Bear markets can lead to devastating losses for growth investors who buy stocks they believe will be market leaders in the future.

Some growth will come from new markets.

For example, electric scooter rentals have appeared on many city streets in recent years.

Users unlock the scooters with their phones.

Costs are low, just a few dollars to rent a device. They leave the scooter at their destination.

When the battery needs recharging, the company sends someone to pick up the scooter.

New Markets Aren’t Bringing Sustainable Growth

The scooter business is an example of a new market.

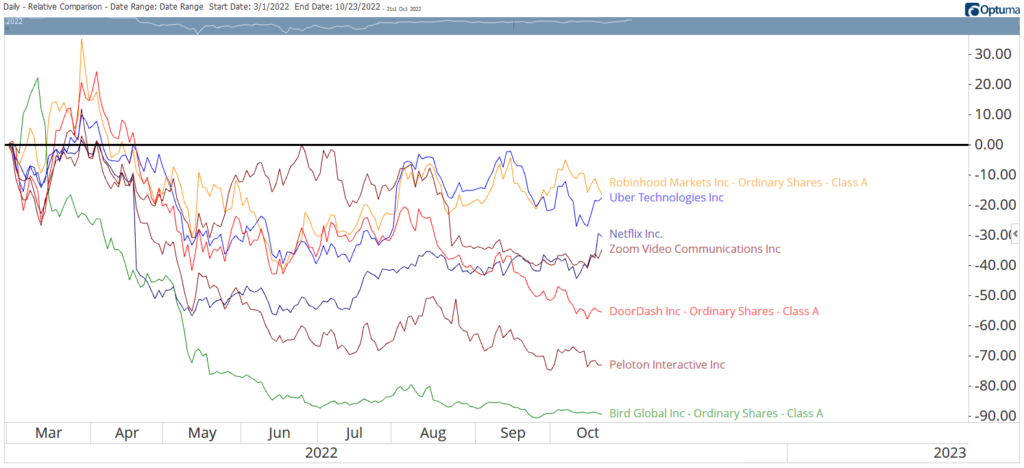

Bird Global Inc. (NYSE: BRDS) is one company in the scooter business. The stock is more than 96% below its 52-week high.

While BRDS stands out, it is not alone.

Many of the growth stocks that were popular in the bull market are on similar trajectories.

Pandemic Darling Growth Stocks Fall Short

Peloton Interactive Inc. (Nasdaq: PTON) is another example of a company creating a new market.

The company sold luxury exercise equipment that came with monthly subscriptions.

During the pandemic lockdowns, consumers rushed to buy the products.

As the world returned to normal, Peloton’s popularity faded.

Now the stock is more than 95% below its high.

Pandemic Darling Stocks Can’t Keep Up

Other stocks that got ahead of themselves are DoorDash, Zoom, Netflix and Robinhood.

These companies offered products that traders got excited about.

But the excitement was overdone.

The stocks are now falling to levels justified by their fundamentals.

In the market, this is a common pattern.

Traders rush in based on short-term stories. They suffer losses in the long run when the story fails to materialize.

Bottom line: This is easy to avoid.

One way is to not buy “story stocks.” But many of these stocks deliver significant gains before they reverse.

Another approach is to sell when the decline is evident.

A sell strategy could be the best approach to any trade.

Click here to join True Options Masters.