Another OPEC meeting has come and gone, and another round of production cuts in oil production is in the offing. The cartel agreed to take another 500,000 barrels of oil off the market.

This is in addition to the 1.2 million barrels they agreed to take off the market last year. Leading up to this meeting, the signaling was that the current production agreement would be extended through the middle of 2020.

Meanwhile, Saudi Arabia complained about some countries violating their quotas, specifically Iraq, Nigeria and Russia. Not to be outdone, the Russians complained that their production quota included their gas condensate, which they do not export at all.

Russian Energy Minister Alexander Novak was clear coming into the meeting that any new production cuts would exempt Russia’s gas condensate production.

This doesn’t project an image of a cartel pulling in the same direction.

Moreover, the state of the oil markets is such that the cartel has already cut production overall below the existing agreement’s standards.

So the big question is, “Are these cuts even cuts at all?”

And this was the same question we were asking last year when the cartel put the current deal in place since the bulk of the announced cuts were implemented earlier in the year.

I’ve been bearish on oil since last year’s meeting. And the reason then was because it sent the markets the opposite signal of what the cuts intended. It betrayed weakness, not strength. Last year’s announcement was meant to impress the markets and goose the price higher but all it did was signal that the bullish economic stance from the central banks was a front.

OPEC was telling the world that the global economy was slowing down with such deep cuts.

And the central banks, by the end of January, confirmed that signal by doing an about face on December’s policy statements.

This is no different than the central banks implementing quantitative easing outside of a crisis period. It’s a signal to the markets that the credit markets cannot stand on their own.

In effect, production cartels like OPEC and the central banks never think through the secondary effects of their policies.

They think we’re all too stupid to read between the lines; that it’s all just simple supply and demand and if they restrict or open up supply, demand will automatically respond accordingly.

It’s like those simple supply and demand curves they teach in first semester economics classes. Simple, understandable and wrong.

The reason they are wrong is because they assume an equilibrium state the market is never in. They are a useful tool to illustrate a basic point and the direction the markets would tend toward barring outside intervention, but they aren’t applicable in a world of open manipulation and central planning.

Because while OPEC and the central banks try to baffle us with their balderdash, the reality is that we’re asking the bigger question: “What are you afraid of to take such extreme measures?” The central banks try to massage us with their messaging and their guild-speak, but they can never really answer that question.

And this is why, despite printing trillions of dollars in the wake of the 2008 financial crisis and the central banks expanding their balance sheets, the credit markets never really recovered. The resultant recovery engineered in nominal GDP terms was long, shallow and ultimately capital destructive.

Remember, nominal GDP growth is a chimera. GDP just measures Gross National Spending. It says nothing about the quality of that spending. So, you can spend yourself into debtor’s prison.

If you don’t believe me, just look at the domestic shale industry.

Scared central banks equal scared lending institutions. Negative interest rates only exacerbate the problem, just ask the European banks now openly hostile to customers leaving money on deposit, by charging them for the privilege to do so.

Reserves? We don’t need no stinking reserves!

I thought the advantage of government debt-based money was the positive carry effects of using it rather than gold, which costs money to store and vault?

But asking such basic questions today could land me in Twitter jail, needing a time out.

OPEC is staring at the same problem. How do they signal to the markets that things are better than they are to keep the price of oil from collapsing through near-term support in what is a primary bear market?

Cutting production because they are scared of a glut in 2020 will not fill the markets with confidence. And the lack of market reaction to the announced cuts is not a case of traders “pricing them in.” It’s a setup for a new round of shorting into the current price as inventory numbers push and pull a market incapable of rallying to new highs.

And any market incapable of doing that will eventually settle back in.

OPEC is cutting production because it needs to. The global economy is in rough shape. The long, shallow recovery of the QE years is finally reaching its conclusion. China is tapped out to create more debt-based pseudo-growth. The Trump administration is actively pricking their debt bubble and, in the process, draining the world of dollars.

In the end, OPEC looks like any other company caught in a great market shift, cutting their way to growth. It doesn’t work. It’ll save you in the long run, but you’ll be a smaller player when it’s all over. Cutting production is simply not a sign of strength and no amount of number manipulation can alter that.

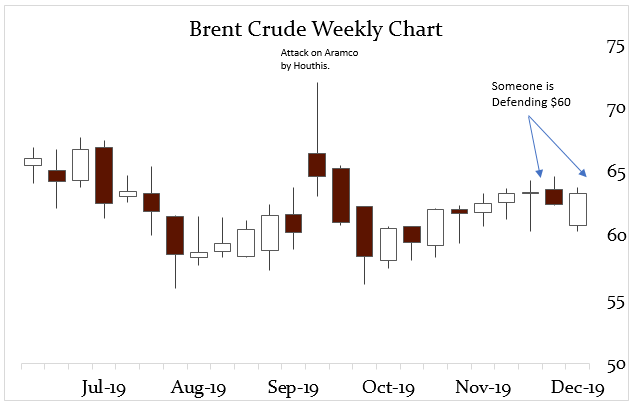

With the Aramco IPO behind the market raising a record $25.6 billion at a $1.7 trillion valuation, directly in line with what was expected, the next thing to watch for is whether oil can rally through $65 before the year end.

I have my doubts like I did last year after that meeting. We’re in a lull period waiting for the next shoe to drop.