Once in a while, you get a little nugget of advice that really sticks in your head.

As a lad fresh out of college and eager to put that finance degree to work, I told an older trader that I was buying shares of a promising biotech start-up.

It was going to cure cancer … or AIDS … or maybe it was Alzheimer’s. It’s been 20 years, so the details are fuzzy.

But, whatever it was, this company was going to cure it and make me wealthy.

He smiled, knowingly, and asked: “You’re just buying the one?”

He then went on to tell me that investing in biotech is a like throwing a big plate of spaghetti on the wall and seeing what sticks.

I kept that in mind as I looked at shares of Novavax Inc. (Nasdaq: NVAX) today.

Novavax stock has had an incredible run in 2020. Had you bought shares at the first of the year and held them, you would have made 35 times your money.

Novavax stock has had an incredible run in 2020. Had you bought shares at the first of the year and held them, you would have made 35 times your money.

That’s the kind of return you can see in biotech … when it pans out. Novavax is one of those proverbial spaghetti noodles that managed to stick.

Novavax is starting the second phase of human testing for its COVID-19 vaccine. It is performing trials on about 3,000 adults in South Africa, in part with funding from the Bill and Melinda Gates Foundation.

The phase 1 results were promising, which explains Novavax’s incredible run. The company that produces the most reliable COVID vaccine will make billions.

Of course, Novavax is more than just a COVID play.

Its most promising product may be its vaccine for the good old-fashioned seasonal flu, NanoFlu. We don’t know which COVID vaccine will prove most effective. But NanoFlu appears to be a better mousetrap among flu shots.

Does any of this make Novavax a stock worth buying? Let’s take a look at Novavax stock using Adam O’Dell’s Green Zone Ratings system.

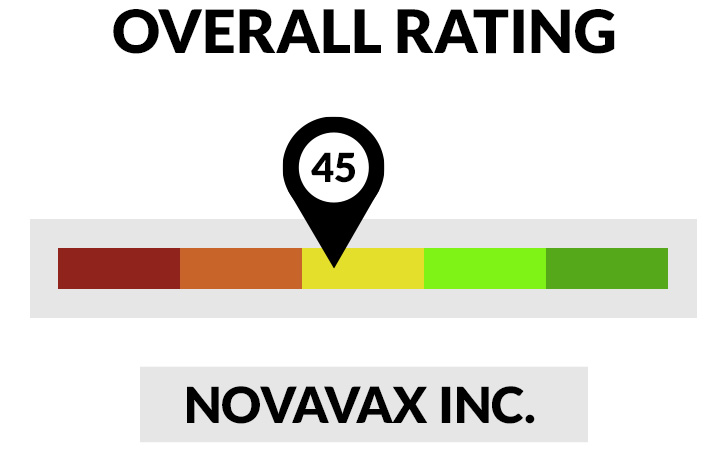

How Novavax Stock Ranks

At first glance, it doesn’t look good. Novavax has an overall rating of just 45, putting it in the bottom half of all stocks.

- Momentum —Novavax rates a 94 in momentum. Given that its shares have risen by a factor of 35 this year, I’m surprised it doesn’t rate higher.

- Volatility — What is surprising is how well Novavax rates on volatility, coming in at 87. This means that the stock is less volatile by Adam’s criteria than all but 13% of stocks. You’d expect a stock with this kind of movement to have wild swings, and to be sure, the stock has become more volatile this month. But the swings have been few and far between. It’s been a straight shot higher.

- Growth — Novavax rates respectably high in growth, coming it at 64. This was driven by growth in earnings per share, which rated 82. Sales growth was a little less impressive, at 35. Of course, biotech plays have lumpy growth. Either their products work, and sales go through the roof … or they don’t.

- Value — Novavax rates poorly on value, coming in at 21. Now, the problem with applying a valuation analysis to a biotech stock is that all of your metrics are backward-looking. You’re looking at past earnings or sales when these metrics might not be relevant. You have to value the company based on your expectations of future sales, which themselves depend on clinical trials and FDA approval.

- Size — Novavax isn’t a small stock after rising by 35 times this year. Its market cap is $9.4 billion, giving it a rating of 20.

- Quality — And finally, we get to quality. By Adam’s metrics, Novavax is a real piece of junk, rating just 3. So 97% of all companies rated higher. Novavax has poor margins and cash flows, rating a 5 by these metrics.

So, based on a systematic analysis, you shouldn’t buy Novavax stock. Or at least not with your nest egg.

But a biotech play like this can be an interesting speculation. And there’s nothing wrong with taking a roll of the dice with a small amount of your capital. Kudos to anyone who enjoyed the thousands of percent of gains in the stock this year.

But a stock like this is, at best, a trade. And it’s a wildly speculative one at that. You don’t want to bet your retirement on it.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.