Last year, BP issued a report that confirmed oil, and thus the need for oil production, was in decline. The company announced that it was likely “the demand for liquid fuels … never fully recovers from the fall caused by COVID-19, implying that oil demand peaked in 2019 in [the company’s internal planning] scenarios.”

To the experts that makes sense. In 2020, demand fell, and new energy sources are expanding all the time.

To forecast the future, many experts look at the recent past and expect that to continue in the future. But this time, the experts ignored an important reality — demand for oil fell in 2020 because the economy shut down.

With the economy recovering, demand for oil is increasing. Now the experts are reversing course and acknowledging that demand for oil will grow with the economy.

A New York Post article noted:

Global oil demand is set to return to pre-pandemic levels by the end of 2022,” the [International Energy Agency] said in its monthly oil market report, predicting that demand will rise by 5.4 million barrels per day this year and an additional 3.1 million barrels next year to an average of 99.5 million barrels per day in 2022.

At that level, demand in 2022 should surpass pre-COVID-19 levels of usage.

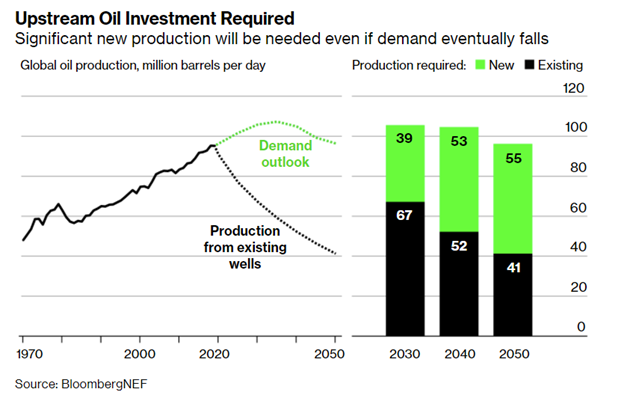

BP and other large oil companies may not benefit from the rebound. They have been reducing exploration and new drilling, and output from current wells is declining in line with historical patterns.

Oil Production Must Rise to Meet Post-Lockdown Demand

Source: Bloomberg.

Oil Production Limits Could Make Oil Prices Bullish

The IEA said that meeting growing global oil demand is “unlikely to be a problem” due to increased production by OPEC+ countries like Saudi Arabia. Lifting sanctions on Iran will also increase supply.

But the IEA also expects that further output by the U.S., Canada, Brazil and Norway will be needed to meet demand.

This is where investors need to take notice. Meeting demand requires increased output from the U.S. and Canada. Drilling and transporting oil have become more difficult in those countries — implying demand will be tight and that oil prices are in the early days of a long-term bull market.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.