocks are due after last year’s mega-tech dominance. And if you haven’t had a chance to take our survey, click here.

Last year’s biggest stock market performers were the “Magnificent Seven”…

The nickname refers to a handful of mega-cap tech stocks that are both industry leaders and household names (Microsoft, Apple, Amazon, Tesla, Nvidia, Google and Meta/Facebook).

But 2024 is starting to seem like a different story.

Tesla’s shares are down 15% for the year.

And although Nvidia is off to a great start, the rest of the bunch are struggling to stay a few points ahead of the S&P 500 Index.

As I explained in a recent issue of Banyan Edge, valuations are just too high to expect continued outperformance to the same degree in these top tech stocks from here.

Instead, 2024 is providing us with the perfect opportunity to broaden our horizons — and start cashing in on small-cap growth…

The Stock Market’s “David vs. Goliath” Story

Over the long arc of market history, small-cap stocks have outperformed large-cap stocks.

A large number of research studies on U.S. stocks, as well as foreign-developed and emerging-market stocks, have proved this.

And right now is the perfect time to build an overweight small-cap portfolio.

Of course, there are specific risks that come with investing in small-cap stocks.

Relative to large companies, small companies typically are characterized by the following:

- A smaller capital base, reducing their ability to deal with economic uncertainty.

- Greater volatility of earnings.

- Greater uncertainty of cash flows.

- Less depth of management.

- Less proven business models (in some cases).

- Less information availability due to fewer analysts covering them.

- Greater volatility of share price.

Of course, unless you — for some reason — believe in “free lunches,” the unique risks that come with investing in smaller companies are precisely why they offer a higher return.

You just have to know which small-cap stocks are worth buying.

That’s where Green Zone Power Ratings come in…

Stay in the Green Zone (and OUT of the “Red Zone”)

In April of last year, I told Money & Markets Daily readers how they can use Green Zone Power Ratings not just to find great small caps — but to steer clear of the biggest losers.

One of the stocks I talked about avoiding was Canopy Growth Corp. (Nasdaq: CGC).

Canopy Growth was once a $50 stock — and not too long ago.

It was a darling of the “pot stock” era, and it’s still around, even though share prices have crumbled from its all-time high in February 2021. Buying up shares for a fraction of the price might have seemed like a strong small-cap, post-recession investment.

But one quick look at CGC’s Green Zone Power Ratings showed us otherwise. In April of last year, it rated just a 9 out of 100, landing in our ”High-Risk” category (aka the “Red Zone”).

Sure enough, share prices tumbled even further. CGC is down 70% since I warned readers about it last April.

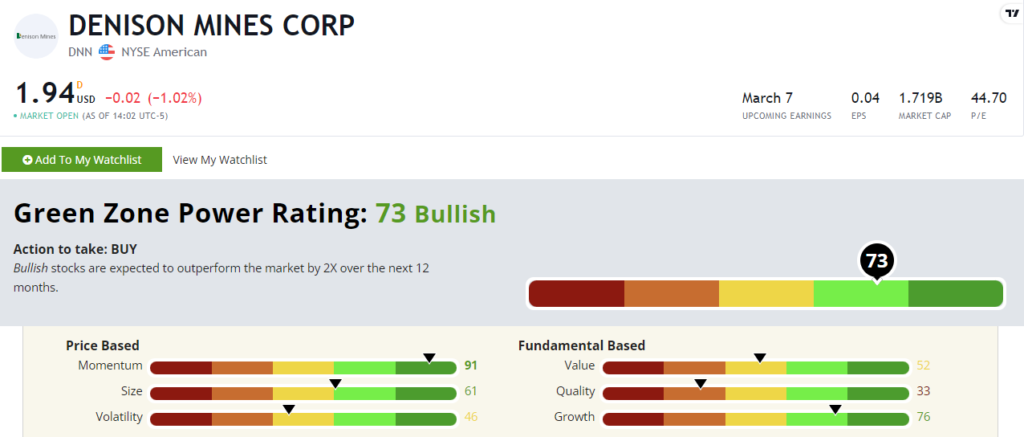

Another small cap that rated much higher on my system, Denison Mines Corp. (NYSE: DNN), cleared gains of 80% during roughly the same period.

Best of all, since Green Zone Power Ratings is a fully automated system, it can keep up with the volatility of these small-cap stocks.

Where a traditional stock analyst might take weeks or even months to provide updates on a specific small-cap, Green Zone Power Ratings are updated frequently. So as prices climb (or fall), a stock’s rating can change to account for that.

For example, DNN’s impressive 80% gain makes the stock less of a value proposition, and it also hurts the company’s Volatility rating (as you can see below):

So DNN still rates as “Bullish.” But with weak ratings for Volatility, Value and Quality, there’s also reason to look for something even better.

Diving Deeper Into Small-Cap Territory

“Magnificent Seven” mega-cap tech stocks had an amazing run in 2023.

So it’s hardly surprising that investors have overlooked the potential of investing in small caps after a stock market crash or recession.

But time and time again, small-cap stocks have outperformed as markets bounce back.

I’m on a mission to educate my readers on this advantage … and I’m biasing the portfolios I build in my stock research services — Green Zone Fortunes and especially 10X Stocks — to the “small” side.

I’m gearing up for what I expect to be a massive run of outperformance in small, high-quality companies over the next two to three years.

To good profits,

Adam O’Dell

Chief Investment Strategist