Sometimes, you set out to teach … and you end up becoming the student…

It’s been almost a year since I started my special weekly feature on the Green Zone Power Ratings system.

My goal was to show you how easy it could be to invest when you have such an incredible tool at your fingertips (it’s right there in the search bar above this article!).

We tackled everything from emerging investments to mammoth mega trends like artificial intelligence (AI) — using the system to guide our conclusions.

Within seconds, we could tell whether we were looking at a stock that was worth investing in.

But over the course of weeks and months, we saw something that was even more interesting.

And it all started with one of the very first stocks we looked at…

How I Find Market-Crushing Stocks in Seconds

Before we dive in, let’s look at a quick refresher on how easy it is to use Adam’s Green Zone Power Ratings system …

If you’re curious about a stock and want to see if it’s worth buying, it’s the perfect place to start.

Want to know how I built a watchlist of AI stocks in five minutes?

I started by Googling “AI stocks” … and then plugging tickers into our search bar at www.MoneyandMarkets.com.

Look for the “Search” magnifying glass, or click this big button on our home page:

In a matter of minutes, I had an initial impression of a handful of companies that are innovating within the AI space.

Go ahead and try it yourself! And feel free to email us at Feedback@MoneyandMarkets.com with what you find or any questions regarding the ratings system.

If you need to know what each level of the system means, here’s a quick breakdown of how each rating category is expected to perform over the next 12 months:

- Strong Bullish (81 to 100): Expected to outperform the market by 3X.

- Bullish (61 to 80): Expected to outperform the market by 2X.

- Neutral (41 to 60): Expected to perform in line with the market.

- Bearish (21 to 40): Expected to underperform the market.

- High-Risk (0 to 20): Expected to significantly underperform the market.

Now, let’s get into what I found…

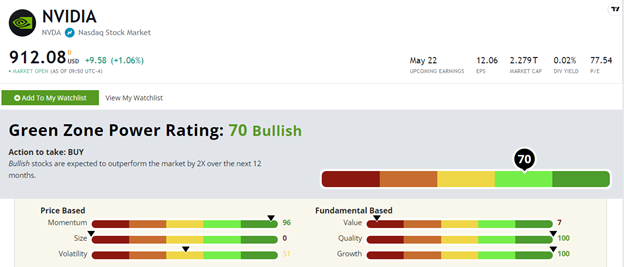

NVDA Stock: From “Neutral” to Market Obliterating

Last May, I pointed to two stocks that I believed would become “AI blue chips” — Microsoft Corp. (Nasdaq: MSFT) because of its massive size and established cloud and software businesses, and Nvidia Corp. (Nasdaq: NVDA) because it was making the microchips that the best AI software is running on.

At the time, MSFT rated a “Bullish” 62 out of 100, and NVDA lagged slightly with a “Neutral” 56 rating.

MSFT has since improved to a 77 overall, and its share price has increased 35% since I published that article.

But things get really interesting with NVDA…

Back in May, I noted that our system had flagged this AI stock as a watch for now, but I pointed out its incredible Momentum rating of 97, as well as its strong ratings on Quality and Growth.

Now, 10 months later, the Momentum rating is still at 96, and both NVDA’s Quality and Growth are sitting at 100 out of 100. And that’s helped boost its overall rating to a “Bullish” 70.

Since writing about Nvidia, the stock has gained 217%!

That’s 8X the return of the S&P 500 in the same period. Now that NVDA is firmly in Bullish territory, that outperformance should continue.

This is not meant as a brag.

Honestly, I took it as a lesson more than anything else.

When I first featured these stocks in Money & Markets Daily, I was trying to highlight how you can use Green Zone Power Ratings to your advantage.

I had no idea the AI mega trend was going to solidify as it has over the last year and change.

I’m also pointing out NVDA because it shows what happens when you invest in something before the crowd.

Back in May, this stock was just a “watch” in our system, but strong ratings in Momentum, Growth and Quality meant investors who got in early made a fortune.

Fast forward to 2024, and Adam has just found a company in a similar situation.

He’s following one of the most successful “Tech Titans” in history into a stock that could dominate the $200 Trillion AI Revolution.

And he’s urging readers to invest NOW before it becomes a “Strong Bullish” market leader.

Click here to see how you can access Adam’s brand-new recommendation now.