Recently, I was pondering something I heard from a motivational speaker once…

We’re driven by two main emotions…

The need to avoid pain, and the desire to seek pleasure.

Of those choices, we’re genetically programmed to avoid pain more than anything else. Makes sense, since that’s what kept our ancestors one step ahead of the lions and bears.

That same instinct is also why it’s so hard to convince ourselves to buy a stock after a major sell-off such as we had in February and March.

It also explains why so many people remain paralyzed despite the huge, sustained rally of the past past two months since the stock market bottomed on March 23.

Since then, the S&P 500 is up nearly 30% and the Nasdaq more than 35%.

Source: Tradingview.com

Yet there’s no shortage of predictions of “Depression 2.0” or at least a retest of the lows.

I told my Total Wealth Insider newsletter subscribers many weeks ago to forget all that. Such predictions were already embedded in the price of the S&P index, and we’re heading for new stock market record highs.

For instance, in 2008 it took the S&P 500 a full year to decline by 40%.

By comparison, when the coronavirus outbreak struck, the S&P 500 fell by nearly that much in a month.

Basically, thanks to the coronavirus, there was a huge amount of investment pain compressed into a very short period of time.

Once the Federal Reserve stepped in, and then the government’s stimulus machine clicked into action, there was no looking back for the current rally. I expect it to take us to new stock market record highs — by this summer.

Why New Stock Market Record Highs Are Coming Soon

One of the “fuels” that will keep the market rising is the heavily bearish sentiment that still prevails among investors.

For instance, the American Association of Individual Investors’ weekly surveys indicate pervasive gloom. As recently as last week, more than half of those surveyed expect the market rally to be short-lived.

Other surveys, such as one created by the San Francisco Federal Reserve Bank, has its own “High frequency measure of economic sentiment” (based on an algorithmic analysis of positive and negative-minded words used within economics-related news articles) shows high levels of pessimism as well.

Even CNN’s online “Fear & Greed Index” — an amalgam of various sentiment-related indicators in the stock and bond markets — remains only in neutral territory.

The point being, there are still lots of people on the sidelines waiting for the “second leg down.”

And yet what’s happening on the economic front?

There’s no shortage of headlines announcing shockingly high unemployment, and record declines in retail sales. But that’s not unexpected, given what the economy’s been through.

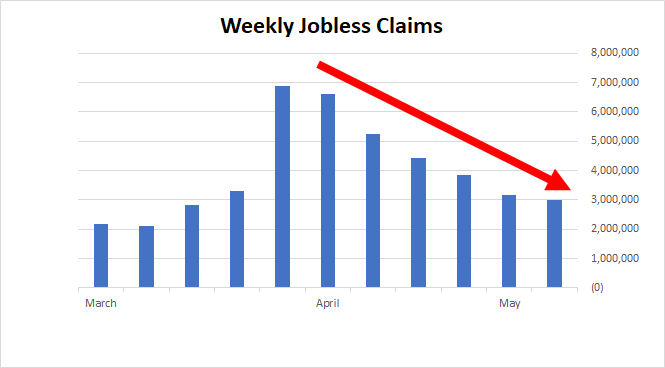

To me, weekly jobless claims offer a better look at why the market — and economic recovery — can keep going.

Source: Bureau of Labor Statistics

The chart above tells us that things are getting better, even if we’re going to be inundated by news headlines proclaiming massively high monthly unemployment numbers and shockingly big declines in monthly retail sales.

It’s a classic mistake of many investors. The headlines are old news. It’s the recovery that’s new, and barely glimpsed unless you’re looking for it.

Unfortunately, when the news headlines are more favorable, the stock market will be long past its current price and back near its old highs, when fewer bargains are available.

As of right now, though, there are still many places to look — companies in the leisure, retail, energy and travel sectors especially. I’ve already begun sprinkling many of the best of these stocks into my Total Wealth Insider portfolios.

In my opinion, the worst is already priced into many of these companies. Most have barely participated, if at all, in the rally of the past two months.

Most are still priced for the worst and should do well indeed, setting new stock market record highs even if parts of the U.S. and its regional economies reopen (and close) in fits and starts in coming quarters.

Best of Good Buys,

Jeff Yastine

Editor, Total Wealth Insider

• Jeff Yastine is the Editor of Total Wealth Insider for Banyan Hill Publishing, and he has more than two decades of experience as an investor and financial journalist. Mr. Yastine was an Emmy-nominated anchor and correspondent for PBS’s “Nightly Business Report” from 1994 to 2010, where he interviewed and covered some of the biggest names in the financial world.

Follow him on Twitter @JeffYastineGuru and subscribe to his YouTube channel for his unique insights.

Editor’s note: There’s been a lot of talk and disagreement about what kind of economic recovery we’ll see as the economy begins to get moving again. Are you with Jeff and think new stock market record highs are coming this summer? Why or why not? Share your thoughts below.