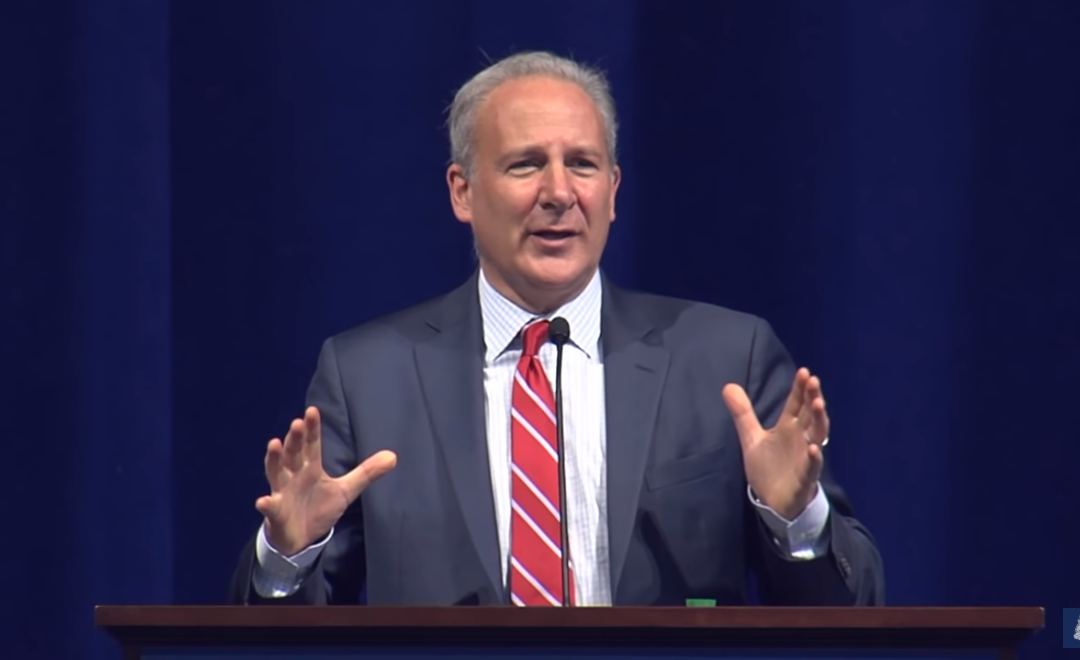

Euro Pacific Capital CEO Peter Schiff said he believes the Federal Reserve will do whatever it takes to reinflate the bubble following Wall Street’s crash this week into a bear market.

“The virus was really just the pin that pricked the bubble. In that regard, the current sell-off has much in common with the crash of 2008.”

Things are so bad right now even casual observers are generally aware that stocks have cratered since mid-February, with all three major U.S. indexes falling into a bear market — a decline of 20% or more from recent record highs.

The fall finally ended the record expansion that began in 2009.

The Dow Jones Industrial Average officially became a bear market Wednesday, and the S&P 500 and Nasdaq followed a day later.

While the numbers weren’t officially down 20% until this week, Schiff said in an exclusive interview with Money & Markets that it was simply a matter of the math catching up to reality for stocks — which he contends were already in a bear market.

“And (the bear market) will continue until the central banks introduce some new extraordinary policy. But it’s important to realize that this sell-off would have happened with or without the coronavirus. Stocks have been in bubble territory for quite some time, pushed higher by monetary stimulus which made investors forget that stocks could actually fall,” Schiff explained via email.

“The virus was really just the pin that pricked the bubble. In that regard, the current sell-off has much in common with the crash of 2008. That sell-off started because of the surprise fall in real estate prices.”

Aside from the coronavirus’ negative impact, Schiff believes investors are beginning to get spooked by the rise of left-wing politicians who want the U.S. government to exert more control over the economy, “which will create adverse conditions for investors and companies.”

Younger investors in particular haven’t seen anything like the dramatic sell-off we’ve witnessed the past few weeks. In addition to 2008, Schiff said this time also reminds him most of the stock market crash of 1929, both of which “were followed by protracted economic downturns.”

For people freaking out, Schiff said central banks around the world will likely put a floor under asset prices via stimulus — which will be a boon for hard assets.

“Bear in mind that the central banks around the world are absolutely committed to keeping stock prices high,” he said. “They will pump huge quantities of new money into the system. This may help put a floor under stock prices but it will really light a fire under hard assets like gold.”

Fed Hurting Savers, Should Return to Gold Standard

Former presidential candidate Ron Paul has long called for the Federal Reserve to be audited and ended. Schiff also is a frequent critic of the central bank’s policies and he too believes the U.S. should return to a gold standard.

“A gold standard would have prevented the kind of speculative bubbles that we are currently seeing from forming in the first place,” he said. “It would have prevented the debt creation that is currently sapping the world’s economic vitality.”

Schiff also touched on negative interest rate policy, or NIRP, and he said the Fed is bound to employ it, which will crush people who are trying to save money.

“Yes, they will take rates negative. There is no limit to what they will try. They don’t care about savers,” he said. “Adjusted for inflation, rates are already negative and they will get a lot more negative in the future regardless if the Fed pushes nominal rates negative.

“They care about borrowers and creating the illusion of false prosperity. Investors need to look to high-yielding foreign stocks for income.”

Schiff on Gold

In addition to being the CEO and Investment Committee Chairman at asset management company Euro Pacific Capital, Schiff also is the Chairman of SchiffGold, an online precious metals marketplace and blog, and the host of his own podcast, The Peter Schiff Show.

On the March 6 edition of his podcast, Schiff said traders are far too consumed with stock prices while gold is in a bull market, particularly with oil prices being so low. Lower oil prices should be a positive for gold mining companies and mining stocks in particular, which hasn’t been the case.

“Because they believe stocks will continue to rise and outpace gold,” he said. “They do not understand how vulnerable fiat currencies are to devaluation.”

Be sure to follow New York Times bestselling author Peter Schiff on Twitter @PeterSchiff and Facebook, and go to www.europacificfunds.com for more information.