Technical analysts focus solely on price action, ignoring fundamentals and economic news. When technical signals align with news, the signals tend to be powerful.

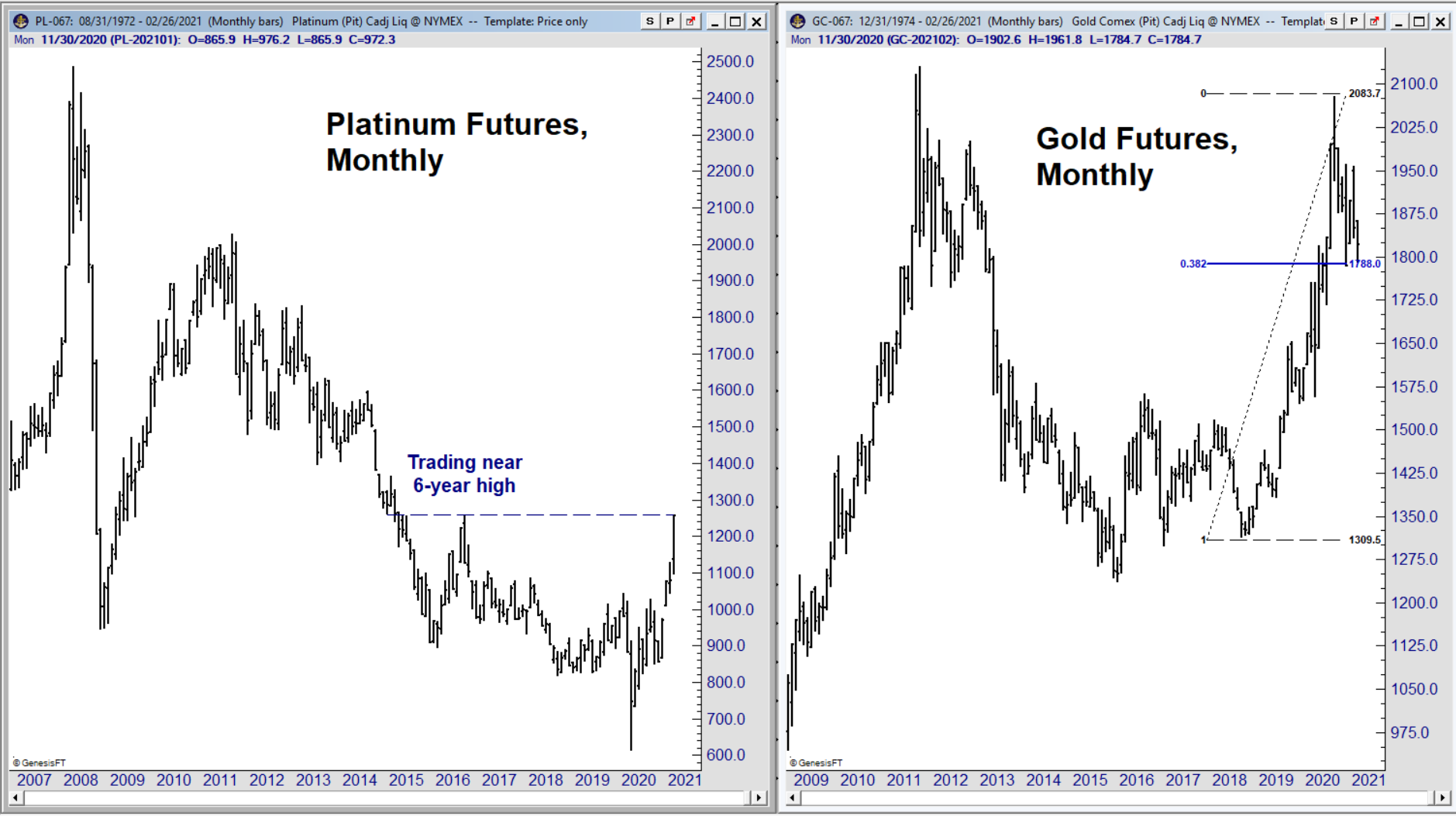

With such an alignment underway in the precious metal markets, investors should consider adding these assets to their portfolios. The chart below shows buy signals in platinum and gold on the monthly charts.

Platinum and Gold Futures

Source: Trade Navigator.

Rare Metals Are a Valuable Consideration for Investors

Platinum is completing a multi-year base pattern. This type of pattern forms as prices move back and forth in a trading range. The range indicates that supply and demand are relatively balanced. A breakout from the range indicates there is a shift in the fundamentals.

For platinum, an increase in demand should push prices up.

Bloomberg recently cited several factors that point to higher prices. One reason is that “tougher pollution regulations requiring vehicle makers to use more platinum in catalytic converters are supporting prices.”

There is also an imbalance between supply and demand, “after years of surpluses, COVID-19 mine shutdowns in South Africa saw the platinum market deficit widen to 400,000 ounces in 2020, Johnson Matthey said in a report… While the market could return to a surplus this year, disruptions at a key refinery in the country improved the immediate outlook for the metal.”

For gold, the buy signal comes from the fact that metal pulled back 38.2% after a strong rally. Many traders buy after 38.2% retracements simply because this is a widely followed technical indicator. It is so widely followed that gains after 38.2% retracements often serve as a self-fulfilling prophecy.

News also supports a gold rally. Gold is an inflation hedge, and a recovery in demand that is driving platinum prices higher should also drive gold higher. Inflation is also certain, as I noted last week, because of the way it is calculated.

With the charts and the news saying buy, investors need to consider platinum and gold before the next rallies occur.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.