This week, I address a cannabis stock I’ve discussed before: Planet 13 Holdings (OTC: PLNHF). I have some real information to pass on to you.

Some of you have written in to ask about Planet 13.

Bryan W. said:

Would love a vid on Planet 13.

C.M. left a comment on YouTube:

Now that P13 is up to $5.83, it is too late to buy?

Thank you both for your feedback. I set to answering your requests in the latest Marijuana Market Update.

Planet 13: Big Q3 Earnings & California Deal

First, I discuss Planet 13’s most recent earnings report. It was a good third quarter:

Compared to the same quarter a year ago, Planet 13 increased its revenue by 36.5%.

This was despite its superstore in Las Vegas only operating at 50% capacity due to the COVID-19 pandemic.

Planet 13’s financials are impressive.

The company’s consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) for the quarter was $6.2 million — an 83.8% increase from the same quarter a year ago.

Planet 13’s gross profit for the quarter was $12.4 million, compared to $9.8 million for the same quarter in 2019.

In June, the company announced it was buying California dispensary Newtonian Principles Inc. in a cash and stock deal valued at $4 million:

The acquisition included Newtonian’s California cannabis sales license and a 30-year lease for a dispensary in Santa Ana.

First, Planet 13 got a bargain because the initial negotiated price for the acquisition was $10 million.

Second, the Santa Ana dispensary is near the South Plaza Mall, which has about 24 million visitors a year and is just 10 minutes from Disneyland.

Planet 13 is looking to expand that Santa Ana location and make it a superstore similar to the one in Las Vegas.

This would be a huge attraction for tourists in the region — again, just like the store in Las Vegas.

About Planet 13 Stock

Planet 13 stock price has done well over the last 12 months.

The stock price rose 272% in the past year.

Since its low point in March 2020, Planet 13 shares are up more than 708%.

It has pared back since reaching a top of $6.09.

In today’s Marijuana Market Update, I answer C.M.’s question about whether $5.83 is too late of an entry point.

Cannabis Watchlist Update

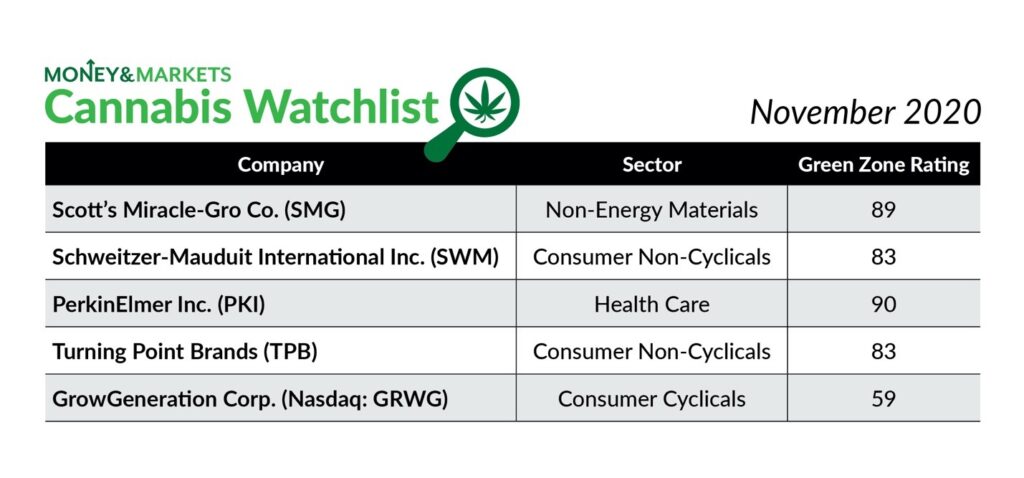

Now for an update on our Cannabis Watchlist:

Four of our five positions are now showing double-digit gains since I put them on the watchlist.

And all but one have seen marked gains since I updated you last week.

The watchlist’s cumulative gains of 26% blast past the broader market.

The iShares Core S&P 500 ETF (NYSE: IVV) is only up 3.8% since I put the first three cannabis stocks on our watchlist.

Here’s a deeper look.

- Schweitzer-Mauduit International Inc. (NYSE: SWM) — This traditional tobacco company has been consistently in the black since I put it on the watchlist in September. It’s showing a 31% gain since then.

- PerkinElmer Inc. (NYSE: PKI) — The company that tests cannabis strains has also been a consistent winner since I added it in September. JPMorgan Chase & Co. recently increased its stake in PKI. The stock is up more than 23%.

- Turning Point Brands Inc. (NYSE: TPB) — This is another traditional tobacco company making a run into the cannabis market. Turning Point is our best performer thus far in the watchlist — up nearly 43% since I put it on the list in October.

- GrowGeneration Corp. (Nasdaq: GRWG) — This cannabis company is selling more stock in hopes of raising an additional $125 million in public money. Since I added it to the watchlist in November, it’s up more than 21% and still has room to grow.

- Scotts Miracle-Gro Co. (NYSE: SMG) — This has been our weakest performer thanks to early snow in the North. Despite being down as much as 10% early in October, the stock has rebounded and is up 6%.

If you invested when I made those recommendations, congratulations on your gains!

Remember, the email address to send comments, questions and stocks you want us to examine is feedback@moneyandmarkets.com.

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel, and get an alert when we release a new update.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.