Welcome to our first mailbag edition of the Marijuana Market Update!

User KK Q left a comment on our YouTube page about the newest stock on our Cannabis Watchlist, Planet 13 Holdings Inc. (OTC: PLNHF):

I’m bullish on this stock for the next 1-2 years+, but for some reason, I’m worried that if it gets federally legalized, it will actually HURT Planet 13 because people can get it in their home.

Thanks for the comment! I understand the concern. Legalizing cannabis at the national level will open a ton of doors. We’ll likely see new producers, growers and retailers pop up once it happens.

But I wouldn’t worry too much.

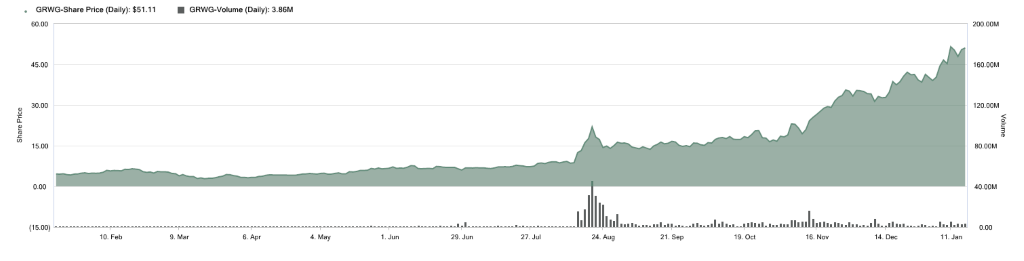

GrowGeneration (GRWG) Cannabis Stock Price

The next question comes from YouTube as well:

Matt, what is your thought on the current trading price of GRWG? Do you expect a major correction coming?

Today, GrowGeneration Corp. (Nasdaq: GRWG) trades around $51 per share. That’s about 1,680% up from its March 2020 lows.

GRWG up Over 1,600% Since March 2020

There is an issue with the stock valuation. To find out what it is — and what I recommend doing with GRWG stock in the coming months — watch my video now.

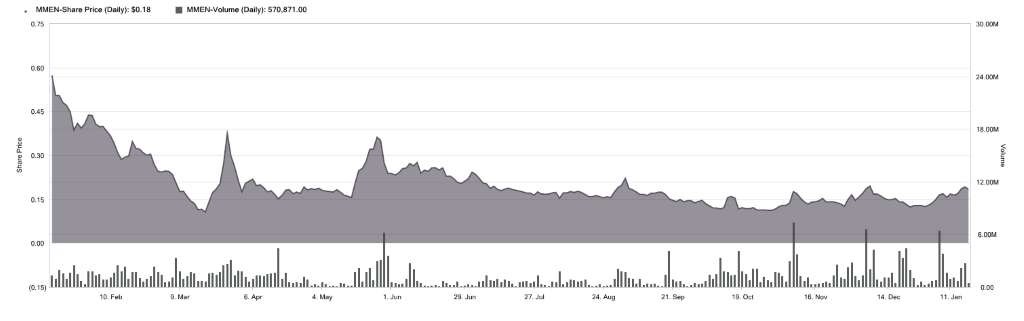

MedMen (MMNFF) Cannabis Stock

The last comment is from Anthony, who said:

Hi Matt. What do you think of MedMen Enterprises Inc.?

Another commenter added:

MedMen tried being a super flashy store … was it timing or lack of size/scope or dilution that hurt them?

MedMen Enterprises Inc. (OTC: MMNFF) is a small California-based cannabis company that operates 25 retail stores in six states.

My biggest concern here is that the stock price hasn’t moved much since the 2020 election.

MedMen Stock Stagnant Since Election Day

It hit a low of $0.11 per share back in March 2020 and rocketed to $0.38 per share about 10 days later.

It touched that high again in May but has dropped off since.

Today, it trades at about $0.16 per share —up 45% from that March low.

But it didn’t bounce up like many other cannabis companies after Election Day.

Watch my video to find out what action I recommend taking on MedMen stock.

Thank you for all your questions and comments. I’ll dig into more of the cannabis stocks you’ve requested in the coming weeks.

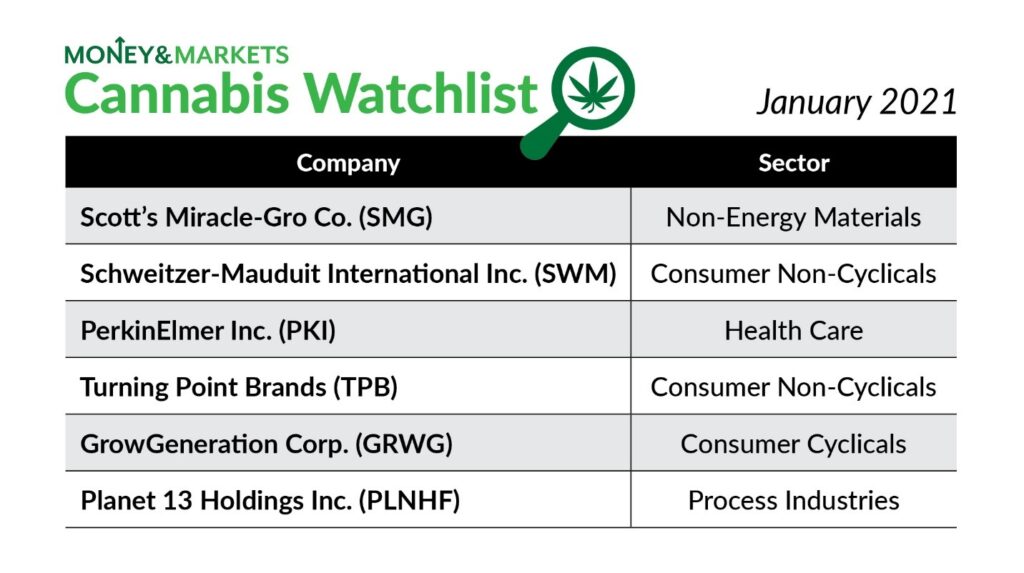

Cannabis Watchlist Update

Now, I want to look at our Cannabis Watchlist.

It continues to perform well, with the average gain of our six positions at 37%.

Here’s a deeper look at the watchlist:

- Schweitzer-Mauduit International Inc. (NYSE: SWM) — This traditional tobacco company has been in the black since I put it on the watchlist in September. It’s showing a 40.3% gain.

- PerkinElmer Inc. (NYSE: PKI) — The company that tests cannabis strains has also been a consistent winner since I added it in September. JPMorgan Chase & Co. recently increased its stake in PKI. The stock is up more than 24% since I added it in September.

- Turning Point Brands Inc. (NYSE: TPB) — This is another traditional tobacco company making a run into the cannabis market. Turning Point is up more than 48% since I put it on the list in October.

- GrowGeneration Corp. (Nasdaq: GRWG) — This cannabis company is selling more stock in hopes of raising an additional $125 million in public money. Since I added it to the watchlist in November, it’s up more than 84% and still has room to grow.

- Planet 13 Holdings Inc. (OTC: PLNHF) — This is our most recent addition — added two weeks ago — and it has faced a little resistance since we added it. The Las Vegas-based company has big expansion plans into California, which I believe will pay off in the long run. As for now, the position is down 5.6% since I added it.

- Scotts Miracle-Gro Co. (NYSE: SMG) — Despite being down as much as 10% early in October, the stock has rebounded and is up nearly 30%.

Next week, I will talk about another cannabis stock that you’ve mentioned in our YouTube comments section.

As always, my team and I love the feedback we’re getting on our YouTube channel and through email.

Feel free to send comments, questions and stocks you want us to examine to feedback@moneyandmarkets.com — or leave a comment on YouTube!

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.