As I talked about in my last article, gold closed the second quarter at its highest level, in U.S. dollar terms, ever.

On a cash basis, in the forex markets, gold closed at $1,781 per ounce. That’s a full $10 higher than the Q3 2012 peak during the aftermath of the last gold bull market.

In many ways, this is a follow-up to that article with gold confirming that the political unrest in the U.S. is what is driving its relentless march higher. As markets open Monday morning there is a reflation trade on with stocks surging on good news out of China.

This has oil up to test the top of its current trading range, the dollar down and copper up slightly. None of these moves are technically interesting.

But the grain markets are, with corn and soybeans breaking out of medium-term trading ranges thanks to a terrible corn report from the USDA last week. Rising corn prices have lit a fire under soybean prices, now over $9 a bushel for the first time since the killing of Iranian General Qassem Soleimani sent all commodity markets crazy to open 2020.

Because general commodity markets are up, silver is also threatening to break out of its prison below $18.50 per ounce. Silver doesn’t want to join gold in what I’ll call the “monetary crisis” trade. That’s why it’s not as interesting as gold, still lagging behind having not bested the post-Brexit 2016 high.

But it is showing signs of life while it still trades directionally with oil and copper, because its volatility is higher. Resistance stands in silver at just below $19. And that’s finally under threat.

Two Gold Impulses at Odds

But the real story is gold because, as I’ve been talking about for over a year now, gold is trapped between two primary impulses — as a safe-haven asset hedging against political paralysis (bullish) and as a source of emergency dollar liquidity (bearish).

But the real story is gold because, as I’ve been talking about for over a year now, gold is trapped between two primary impulses — as a safe-haven asset hedging against political paralysis (bullish) and as a source of emergency dollar liquidity (bearish).

These two impulses have been at odds with each other creating a lot of cognitive dissonance in the minds of gold analysts and traders. Why would gold drop when the dollar dropped? Why would it rise alongside stocks?

Since dollar stress has been abating, at least as reported by the Federal Reserve every week, markets can trade with a little less urgency.

But that is also a false sense of security, because we are in uncharted policy territory. The U.S. and EU are repealing the free market in stocks and bonds.

Gold with Q2’s close may have finally broken free of simple dynamics and is trading independently of both primary impulses.

After a bit of profit-taking to end last week, gold is once again threatening the $1,800 level, but this time against the backdrop of dollar weakness. So it’s clear today that the fear trade is off, and the inflation trade is on.

And yet, gold rises now no matter what happens.

Money & Markets Chief Investment Strategist Adam O’Dell thinks gold is ready to soar to $10,000 per ounce.

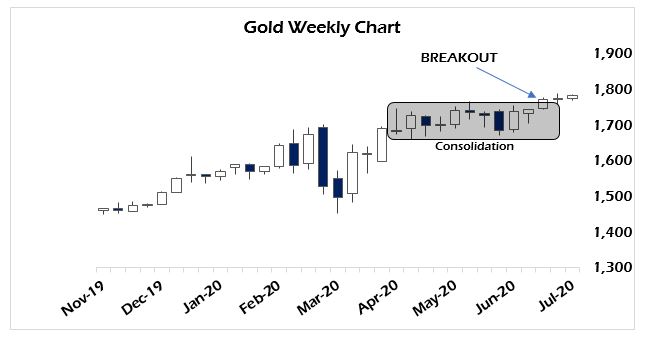

Gold spent ten weeks in consolidation after its breakout above the pre-crisis high established in January. Now it’s trading off that base with an eye toward the all-time high.

That’s the point. If gold has decoupled from the dollar, then that quarterly close is telling us the secular bull market has returned for real even though gold is still trading more than $100 below its all-time high.

For me, it’s clear that the reason for this is we are in unprecedented times politically. President Trump is under immense internal and external attack. The whole of the U.S. political and media establishment are against his reelection.

Prominent Republican figures are forming coalitions against him, like former President George W. Bush and Senator Mitt Romney (R-Wall St.).

His control over the military leadership is tenuous with public messaging from Secretary of Defense Mark Esper, Chairman of the Joint Chiefs of Staff Joseph Milley and Former Secretary of Defense Gen. James Mattis all defying Trump openly.

This is unheard of in modern times and meant to undermine his support among patriotic conservatives and military veterans, a strong pro-Trump constituency.

Trump, for his part understands the situation. And he used his speech celebrating the Fourth of July at Mt. Rushmore, denounced in the worst possible terms by the media, as the strongest campaign statement he could make to those same people.

In no uncertain terms Trump denounced the insurrection against our culture, traditions and history. Using phrases like “cultural revolution” he let everyone know that he understands what’s happening here and what needs to be done to oppose it, even if his own party would rather have Biden win to restore the pre-Trump status quo.

This political infighting is what gold is responding to. The closer we get to the election the worse the rhetoric will be from both sides. Democratically-run cities and states are reviving COVID-19 lockdown restrictions and mandatory mask-wearing while focusing on rising cases to ramp up the fearmongering and keep people further divided.

At the same time the economic figures are improving at a rate that makes that a tough sell and resistance to COVID-19 nonsense is rising as seen in things like the employment reports which, even discounting them for statistical massaging, are a good indication America wants to get back to work.

Where Gold Could Go

Gold understands these dynamics, and buying it (along with guns) is the first-order response by people unsure of where their government is heading. With each day it becomes clearer to more people that no matter how the election turns out, there is no going back to the way things were before it.

This is why gold is rising on both a weak dollar and a strong dollar right now. The fundamentals are lining up regardless of the justification. Fear of inflation is just as strong as fear of deflation. Both are positive, in the end, for gold.

Because if there is one common thread through this commentary it is that when governments fail, government debt becomes worthless no matter how much the central bank intervenes.

The Fed still has some credibility left. Because we need it to. But that faith is rapidly eroding as all debt is becoming suspect, including U.S. Treasurys.

The Fed is not only engaging in quantitative easing (money printing) to support Treasury prices and keep an insolvent U.S. government paying its bills, it is also now buying corporate debt to keep those prices from collapsing. And Blackrock is buying stocks at a furious pace to maintain that illusion as well.

At some point the music stops. And the system itself seizes up.

As a cynic and a betting man I’m looking ahead now to September to the next dollar spasm. It is out there on the horizon. The powers arrayed against Trump will not allow him to be reelected without at least one more major crisis to navigate.

This is why I’m not going all-in on a new gold bull market just yet. The fundamentals are there. The trading pattern has been established. Certain important technical signals are in place.

But when a real financial crisis hits, gold will get sold just like everything else, one last time before things truly get crazy.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.