Depending on where you go in the world, we’re either still mired in a COVID-19 deflationary funk, or we’re on the leading edge of a raging inflationary inferno.

Charlie Bilello, Founder and CEO of Compound Capital Advisors, broke it down for us in a recent tweet:

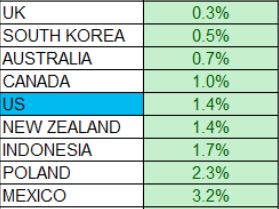

Global Inflation Rates… pic.twitter.com/6enh0MC8og

— Charlie Bilello (@charliebilello) January 13, 2021

You see some familiar names in the deflationary camp. Japan has struggled with deflation since the early 1990s. Japan’s consumer prices haven’t risen in a meaningful way since Bill Clinton was the Governor of Arkansas, and Donald Trump was just another real estate mogul from New York.

Italy and Spain have also struggled with deflation since the 2008 meltdown and subsequent European sovereign debt crisis.

We see many of the usual suspects on the inflation side as well.

- Venezuela at 1,813% annualized inflation.

- Argentina at 35.8%.

- Turkey at 14.6%.

To put Venezuela’s situation in perspective, something that would have cost one bolivar a year ago would now cost more than 19 bolivars today.

In a normal world, those would be catastrophically destabilizing inflation rates. Only when compared to Venezuela does 35.8% or 14.6% seem almost normal.

The U.S. Inflation Rate

The U.S. is right, smack in the middle with a “goldilocks” inflation rate of 1.4%.

Source: Charlie Bilello on Twitter.

I know I’ll probably get hate mail for saying that. Have I been to the grocery store lately? Am I not aware that the price of a cantaloupe is up 37% in January alone?

I made that last number up. And I know there’s is evidence of inflation out there, particularly in housing. The inflation number is always going to look a little lower than it feels in the real world due to hedonic adjustments. (Computers, phones and other technology get “cheaper” because a $1,000 iPhone today is more powerful than a $1,000 iPhone from a year ago.)

But all of that said, the U.S. is still in a sweet spot, at least relative to the rest of the world. Is it realistic to think it will last?

Investors have been bidding up traditional inflation hedges like gold and non-traditional new ones like bitcoin ever since it became obvious last spring that the government’s response to COVID-19 would be the largest budget deficits in history financed by the most aggressive central bank bond-buying program we’ve ever witnessed. Gold’s price has corrected slightly over the past few months, but it’s up a good 20% over the past 12 months. And bitcoin … well, I covered that just days ago.

I’ve been writing for months that, while I don’t see inflation getting out of control in the immediate future, it makes sense to start nudging your portfolio towards inflation hedges. If that doesn’t suit you, target assets that do better amid inflation, such as emerging markets and commodity-producing stocks. I recently recommended South American miner Vale SA (NYSE: VALE), as it checks both of those boxes.

If we do get widespread inflation, stocks, in general, should be OK. An infinite number of new dollars chasing a finite number of shares translates into higher share prices. But some sectors will perform better than others, and I expect that emerging markets and commodity producers will be among those winners.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.