We all love an underdog.

Whether it’s Rocky, Moneyball or a story about a well-known celebrity’s humble beginnings, people respond to the ascension of the unexpected.

In the commodity sector, aluminum stocks are the underdogs.

When you think of construction commodities, you think of steel and copper. But aluminum is also very important.

Aluminum is light-weight. It’s perfect for building airplanes and auto bodies — products that are making a market comeback.

As the U.S. government attempts to lift the nation’s economy out of the current recession, it will focus on infrastructure projects. More nationwide construction projects mean commodities like steel, copper and aluminum will be in high demand.

This week, my stock selection is Norsk Hydro ASA (OTC: NHYDY), a Norwegian aluminum and hydroelectric manufacturer.

Why Norsk Hydro Stock Is a Buy Now

NHYDY is a rare stock. There aren’t many Norwegian stocks in the U.S. market, which is why it’d be smart to take advantage of it today.

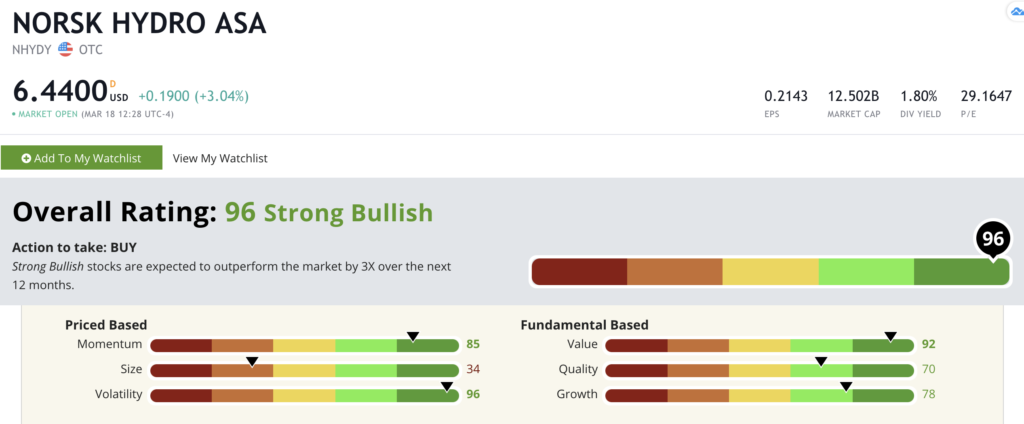

Norsk Hydro stock rates a 96 overall in our Green Zone Ratings system. We are “Strong Bullish” on this stock: We expect the stock to outperform overall market gains by three times over the next 12 months.

Norsk Hydro’s Green Zone Rating on March 18, 2021.

Here’s a breakdown of NHYDY’s top scores:

Volatility — Norse Hydro rates a 96 on the volatility factor, which means the stock is stable and reliable. The less volatile, the higher the score. This high volatility score is rare for commodity companies, which usually see choppy, unstable stock prices and are vulnerable to boom-and-bust cycles.

Value — At a value of score of 92, NHYDY is a high-value stock. Over the past decade, commodity stocks have been left for dead, which created a prime investment opportunity for us. These stocks are trading at dirt-cheap valuations that are too good to pass up.

Momentum — With a momentum score of 85, NHYDY is primed to grow in the future. This score should accelerate as infrastructure plans and aircraft construction begin to roll out again after the COVID-19 pandemic subsides.

Bottom line: Norse Hydro stock is a remarkable, non-volatile commodity play. While big investors are attracted to shinier, more popular tech stocks, smaller, independent investors will profit from faith in construction materials stocks. NHYDY is a reliable and promising buy in this environment.

To safe profits,

Charles Sizemore

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Matt and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.