It seems like no one cares about the federal deficit or government debt anymore. Now, policymakers debate whether $1.9 trillion in new spending is enough or whether they should add more money to the programs they believe will help their constituents.

Lost in the debate appears to be the fact that “at 100.1% of gross domestic product, the debt already exceeds the annual output of the economy, putting the U.S. in company with economies including Greece, Italy and Japan.”

Low interest rates are one reason many economists and policymakers aren’t focused on debt. With low rates, debt servicing costs are falling. In 2020, the debt size grew by about 25%, while the amount the government paid in interest fell by 8%.

Another reason for the lack of concern about debt is that the Federal Reserve is now buying an increasing amount of the debt. The Fed refunds the interest payments to the Treasury and can forgive the principal at maturity.

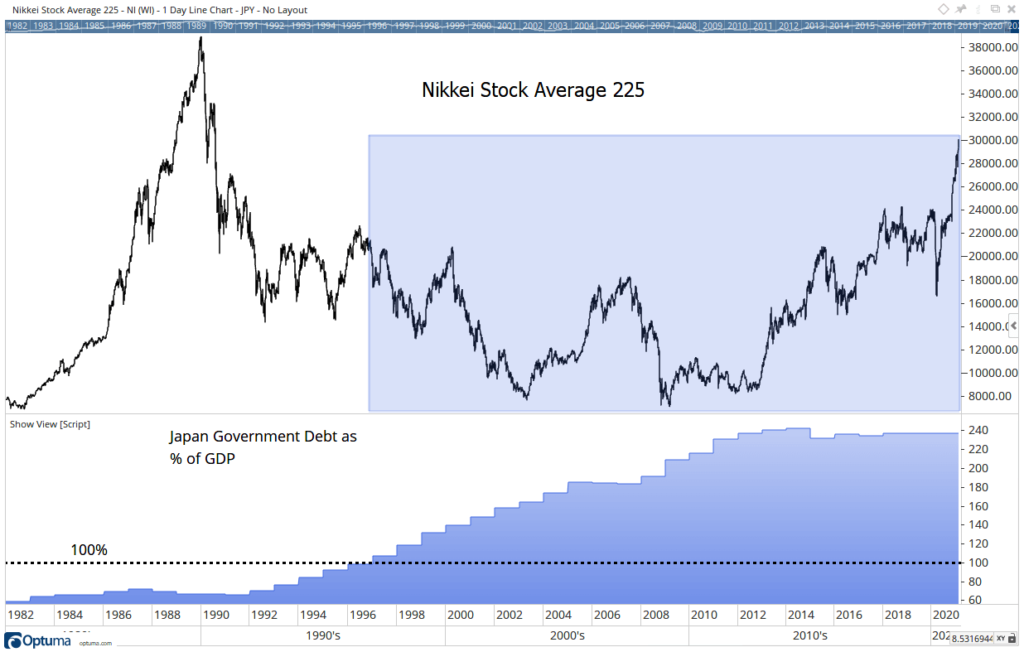

Both of these factors apply to Japan, where the debt now stands at more than 236% of GDP. Rates are low, and the central bank buys much of the debt that’s issued so it can be forgiven later.

Debt topped 100% of Japan’s GDP in 1996. While proponents of debt argue Japan can handle the heavy load, they may be missing an important point. The chart below shows stock prices needed about 25 years to adapt to the situation.

Japan’s Stock Market Struggled to Adjust to Heavy Debt

Source: Optuma.

Long-Term Stock Gains May Lag as Debt Rises

As debt rose and interest rates fell, stock prices moved sideways. This is highlighted by the blue rectangle in the upper part of the chart.

This chart disputes the argument that there is no alternative to stocks when interest rates are low. Some argue the lack of alternatives means stocks must go up.

In Japan, low interest rates coincided with low stock market returns.

Of course, it could be different in the U.S. But Italy and Greece have also struggled under heavy burdens despite low interest rates.

Now could be the time to stop expecting long-term gains in stocks. It could be best to focus on wealth preservation and short-term trading opportunities.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.