The stock market looks ugly … there’s no denying that.

The S&P 500 is flirting with a bear market, and the Nasdaq Composite is already there!

But these headwinds are setting the table for a huge run higher when the market rebounds. Notice I didn’t say “if.”

Let’s look back at one of the worst market crashes ever and see how NVIDIA Corp. used powerful mega trends to soar 4,000% higher in the aftermath.

Market Downturn: We’ve Been Here Before

Let’s start with current market conditions.

Since the start of the year, the S&P 500 is down around 17%. It’s inching toward bear market territory.

But, as I mentioned earlier this month, this isn’t the first time we’ve seen a rapid market drop.

During the coronacrash of 2020, the Dow Jones Industrial Average fell 31.68% from its high on February 12, 2020 to its low a month later.

The market suffered similar downturns in 2016 and 2018 … but here’s the key: The market always rebounded.

Look to Tech Stocks When Market Rebounds

The dot-com crash of the early 2000s hammered tech stocks.

The bubble showed us that certain tech stocks were risky and also extremely overvalued.

So many tech startups failed to provide shareholder value. This caused massive headwinds in the sector.

From July 2000 to October 2002, the Technology Select Sector SPDR ETF (NYSE: XLK) fell 79.8%.

The exchange-traded fund (ETF) didn’t hit that high again until 2016. That’s when tech started to explode thanks to new innovations and outstanding profitability in the sector.

The sector started to really rip higher in February 2016. By October 2018, XLK had jumped 94.5% to reach an all-time high.

Tech dominated the market.

What went down, went back up … and it was even stronger than before.

NVIDIA Crushed It From 2016 to 2018

Companies like Apple Inc. (Nasdaq: AAPL), Meta Inc. (Nasdaq: FB) and Amazon.com Inc. (Nasdaq: AMZN) soared to new highs during this run higher.

But there was one tech company that outdid them all: NVIDIA Corp. (Nasdaq: NVDA).

NVIDIA develops graphics and computing components on a global scale.

Its products have been instrumental in revolutionary new tech like:

- Cryptocurrencies and blockchain computing.

- Artificial intelligence (AI).

- Data center processing and cloud computing.

NVDA's Recovery Rally: 2016 to 2018

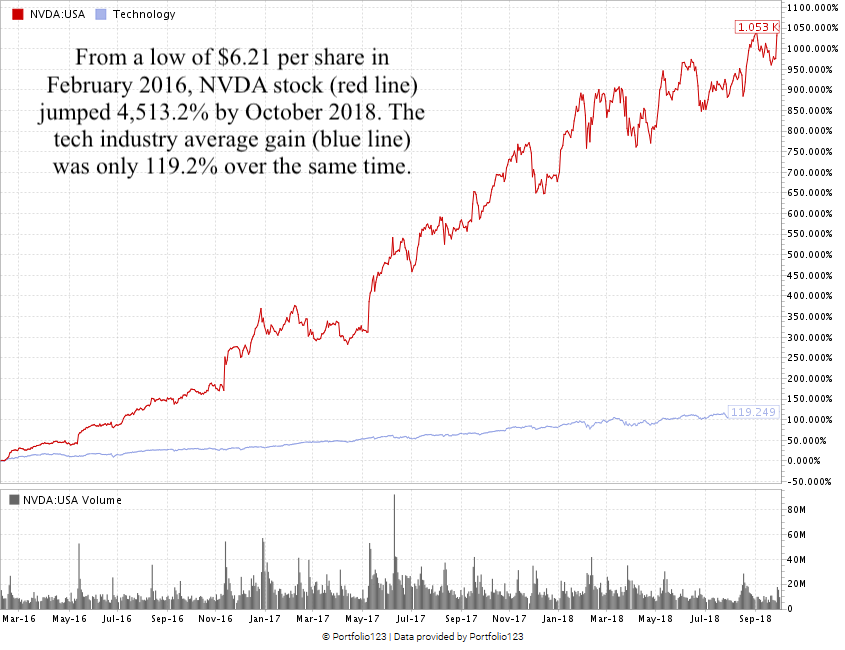

In February 2016, NVDA stock was trading for $6.21 per share.

Over the course of the tech rally from 2016 to 2018, that share price soared to $286.48 — a 4,513.2% move!

The broader technology industry only averaged gains of 119.2% during the same time.

NVDA stock capitalized on two mega trends to leave its technology siblings in the dust:

- Artificial intelligence.

- Data processing.

So while the market is very difficult to look at right now, the point is that what goes down, inevitably comes back up again.

But there is no way a bear market stops a stock like NVDA because it’s developing technology that will be the foundation of our future.

The key is spotting these mega trends that will push stocks to new highs once we have recovered from current market headwinds.

Bottom line: My colleague Adam O’Dell has identified a strategy to help you find profits as these stocks rip 1000% higher off a downturn.

He, along with the rest of the Money & Markets team, is putting the finishing touches on a presentation that highlights this powerful strategy. Adam wants to help his readers turn $10,000 into $100,000 in only one year.

And we’ll have that presentation ready soon. Click here to sign up, so you can attend this free event on June 9. You don’t want to miss it.

Remember, the market doesn’t look great now, but it won’t be like this forever … and we’re already identifying the next mega trends that will produce more 10X gains in the future!

Click here to get ready for Adam’s 1,000% strategy now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.