Peter Lynch is one of those institutional investors who, when he speaks, everyone listens.

He popularized the GARP (growth at a reasonable price) stock investment strategy.

Lynch was a big proponent of investing in what you know.

He said one thing that should resonate with every investor: “If you don’t study companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.”

There’s a lot of truth to that.

But the concept of the exchange-traded fund (ETF) conflicts with Lynch’s argument.

ETFs made it so that the everyday investor could invest in a basket of stocks based on sectors, industries or trends.

I’m not saying ETFs are bad or don’t make good investments.

But there are risks because there’s no guarantee every stock in a fund is a good investment.

This is where our Stock Power Ratings system comes in.

Today, I’m drilling down into the financial sector to show you how our system may have saved you from making a monumental investing mistake.

Neutral on XLF … but Not SIVB

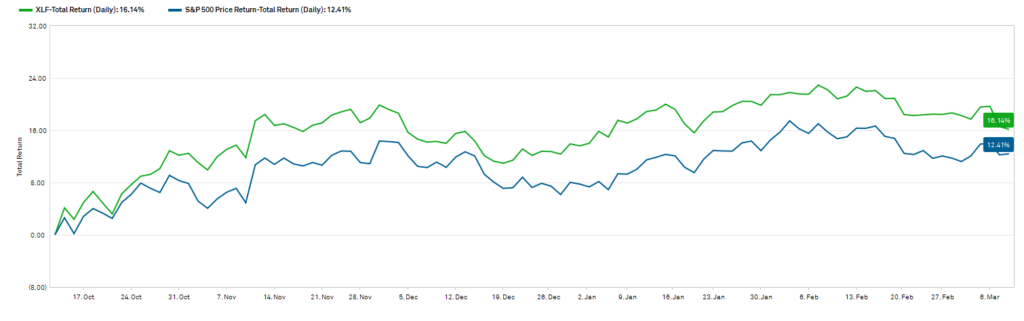

Check out the chart of the Financial Select Sector SPDR Fund (NYSE: XLF):

XLF Beats the S&P 500

From its October 2022 lows, XLF (the green line in the chart above) has performed better than the S&P 500 (the blue line).

I ran an “X-ray” of the 66 holdings in XLF and found that 20 stocks rated “Bullish” or better. Another 29 were “Bearish” or worse. The rest were in the middle.

Overall, the average rating of the ETF is 45. That means we are “Neutral” on the ETF and expect it to perform in line with the broader market over the next 12 months.

But this doesn’t mean every stock is neutral. As I mentioned above, there’s a mixed bag.

Fortunately, the Stock Power Ratings system does more than just help us find the best stocks to buy. It can also save us from investing in the laggards … and avoid massive losses.

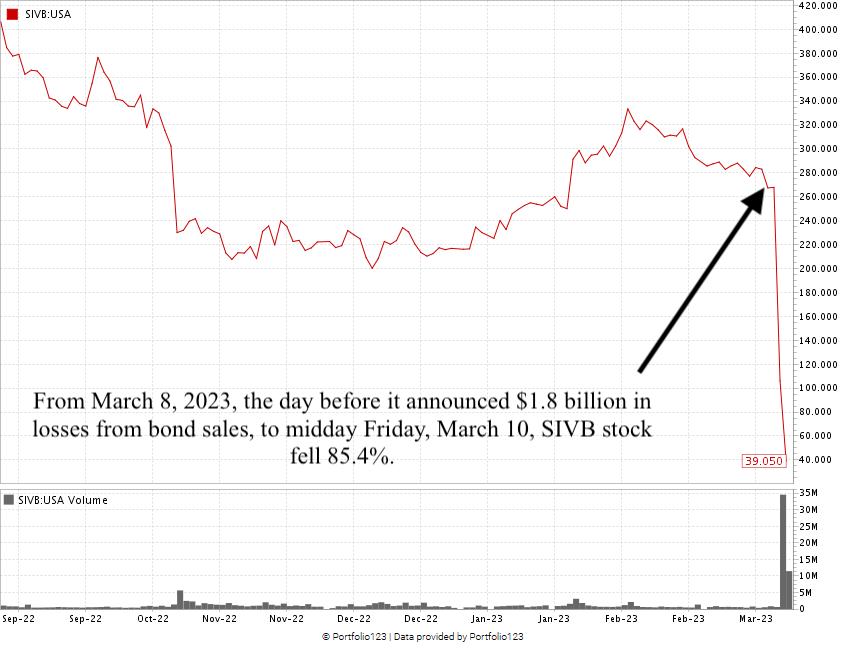

One example that’s been making headlines is SVB Financial Group (Nasdaq: SIVB).

SIVB is the holding company of Silicon Valley Bank — a commercial bank based in Santa Clara, California.

Last Thursday, the bank elected to sell a bulk of its $21 billion bond portfolio. The problem is that with higher interest rates, the price of those bonds fell sharply since SIVB bought them.

The result was a $1.8 billion loss on the sale of those bonds.

That news hammered the stock:

Created in March 2023.

Just six months ago, SIVB was priced at more than $400 a share.

By midday Friday, the stock was trading for less than $40. It shed more than 90% in six months, with most of that drop occurring in just two days.

That was enough to drag the entire ETF down 1.3% in those same six months. SIVB’s drop from Wednesday to Friday pulled the ETF down 4.1% in two days.

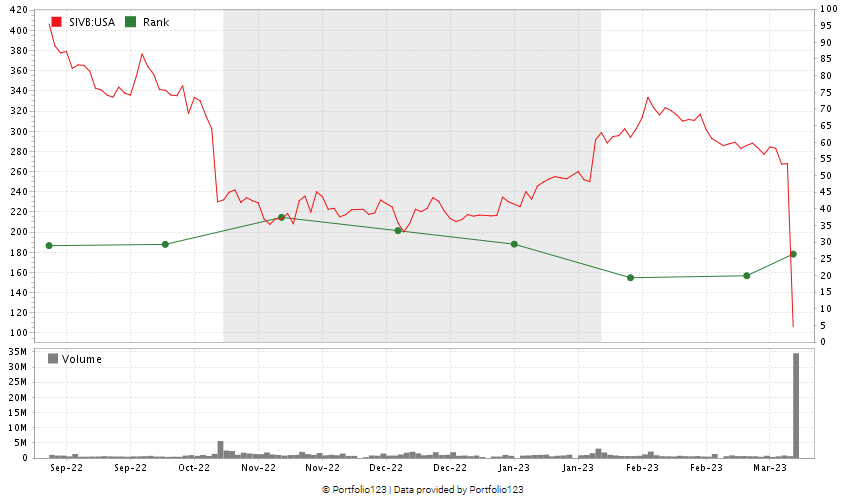

Now, look at this chart:

Created in March 2023.

The green line shows the Stock Power Ratings history of SIVB.

As you can see, the stock never rated above “Bearish” over the last six months. If you used the system, you would have known months ago that SIVB was a stock to avoid.

You would have dodged a complete capital meltdown.

By noon on Friday, the California Department of Financial Protection and Innovation closed the bank and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. The bank is supposed to reopen today with the FDIC insuring deposits up to $250,000.

It’s the first FDIC-insured bank to fail since 2020.

Peter Lynch said it best: “Invest in what you know.” And Silicon Valley Bank shows why it pays to dive deeper to find potential winners … and those stocks you should avoid.

It’s an important lesson when steering your way through this volatile market.

Stay Tuned: An Oil and Gas Play in the Highest-Demand Area

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for our next issue when I give you all the details on an oil and gas company servicing the highest-demand area of the world.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. Tell us what you think about the financial sector. Are you investing in this sector? What is driving your decision? Email us at StockPower@MoneyandMarkets.com and let us know!