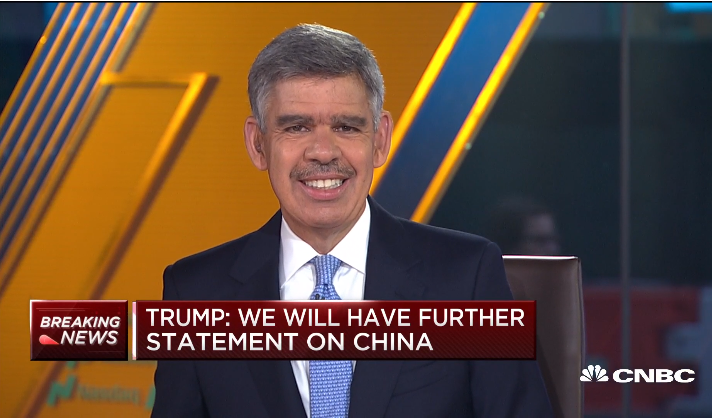

Any Federal Reserve reaction to the coronavirus outbreak — like an interest rate cut — won’t make much of an impact on the markets, according to Allianz chief economic adviser Mohamed El-Erian

The only thing that will help financial markets recover is a medical breakthrough, he said.

He told CNBC’s “Closing Bell” he expects markets to freeze, even if the Federal Reserve decides to cut rates to combat the drop.

“All that that’s going to do is help balance sheets and give some minor relief to markets,” El-Erian said. “But it’s not going to encourage people to travel. It’s not going to encourage people in China to go back to work.”

Without something like a medical solution, El-Erian said markets will continue to fall. He said what’s happening globally is more than just pandemic panic.

“This is a recognition that we have gone too far in terms of liquidity risk and credit risk, and that economic fundamentals have deteriorated,” he said.

"I don't think this is a panic…this is a recognition that we have gone too far in terms of liquidity risk and credit risk, and that economic fundamentals have deteriorated," says @elerianm. pic.twitter.com/BWsubMxwIh

— CNBC's Closing Bell (@CNBCClosingBell) February 27, 2020

As of Thursday’s close, all three U.S. indexes reached correction territory — dropping at least 10% from their most recent record highs.

El-Erian maintained that buying the recent dip in the markets is not a good idea for investors.

“You’ve got to let these economic and natural dynamics play out before the market is attractive enough for the sort of risk that is ahead,” he said.

The Global Spark

On Friday, the annual international car show in Geneva was canceled as reports of the coronavirus spread continued to escalate.

Mexico had its first preliminary positive test. Australia, New Zealand, the Netherlands and the United Kingdom also reported new cases.

However, El-Erian said there is another sign of the spread: school cancellations.

An illustration of the sudden economic sudden stop dynamic that has flown under the radar is the growing number of school closures, and not just in Asia. At least 3 European countries are implementing this type of "social distancing."#economy #markets #coronavirus @cnbc @wsj @ft

— Mohamed A. El-Erian (@elerianm) February 27, 2020

In Japan, the country has decided to close all schools in the country starting Monday. The closure will last until the end of spring vacation — sometime in April.

Chinese officials have kept schools closed and in Hong Kong, schools are closed until April.

A Fed Reaction

As global markets continue to free fall, the call for a Fed reaction to the coronavirus is likely to grow.

“They’re going to start seeing technical dislocations in the marketplace, which is the thing that central banks fear the most,” El-Erian told “The Final Round” on Thursday. “So my expectation is that we will get a cut in March, if not before. We may even get a coordinated global response, meaning the Fed would act with other central banks.”

He added that it would help the financial sector “a little bit,” but because he views this as more of an economic stop, however central banks proceed it will likely do little to halt the market freeze.

“You don’t care about the central bank being there as your counter party, you care about being safe in economic interactions,” he said. “So the central bank will not have much impact on economic activity, unfortunately.”