The Congressional Budget Office projects the U.S. population will hit 369 million by 2052.

That is a 10.1% jump from this year.

When the population goes up, service usage of water and sewers goes up as well.

The chart above shows the need for investment in U.S. water mains by region to 2050.

NACE International projects that, between replacement and expansion, we’ll need $1.7 trillion in new water infrastructure by the end of 2050.

Steel water pipe producer Northwest Pipe Co. (Nasdaq: NWPX) is today’s Power Stock.

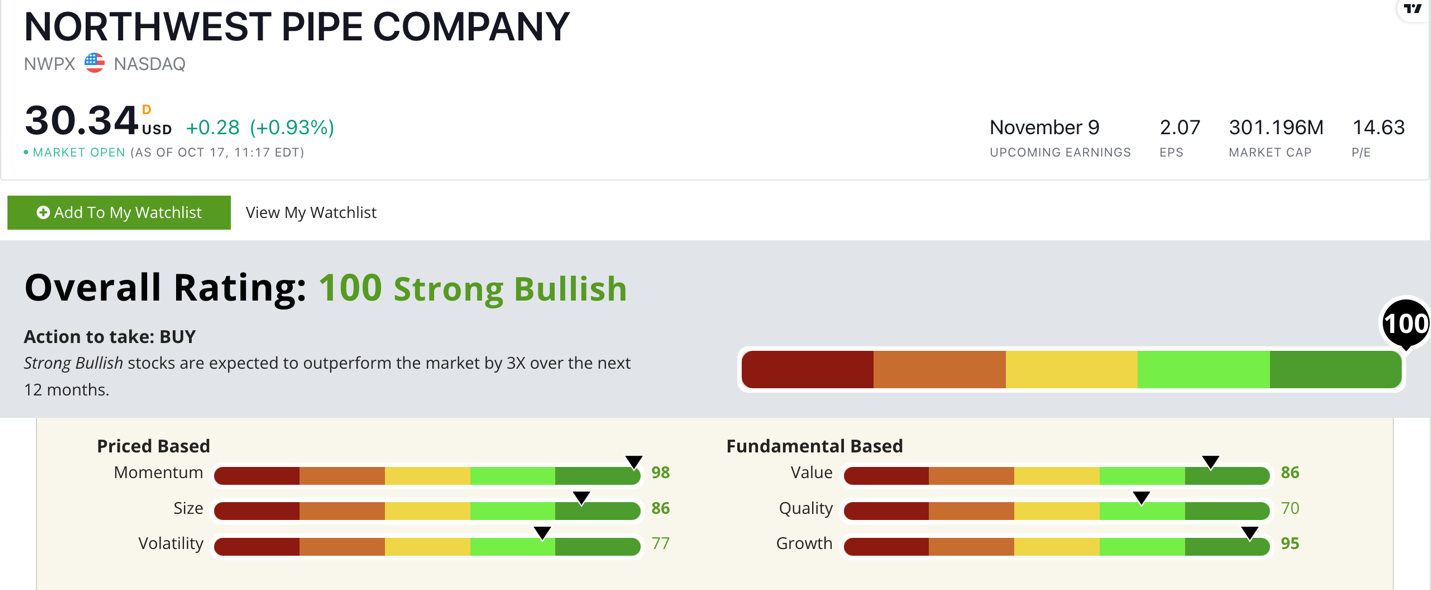

NWPX’s Stock Power Ratings in October.

NWPX manufactures large, high-pressure steel pipes.

These are used for water infrastructure projects, such as water and wastewater systems.

Northwest Pipe Co. stock scores a “Strong Bullish” 100 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NWPX Stock: Excellent Fundamentals + Solid Momentum

NWPX is on track for a strong 2022.

Highlights from its recent quarterly report include:

- Net sales of $118.5 million — an increase of 60.6% year over year!

- The company’s gross profit of $24.1 million was a 152.5% increase from the same period a year ago.

While its sales and earnings numbers show fantastic growth (it scores a 95 on our growth factor), NWPX is a solid value stock — where it scores an 86.

Its price-to-sales ratio is almost half the construction materials industry average.

That tells us it’s a bargain.

The price-to-book value ratio is a similar story: NWPX’s is 1. The industry average is double that.

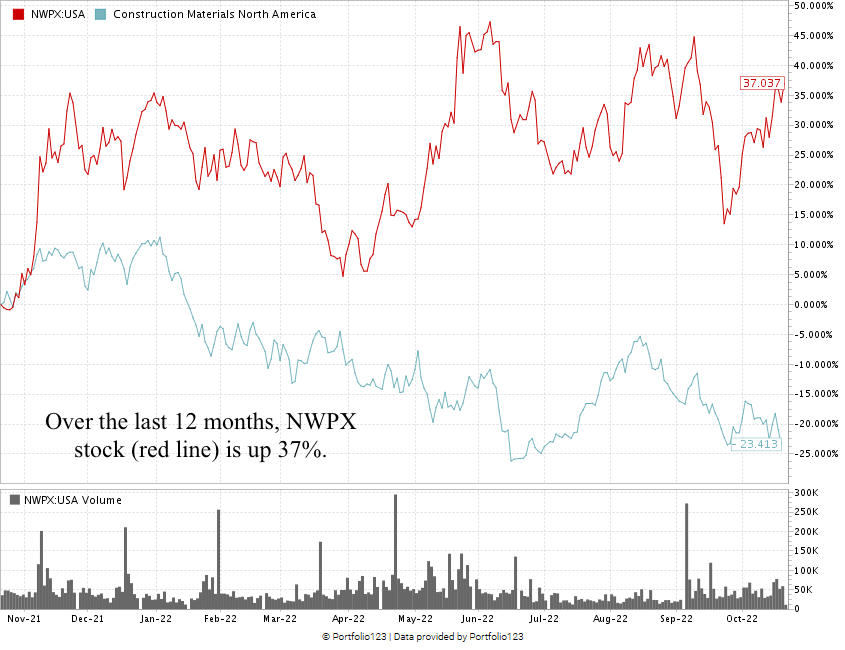

Another bright spot for NWPX is its momentum:

Created in October 2022.

Over the last 12 months, the stock is up more than 37%.

Meanwhile, its peers are averaging a 23.4% decline over the same time.

NWPX scores a 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

As our population continues to grow, the need for infrastructure expansion and improvement grows too.

A leader in providing necessary water infrastructure pipes, NWPX is a strong addition for your portfolio.

Stay Tuned: Crypto Stock to Avoid

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

I’m switching it up for the next issue. I’ll give you a top cryptocurrency Stock to Avoid.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.