Every day, investors try to make sense of new data.

Some numbers change month-to-month, but others are updated more frequently.

Price data changes every day, even every minute, while markets are open.

But one of the most important data points for investors changes at a much slower pace. And it’s easy to project into the future.

I’m talking about population data.

Why Population Data Matters

This might not appear to be economic data. But economic growth is correlated with population and productivity changes.

This makes sense, even if we don’t think about it often.

If a country’s working-age population increases 10%, and the new workforce is as productive as the old, the economy grows 10%. If productivity increases by 1%, the economy grows by 22% because each worker (older and younger) is producing 1% more, and there are 10% more workers overall.

These two factors explain almost all of the changes in an economy.

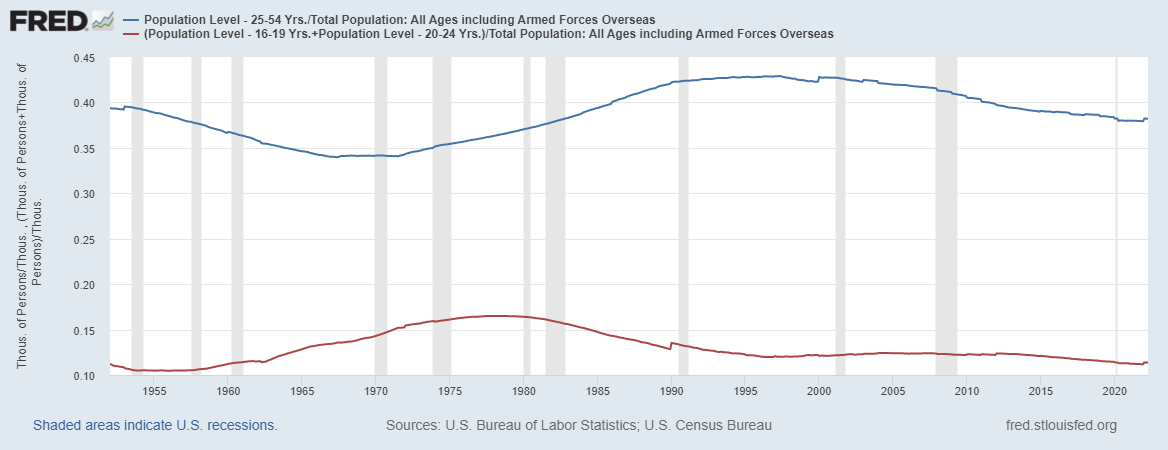

It makes sense to look at population growth to understand the potential trend. The chart below shows population trends, which are bearish for the economy.

Population Growth Trends

Source: Federal Reserve.

The blue line shows the percent of the population between 25 and 54 years old, considered to be prime working age. The red line shows the percent of 16- to 24-year-olds.

Trends in the red line precede trends in the blue line.

The economic boom and bull market that began in the 1980s coincided with an increase in the working age population. This gain was driven by the trend in the number of people aged 16 to 24.

This time, no large group of youths are waiting to join the workforce.

Bottom line: Without an increase in population, economic gains will depend on increases in productivity.

That means we need to develop technology that improves processes in business. There are promising technologies under development, but there’s no guarantee the economy can overcome the population headwinds.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.