For decades, investors used models to determine whether stocks were attractive. Now those models are obsolete. A dual mandate has guided Federal Reserve policy since 1977. That’s when Congress amended the Federal Reserve Act, which gave the Fed a goal:

Maintain long run growth of the monetary and credit aggregates … to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.

This required officials to consider how policy changes affect both employment and inflation. Last week, Fed Chair Jerome Powell announced that the Fed would target low unemployment since “maximum employment is a broad-based and inclusive goal.”

Most Important Fed Announcement in Decades

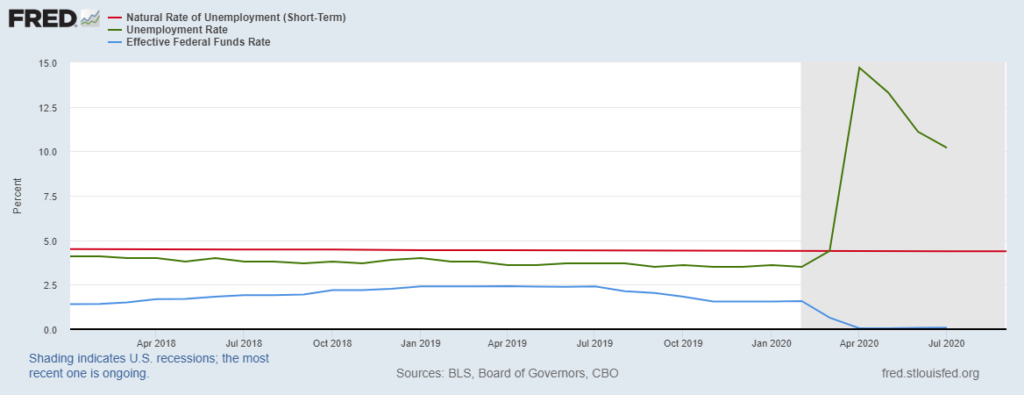

For investors, this might be the most important Fed announcement in decades. Under the new policy, the Fed would not have raised rates in 2018 or early 2019. The chart below shows the unemployment rate in green, the fed funds rate in blue and the natural rate of unemployment in red. The chart covers Powell’s tenure at the Fed. Under the new policy, the Fed won’t raise rates when unemployment is below the natural rate.

Unemployment and the Fed Funds Rate

Source: Federal Reserve

Our revised statement says that our policy decision will be informed by our “assessments of the shortfalls of employment from its maximum level” rather than by “deviations from its maximum level” as in our previous statement. This change may appear subtle, but it reflects our view that a robust job market can be sustained without causing an outbreak of inflation.

NAIRU is determined by Fed economists based on their assumptions. It’s basically whatever they say it is.

What New Fed Policy Means for Investors

That’s the key for investors. The Fed is planning to keep rates near zero as long as possible. That’s important because, as former Fed Chair Ben Bernanke said:

If the real interest rate were expected to be negative indefinitely, almost any investment is profitable. For example, at a negative (or even zero) interest rate, it would pay to level the Rocky Mountains to save even the small amount of fuel expended by trains and cars that currently must climb steep grades.

With rates near zero, valuation models are no longer important to stocks. Right now, price-to-earnings ratios and other metrics are high. But it doesn’t matter. Stocks are now pieces of paper that investors buy and sell based on emotions. Valuation only matters when interest rates matter, and Powell made clear we shouldn’t worry about rates anymore. Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking. Follow him on Twitter @MichaelCarrGuru.