Bubbles are a part of financial markets. These are times when investors ignore fundamentals, and their buying pushes prices to irrational extremes.

The first recorded market bubble occurred in the 1600s when investors in Amsterdam believed tulip prices would always go up. More recent bubbles include interest stocks in the late 1990s and home prices in some markets in the early 2000s.

In looking back at the internet bubble, Federal Reserve Chairman Alan Greenspan noted the challenge regulators and investors face:

“As events evolved, we recognized that, despite our suspicions, it was very difficult to definitively identify a bubble until after the fact — that is, when its bursting confirmed its existence.”

In other words, Greenspan believes it’s impossible to identify bubbles when you are living in one.

He also questioned whether regulators should even be concerned with bubbles, saying:

“Moreover, it was far from obvious that bubbles, even if identified early, could be pre-empted short of the central bank inducing a substantial contraction in economic activity, the very outcome we would be seeking to avoid.”

Eventually, a bubble will burst, and that event could lead to an economic contraction. This makes bubbles dangerous, but regulators need to stand back because bubbles can last for years, as they did in the 1990s.

Investors can’t be as smug as regulators. They can suffer real losses when bubbles burst. To avoid the losses, many researchers have worked on identifying bubbles. You can see the results of one of those efforts below.

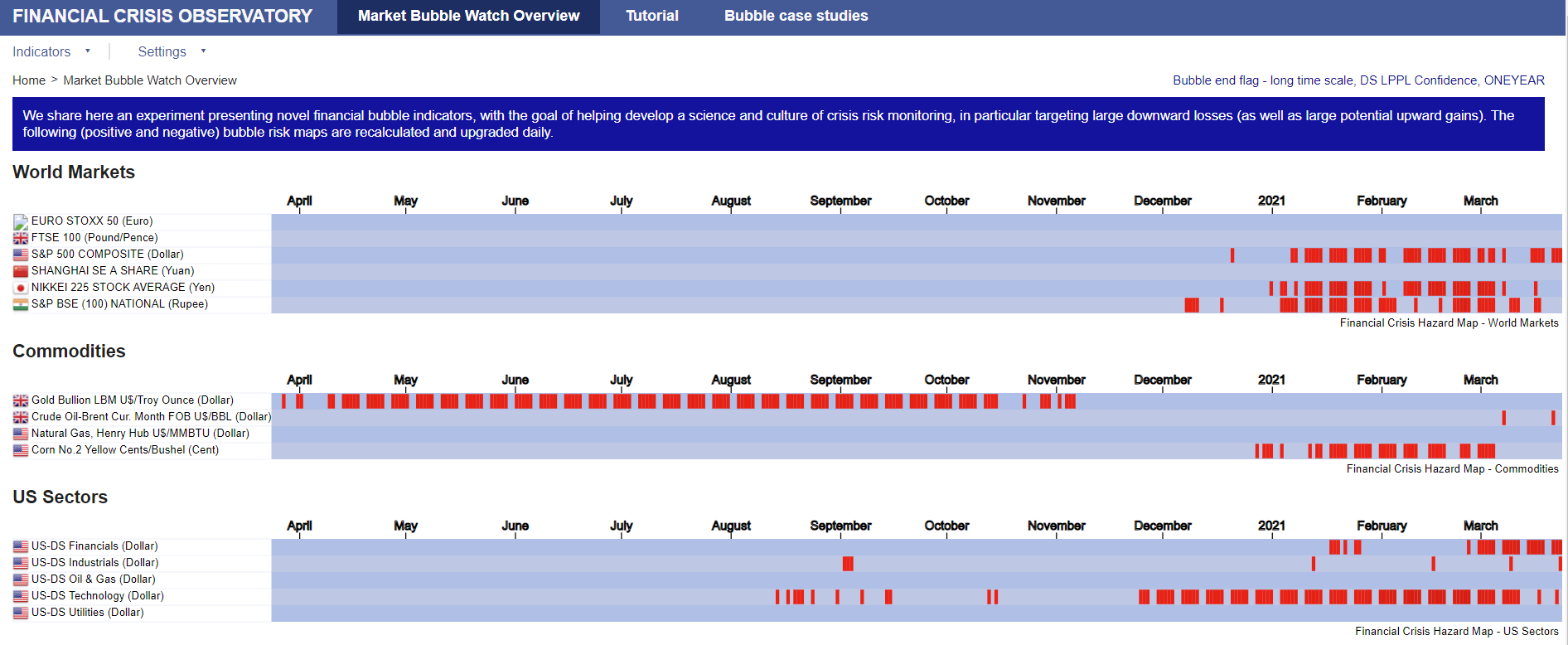

Bubble Watch Overview

Click here to see this full-size chart: Financial Crisis Observatory.

Gold Could Be a Safe Haven From Bubbles

These researchers have spent years studying the markets. Their quantitative models identify periods of high risk.

Since December, stock markets in the U.S., Japan and India have been vulnerable to a selloff. Financial and tech stocks carry the greatest risk. Gold, which experienced a bubble last year according to this model, could be a haven.

Bubbles can last longer than anyone expects them to. While a crash may not be imminent, risks can’t be ignored. Investors should consider safety first for now.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.