It was an oil production deal of historic proportions, but Mexico left discussions without agreeing to the proposal.

An oil price war between Saudi Arabia and Russia seemed to be settled as the two oil rivals and other OPEC nations agreed to a 10% cut in global oil supplies on Thursday.

Energy ministers from the Group of 20 (G20) major economies will meet by video on Friday. The OPEC+ group will press Mexico to sign the deal then

Mexico, which has long been in a standoff with Washington over Trump’s plan to build a wall between the two countries, cares less about low oil prices because of its unique hedging program, which protects it against price falls.

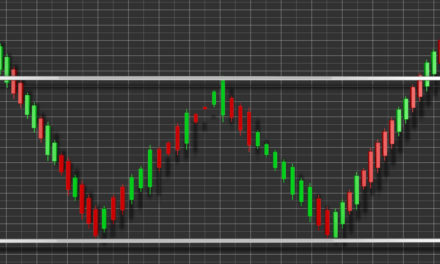

Prices Suffer Without Oil Production Deal

Oil prices have plunged to their lowest in two decades. Global measures to prevent the coronavirus spreading led to a collapse in demand for crude, at the same time as Moscow and Riyadh’s battle for market share produced a flood of extra oil.

West Texas Intermediate crude dropped 7.5% to $23.19 per barrel. Brent crude, the international benchmark for oil prices, fell 2.4% to 32.03.

Most markets around the world closed on Friday for the extended Easter weekend.

Trump Presses for Deal

President Donald Trump threatened OPEC leader Saudi Arabia with punitive steps if it did not fix the oversupply problems. Those have hit budgets of oil-producing nations and hammered higher-cost U.S. oil production.

In late March, Trump called the price war “crazy” following a call with Russian President Vladimir Putin to press Russia to work with Saudi Arabia.

Trump spoke by phone with Putin and King Salman of Saudi Arabia as the countries attempted to close the deal

“We had a big talk as to oil production and OPEC and making it so that our industry does well and the oil industry does better than its doing right now,” Trump said.

What’s in the Oil Production Deal?

The proposed plan called for all OPEC+ nations to cut output by 23%, with Saudi Arabia and Russia each cutting 2.5 million barrels per day (BPD) and Iraq cutting over 1 million BPD.

Riyadh and Moscow said their cuts would both be calculated from an October 2018 baseline of 11 million BPD, even though Saudi supplies surged to 12.3 million BPD this April.

OPEC+ would ease cuts to 8 million BPD from July to December. They would cut another 6 million BPD between January 2021 and April 2022, OPEC+ documents showed.

However, Mexico refused to sign the plan under which it would cut about 400,000 BPD. Mexico said it has proposed a cut of 100,000 BPD.

“This whole agreement is hinging on Mexico agreeing to it,” Saudi Energy Minister Prince Abdulaziz bin Salman told Reuters, adding he hoped it would “see the benefit of this agreement not only for Mexico but for the whole world.”

However, using October 2018 as a baseline may not help. Analysts suggest the actual cuts may be less than the proposed number because overall production was higher then.

“We still see Brent falling to $20 per barrel or lower in the second quarter of 2020,” UBS analysts said.