Editor’s Note: Markets are closed today to observe the Good Friday holiday. Read on to see why this midstream oil stock should be at the top of your list when markets reopen for normal business hours on Monday morning.

After OPEC’s oil production cut, I immediately started researching ways we could use our proprietary Stock Power Ratings system to position ourselves for success.

And that led me to midstream oil stocks for two reasons. (If you want a rundown of what OPEC did, check out my essay in yesterday’s Stock Power Daily here.)

There are three main stages of oil and gas operations: Upstream, midstream and downstream.

Each stage plays a critical role in getting oil from the ground and to the market. And with OPEC scaling back oil production by more than 1 million barrels per day, U.S. companies need to step up to meet demand.

Midstream oil companies focus on processing, storing and marketing oil and natural gas. These are the companies that deliver gas from the refinery to the fuel pump.

But the biggest reason I landed on midstream is a recent study from Goldman Sachs:

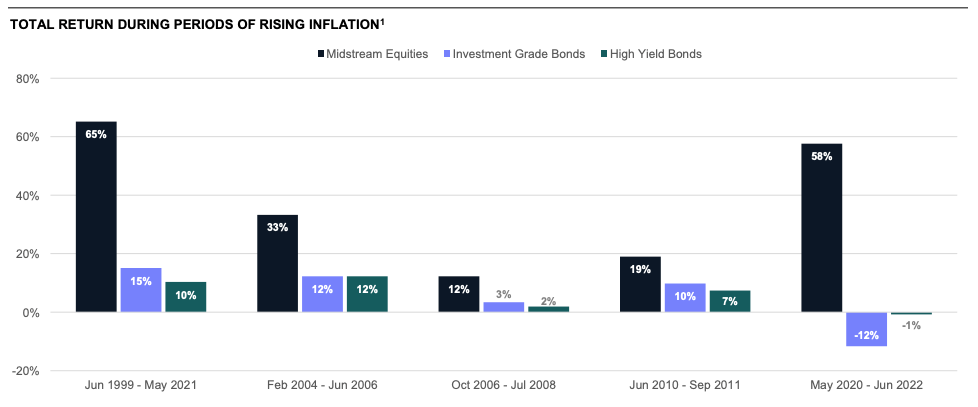

As you can see from this graphic, stocks with a focus on midstream oil and gas crushed investment-grade and high-yield bonds during times of high inflation.

This is important as high inflation persists in the U.S.

Today’s Power Stock operates an oil transportation system that goes from refineries in Texas and Louisiana all the way to customers in Pennsylvania and Michigan. It operates terminals in 23 states.

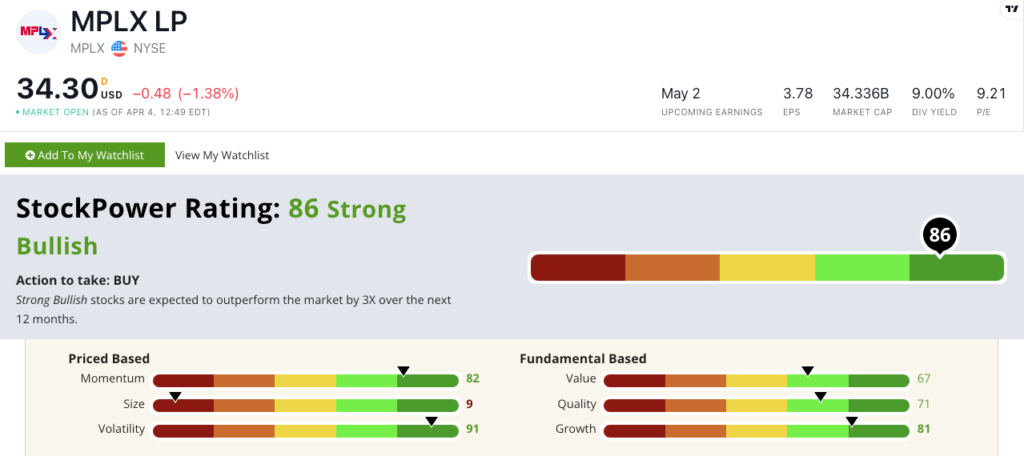

MPLX LP (NYSE: MPLX) scores a “Strong Bullish” 86 out of 100 in our proprietary Stock Power Ratings system.

That means we expect it to beat the broader market by 3X in the next 12 months.

It also comes with a great forward dividend yield (I’ll tell you more about that in a bit).

MPLX works in partnership with its parent company, Marathon Petroleum Corp. (NYSE: MPC) — the third-largest oil and gas company in the U.S., based on 2022 revenue.

MPLX Midstream Oil Stock: Strong Bullish Momentum and Growth

MPLX just closed out a remarkable 2022.

Here are two high points:

- Reported total revenue of $11.6 billion for the year — a 16% increase over its revenue in 2021!

- Its net income for the year was $3.9 billion — $800 million more than it recorded in 2021.

These revenue numbers show why MPLX stock scores an 81 on our growth factor in Stock Power Ratings.

MPLX is also a strong quality stock, scoring a 71 on that factor. Its returns on assets, equity and investment outpace its midstream energy peers. The company’s gross margin is 54.6% compared to its peer average of 36.9%.

The stock also boasts strong momentum:

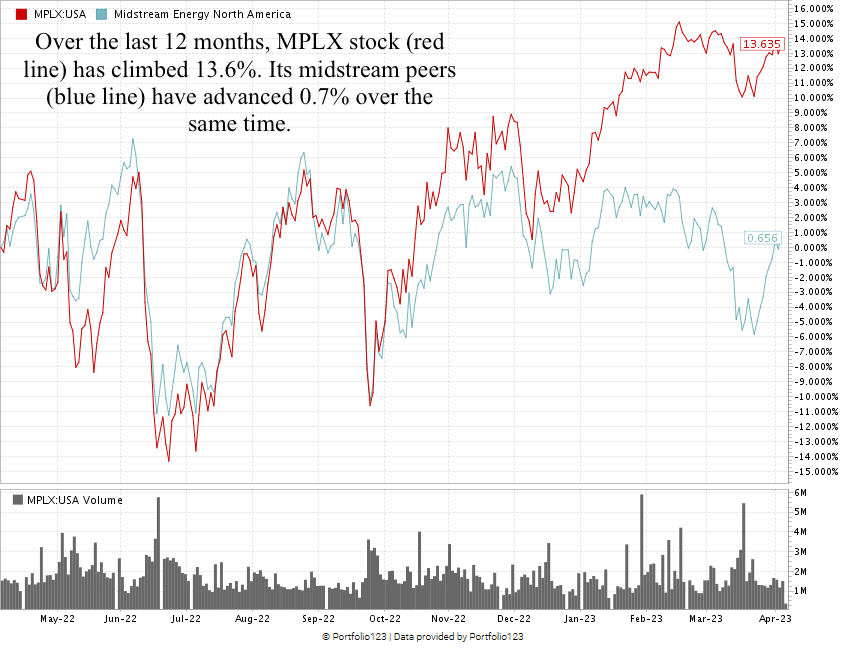

Created in April 2023.

MPLX stock price has increased 13.6% over the last 12 months, scoring an 82 on our momentum factor.

For comparison, its midstream energy peers have averaged a 0.3% loss over the same time.

The stock is currently trading just 2.1% off its 52-week high. I’m confident it will reach that mark … and soar higher.

MPLX stock scores an 86 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Bonus: MPLX comes with an 8.9% forward dividend yield, netting shareholders $3.10 per share per year!

American oil and gas companies are under pressure to produce and deliver more oil after OPEC tightened production and exports.

It means American companies will have to find and bring more oil products to market, quickly.

MPLX has a strong track record of getting oil to the market. That makes this midstream oil stock a strong contender for your portfolio.

Stay Tuned: The Housing Market’s 2023 Potential

The U.S. housing market is starting to heat up again, even with interest rates at their highest level since 2008.

I’ll dive into how we can use Stock Power Ratings to capitalize on this shift in Monday’s Stock Power Daily.

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Today’s Power Stock has a lot of potential as oil prices surge higher, but if you want the best ways to follow what our chief investment strategist, Adam O’Dell, is calling the “Oil Super Bull,” you need to check out his presentation.

This is a broad mega trend that is going to last for years (if not decades), and Adam is targeting energy stocks with 10X profit potential in a matter of years for his premium subscribers.

Click here to see how you can join him in 10X Stocks and start investing in his high-conviction recommendations now.