White House officials admitted inflation is a problem. On a recent Sunday morning talk show, Brian Deese, the director of the National Economic Council said: “There’s no doubt inflation is high right now. It’s affecting Americans’ pocketbooks. It’s affecting their outlook.”

This is an admission that the problem isn’t transitory. Now, the administration has a plan. Deese explained the White House believes a three-point plan will bring inflation under control.

- ”We have to finish the job on COVID. We have to return to a sense of economic normalcy by getting more workplaces COVID-free; getting more kids vaccinated so more parents feel comfortable going to work.”

- “We’ve got to address the supply chain issue.”

- Lastly, he called for congressional passage of Biden’s nearly $2 trillion social safety legislation to provide more financial, educational and health care assistance to all but the wealthiest American families.

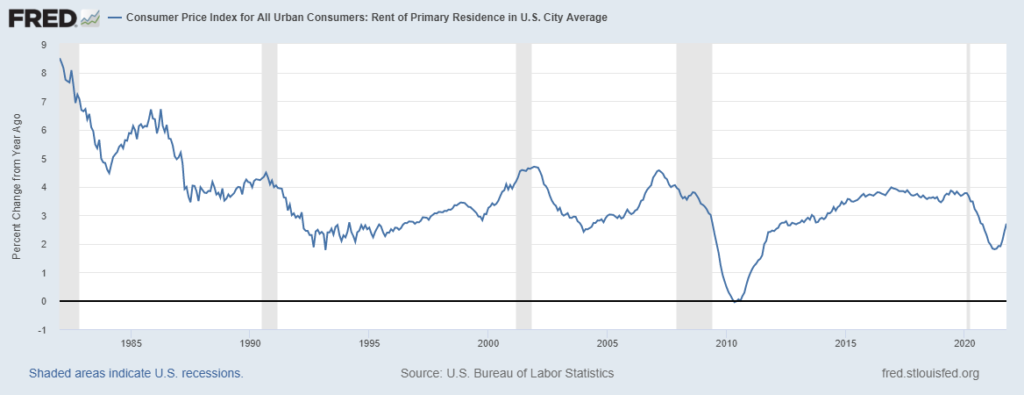

The average American may not take much comfort from that plan. Inflation eats away at earnings, and the chart below shows that inflation can create long-term issues for consumers. It’s a chart of the year-over-year change in the rent component of the Consumer Price Index.

Rent Is Rising Again

Source: Federal Reserve.

Inflation Makes Housing More Expensive Than Ever

While the pace of increases has been in a downtrend since 1982, the trend in rent price has been up. The index shows the average rent increased more than 250% in the past 40 years.

Rent closely tracks sales prices so this data confirms what consumers know. Housing is more expensive today than it ever was.

The chart shows another thing that consumers know but policymakers seem to be ignoring: Rents never decrease. This is generally true for other prices as well. While the rate of increase may slow, the year-over-year change in rents was negative for just one month in the past 40 years.

Higher rents, and the higher costs of goods and services, are here to stay. The rapid rise in prices is already hurting consumers and will hurt for years.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.