Allianz Chief Economic Adviser Mohamed El-Erian changed his tune a bit Monday on buying amid the massive coronavirus-fueled dip in stocks, but he still thinks most investors should stay away from any big plays.

“If you’re a short-term tactical investor, there’s a lot of opportunities out there.”

“If you are a long-term investor, I would wait,” El-Erian said during an interview on CNBC’s “Squawk Box” on Monday. “I think fundamentals are going to deteriorate even faster. I think the policies and fundamentals are going to go in favor of bad fundamentals, unfortunately, initially.”

El-Erian has been sounding the coronavirus alarm over the last month, warning that the epidemic will “paralyze China” during an early February interview.

“The coronavirus is different. It is big. It’s going to paralyze China. It’s going to cascade throughout the global economy,” El-Erian told CNBC back on Feb. 5.

He repeated that warning last Tuesday, after the Dow Jones Industrial Average had plummeted over 1,000 points a day before.

“I would continue to resist, as hard as it is, to simply buy the dip,” El-Erian said. He may have been onto something at the time because the Dow ended up losing almost 3,500 points in its worst week since October 2008.

El-Erian, who is also the former CEO of the investing giant Pimco, thinks its going to be hard for China’s economy to restart after being shutdown for so long because of the virus.

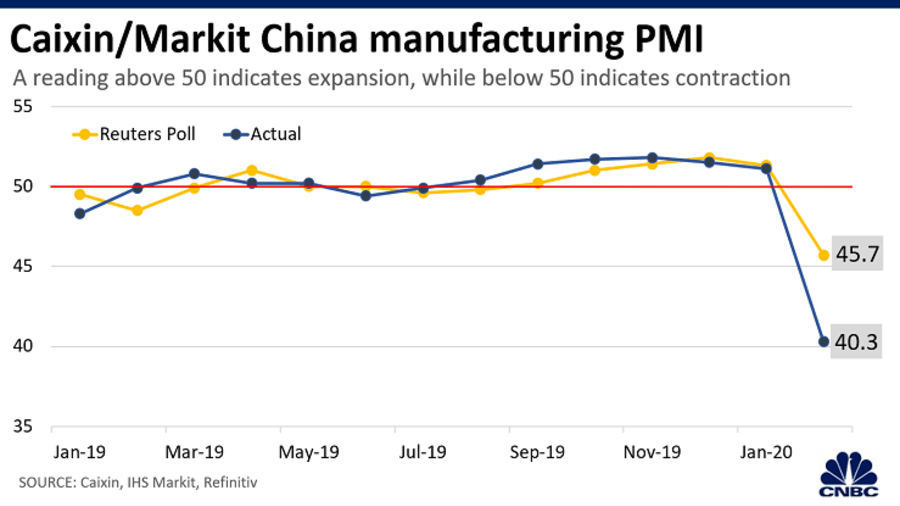

February economic data showed Chinese factory activity hit its lowest reading in history on the Caixin/Markit Manufacturing Purchasing Managers’ Index. It showed a record-low 40.3 contraction, which was well under the 45.7 projection for the month.

Any reading below 50 is considered a recession, while anything above is considered an expansion.

But El-Erian thinks last week’s broad sell-off means it’s “no longer an easy call” to tell investors it isn’t a good idea to buy the dip. He especially thinks there are some good picks out there for professional investors because the downturn was across the board instead of only targeting one sector.

“If you’re a short-term tactical investor, there’s a lot of opportunities out there,” El-Erian said.

Monday’s call to consider the dip came after El-Erian warned at the end of last week that financial markets will start freezing up because of the coronavirus, and even a rate cut from the Federal Reserve won’t help.

“You need a lot of cash and very little debt to navigate what’s ahead, because markets will start freezing up even if the Fed cuts rates, which I think it will,” El-Erian said Thursday.