I know many of you across the U.S. have experienced snow, ice and blistering cold temperatures recently.

Not to brag, but it’s been sunny and in the 80s here in South Florida. (OK, I’m bragging a little.)

But there’s hope for all the winter weather haters like me out there: Spring is coming.

That means grilling outside, sitting on the deck with your favorite beverage and enjoying the outdoors.

I don’t have a deck at the moment, but when I did … I loved it.

Especially in the spring and summer months when I could just sit outside and take in the scenery and weather.

While reflecting back on those times, it got me thinking about potential investing opportunities. That’s just where my mind goes.

And that led me to wood, the key material for all of our deckbuilding needs.

Statista expects wood product manufacturing to increase more than 11% over the next two years!

This includes outdoor wooden buildings and decks.

Today’s Power Stock creates products to preserve and protect wood used for decks and outdoor buildings.

If you’re worried about decay, termites or fires, Koppers Holdings Inc. (NYSE: KOP) has you covered.

In addition to manufacturing chemicals to treat wood for outdoor use, Koppers is also a leading manufacturer of specialty pressure-treated wood used in electrical and communications infrastructure.

And it profits from that process.

KOP scores a “Strong Bullish” 82 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

KOP Stock: Outstanding Value and Momentum

Koppers is a solid value stock to consider.

Here are three high points:

- KOP has a price-to-earnings ratio of 12 while the industry average is 14.1!

- Its price-to-sales ratio is 0.38 … the materials industry average is 1.02.

- The stock’s price-to-cash flow ratio is 6.4 and the industry average is 11.5.

These lower ratios show why Koppers stock scores a 75 on our value factor in our Stock Power Ratings system.

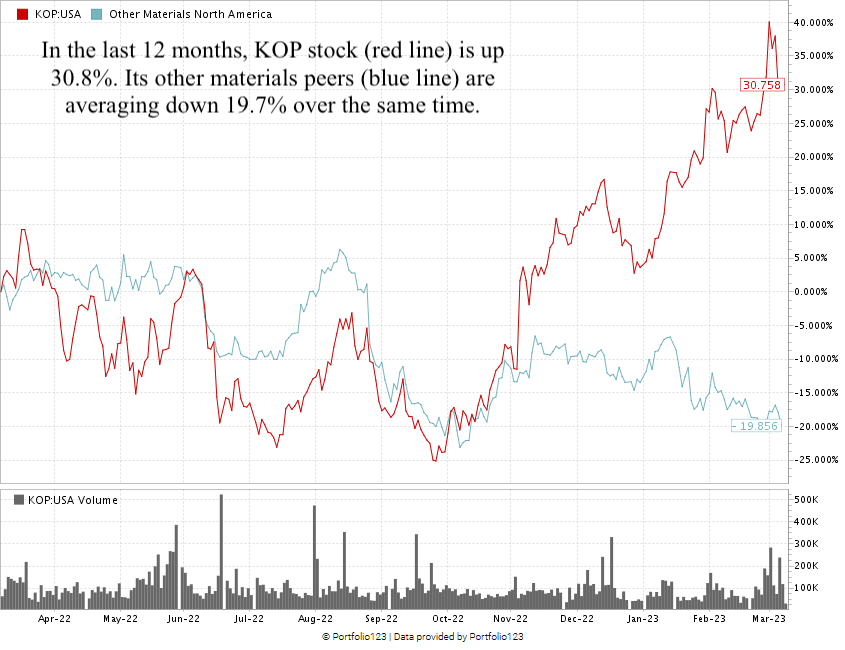

But just like what I highlighted with H&E Equipment Services Inc. (Nasdaq: HEES) earlier this week, KOP’s momentum is what stuck out to me. Check out its stock chart:

Created in March 2023.

I want to focus on how KOP stock has performed since September.

From its 52-week low, the stock has run up 74.6% into the first week of March. That’s the “maximum momentum” we love to see in stocks — and I believe it has a lot of room to run.

Koppers’ stock scores an 82 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

It’s starting to warm up and many Americans are itching to get back outside.

That makes it a good time to build or treat decks to maximize time spent in the warm weather with friends and family.

As a leading manufacturer of chemicals that make our decks stronger and resistant to the elements or termites, KOP is a wood product stock to consider for your portfolio.

Stay Tuned: The Future of Smartphones

Nowadays, everyone has a smartphone.

Does that spell trouble for leading companies within the industry?

I’ll explore this question and tell you what our Stock Power Ratings system says about some of the top smartphone brands in tomorrow’s Stock Power Daily.

Until then…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets